Key Takeaways

- Oxygen is a DeFi brokerage that allows users to stake, margin trade, and use leverage.

- Its launch on FTX is attracting a lot of attention. Serum launched at $0,11 for its IEO and now trades around $6.

- Only users with $50.000 volume in the last 30 days on FTX will be able to participate.

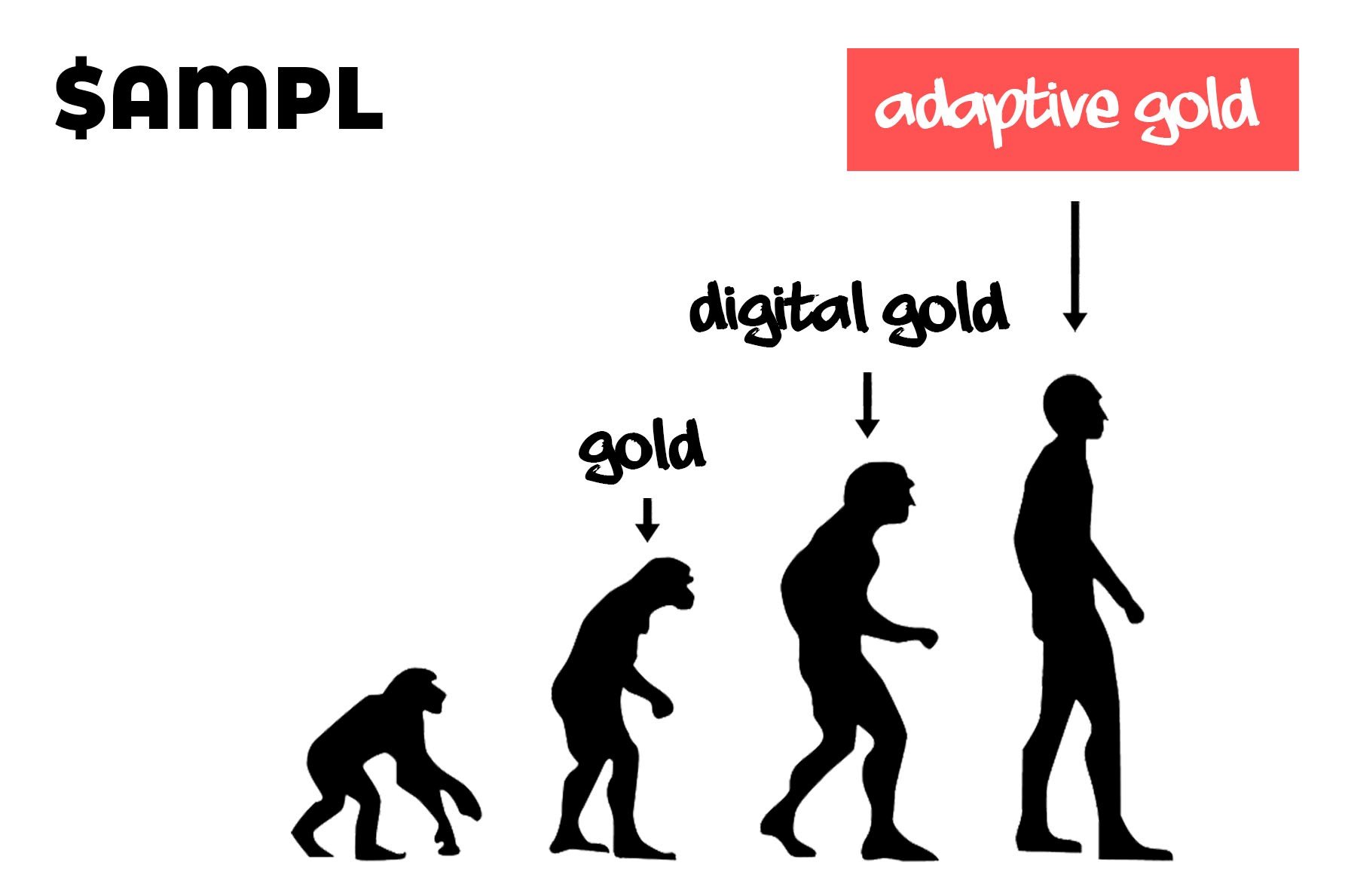

The DeFi news category was brought to you by Ampleforth, our preferred DeFi partner

Share this article

Investors are following the latest DeFi project to launch on Solana. Oxygen’s IEO kicks off tomorrow, bringing staking and levered trading to the Solana ecosystem.

A History of Insane Upside Post-IEO

After the successful launch of Raydium on FTX, Oxygen is the next piece of the Solana puzzle.

Speculators have been particularly interested in this offering. Historically, similar tokens have seen incredible growth after their release. Leading the way is FTX’s native token FTT up more than 180x since its launch.

Oxygen is a DeFi prime brokerage service built on Solana and powered by Serum’s on-chain infrastructure. Similar to dYdX on Ethereum, users will be able to earn yield on their crypto by lending it to traders or borrow from the protocol’s pools to increase their own leverage.

The OXY token will serve as a governance token. It will also distribute to its holders 100% of the fees generated by buying back OXY from the market and burning it.

The protocol’s revenue will come from three sources:

- Network fees (a fraction of the yield received by users).

- Trading fees.

- Liquidation fees.

Fees are close to null on Solana, allowing for the kind of dynamic actions performed daily by traders. On a platform such as dYdX, taking a position can easily cost north of $50, which further slims the potential margins that traders can exploit.

While the Ethereum network compensates its high gas fees with higher amounts of liquidity and potential yield for average users, high-frequency traders that operate hundreds of trades per day may find Oxygen’s value proposition enticing.

Any user with an FTX account approved to at least KYC level two and has either 500 FTT staked FTT or has executed more than $50,000 in volume in the past 30 days will receive one ticket. Investors may be able to purchase additional tickets based on their trading volume over the past 30 days. This is also true for the average daily FTT held over the past 7 days.

The offering begins tomorrow between 9:00 and 10:00 pm SGT. Users who meet the IEO criteria will be able to bid on 1,000 allocations of 2,000 OXY, the token of Oxygen.

Disclosure: The author held Bitcoin and Ethereum at the time of press.

Share this article

After Successful Launch, Solana DEX Raydium May Integrate SushiSwap

SushiSwap on Solana? Thanks to Raydium, it may happen soon. Proposed SushiSwap Integration Raydium, a new automated market maker (AMM) built on the Solana blockchain, may integrate SushiSwap. A proposal…

FTX Bets on Solana, Not Ethereum, for Its New Decentralized Exchange

FTX is spearheading the launch of a new decentralized exchange (DEX) to kickstart a new DeFi ecosystem on the Solana blockchain. Touted as an “Ethereum Killer,” can Solana’s high throughput…

Looking Back on 2020 and 2021 Predictions

Happy New Year from all of us at Crypto.com Research! 2020 was an unprecedented year for the world and for crypto. Before we fully plunge into 2021 predictions, we will…

After Robinhood Blunder, Blockfolio Will Pay Users Dogecoin for Tradin…

Thanks to an integration with the cryptocurrency exchange FTX, Blockfolio users will now access zero-fee trading and token bonuses. Blockfolio Supporting Crypto Trading Blockfolio now supports crypto and stock trading….