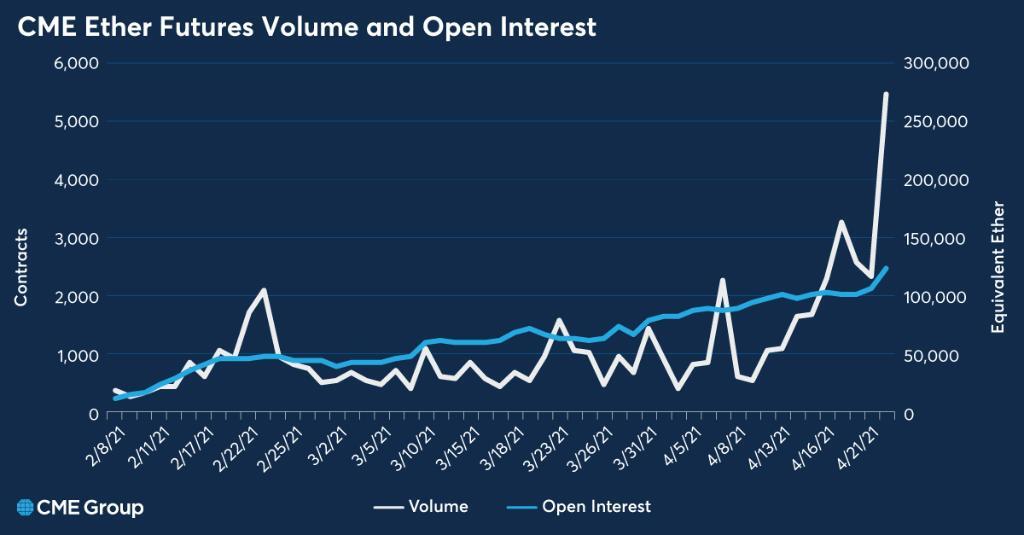

- Volume and open interest of the CME Ethereum futures have hit all-time highs

- CME Ethereum futures volume has hit 5,469 contracts valued at roughly 273.5k ETH

- The open interest has hit 2,462 contracts, which is the equivalent of 123.1k ETH

- The data on CME Futures hints that institutions are bullish on Ethereum

The CME Group’s Ethereum futures contracts have hit all-time highs in volume and open interest. According to the team at CME, the Ethereum futures have hit a record-breaking volume of 5,469 contracts and open interest of 2,462 contracts. The team at the CME group shared this data through the following statement and accompanying chart.

Ether futures trading continues to gain momentum with two new records set on April 22 — volume reached 5,469 contracts (273.5K equivalent ether) and open interest achieved 2,462 contracts (123.1K equivalent ether).

Institutional Interest in Ethereum is Rising

From the chart, it can be observed that the increased volume and open interest on the CME Ethereum futures, is a clear sign of demand of the trading product from institutional investors.

Also worth mentioning is that Ethereum was trading at roughly $175 one year ago and after the Coronavirus crash of March 2020. In the same year, Ethereum would go on to gather the attention of traders owing to the CME Group announcing in Q4 of 2020, the launch of Ethereum futures in February this year. Ethereum closed 202o at a value of roughly $750 as a result of the excitement surrounding the futures contracts.

Doing the math, and using the current price of Ethereum at $2,300, ETH has grown by a factor of 13.14x in one year and by a factor of 3.06x since the beginning of 2021.

From the quick calculations, it can be observed that institutional investors gaining exposure to Ethereum through the futures contracts has been beneficial to the value of ETH. To note is that several Ethereum ETFs are already trading in Canada thus injecting additional confidence to institutions that are looking at ETH as an investment option.