In brief:

- Ethereum’s monthly returns have been positive for 10 of the last 12 months

- Ethereum is well on its way towards closing March on a positive note

- The recent dip to $1,537 could set the pace for Ethereum retesting $2k in April

The digital asset of Ethereum has had a volatile few days and the turmoil might have caused many traders to forget that ETH was valued at roughly $100 only one year ago. The latter price level was a result of the nerve-wracking crash of mid-March 2020, which saw ETH drop to a low of $86 – Binance rate.

Ethereum has Had Positive Returns for 10 of the last 12 Months

Ethereum would go on to rise gradually over the next 12 months, posting a new all-time high of $2,036 on the 20th of February, 2021. With respect to monthly returns, Ethereum investors have experienced positive gains in 10 of those 12 months as illustrated by the screenshot below courtesy of Bybt.com.

Ethereum Could Be Setting up for New highs in April

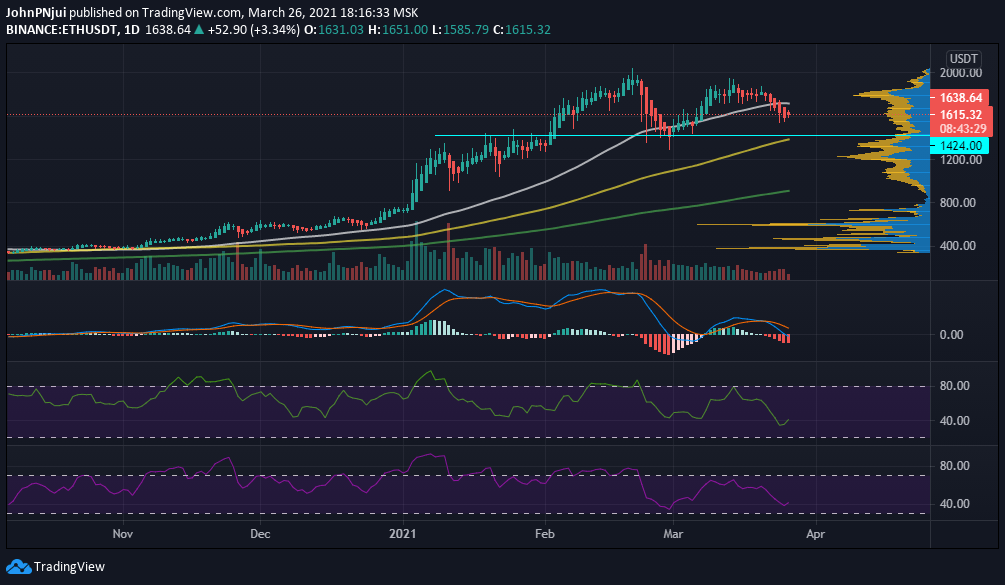

To note is that Ethereum opened the month of March 2021 at a value of $1,424. Chances are that Ethereum closes the month of March firmly above this value and confirming a 6th straight green month for ETH beginning October 2020.

Additionally, from the above ETH/USDT daily chart, Ethereum could be on a path towards another green month of April as shall be explained.

To begin with, yesterday’s crypto-wide meltdown saw Ethereum post a local low of $1,537. This in turn means that the $1,500 price area is a strong support zone moving forward. Secondly, despite the selling pressure evident in the last week, the daily MFI and RSI are hinting of a trend reversal as the month of April approaches.

Thirdly, 608,000 Ethereum quarterly options expired on the Deribit exchange earlier today thus reducing the amount of selling pressure surrounding ETH. Similarly, Ethereum futures on several platforms such as Bitmex and CME, also expire today, March 26th.

Fourthly, Ethereum has a lot of fundamental factors that will likely push its value higher in the days to follow. They include:

- the implementation of EIP-1559 during the Berlin upgrade that is estimated to occur on April 14th, 2021

- Ethereum balances on crypto exchanges have been in a state of constant decline pointing towards staking on ETH2.0, locking of ETH on DeFi, and cold storage