Summary:

- Ethereum reserves on crypto exchanges have hit a 2 year low

- Ethereum continues to be locked in DeFi and the ETH 2.0 deposit contract

- NFT marketplaces are also pushing up the demand of ETH outside crypto exchanges

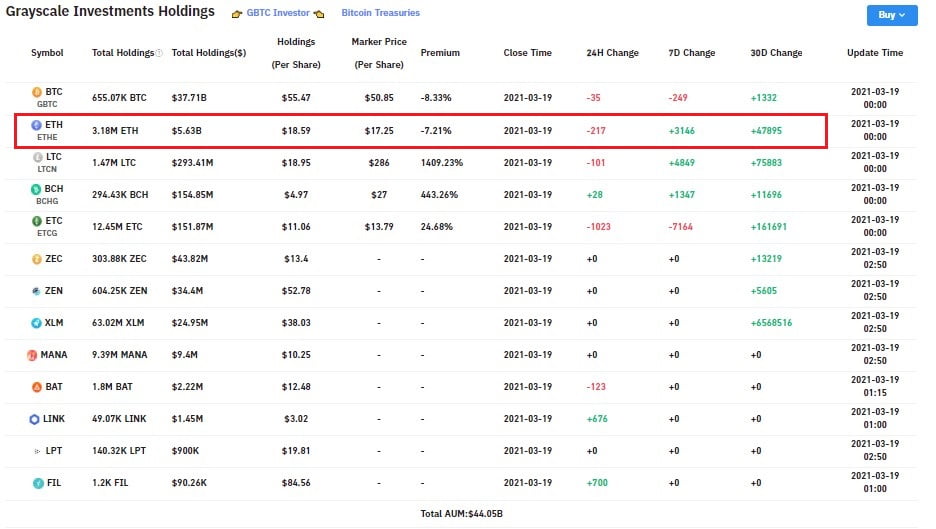

- The institutional accumulation of ETH is evident with Grayscale adding 47,895 Ethereum in the last 30 days

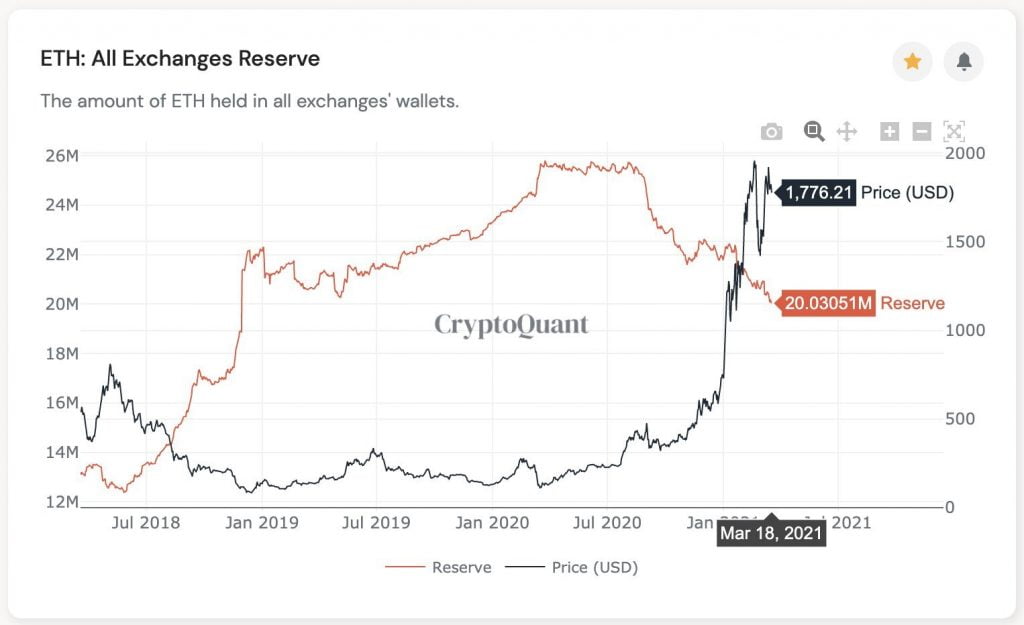

Ethereum balances on crypto exchanges continue to decrease by the day. According to data by the team at CryptoQuant, Ethereum reserves in all crypto exchanges have hit a two-year low. The team at CryptoQuant further provided the following chart to demonstrate the decline of ETH reserves on crypto exchanges.

Accumulation of Ethereum by Individuals and Institutions Continues

In an earlier analysis, four scenarios were identified as the possible reasons for the diminishing Ethereum balances on crypto exchanges. They included:

- Ethereum is being transferred to the various DeFi protocols which now host 9.2 million ETH locked in the various platforms

- NFT marketplaces on the Ethereum network have had a significant increment in trade volume and demand for ETH has skyrocketed as a result

- Staking on Ethereum 2.0 has hit a new high of 3.552 million ETH

- Individual and institutional investors are continually accumulating Ethereum and storing ETH offline

With respect to the accumulation of Ethereum by institutional investors, Grayscale Investments best exemplifies this. The Wall Street firm has accumulated 47,895 ETH ($86.9 Million) in the last 30 days as seen in the following screenshot courtesy of Bybt.com.

Can Ethereum Retest $2k This Weekend?

Can Ethereum Retest $2k This Weekend?

A brief look at the Ethereum chart reveals that ETH is trading at $1,815 and directly above the crucial $1,800 support zone. The latter price level is important for Ethereum as it was the springboard that allowed ETH to break past the $2k price ceiling back in mid-February.

With the weekend about to kick-off, Ethereum could have the freedom to climb the necessary $200 to push push higher for a new all-time high.

However, as with all altcoins, Ethereum’s fate is tied to that of Bitcoin. Therefore, the King of Crypto needs to either be bullish or consolidate during the weekend for ETH to have a chance at rising higher.