- Ethereum deposited in smart contracts has reached 22.8% of its circulating supply

- Ethereum on crypto exchanges has dropped to 12% of the circulating supply

- 2021 has seen 10 events where over 200k ETH is withdrawn from exchanges in a day

- Ethereum has set a new all-time high of $3,605 – Binance rate

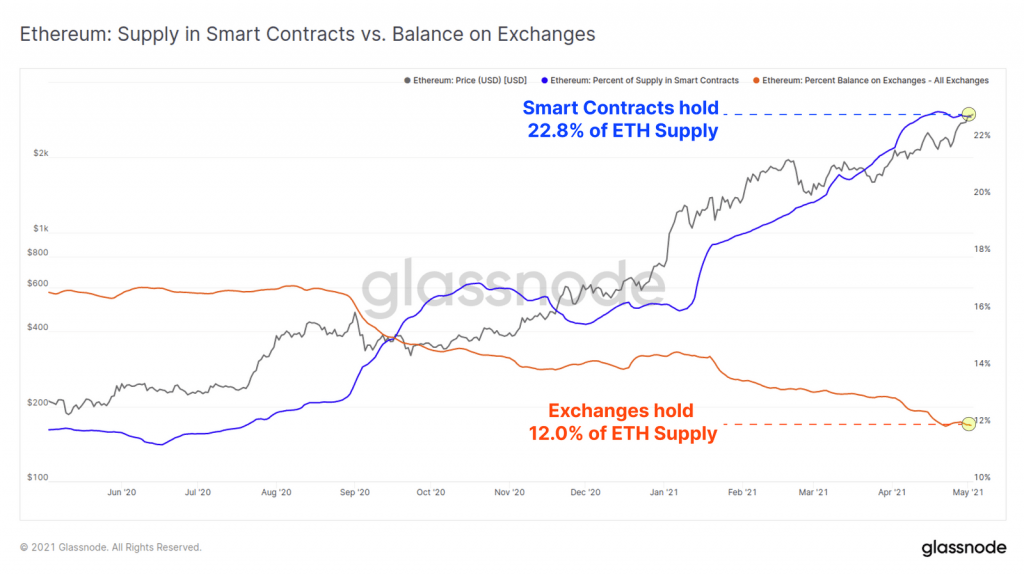

The trend of Ethereum investors moving their ETH out of exchanges and into DeFi is at its peak. According to data from the team at Glassnode, the amount of Ethereum deposited in smart contracts has reached 22.8% of its circulating supply. At the same time, the amount of Ethereum left on exchanges has hit a new low of 12% of ETH’s circulating supply.

The chart below, courtesy of Glassnode, provides a visual cue of the flow of Ethereum out of exchanges and into smart contracts that are at the core of DeFi.

Ethereum Outflows Are Contributing to ETH’s Bullish Rise

Ethereum Outflows Are Contributing to ETH’s Bullish Rise

From the chart, it can be observed that the amount of Ethereum’s supply held in smart contracts has risen alongside the price of ETH. Therefore, it can be confirmed that the demand for Ethereum in DeFi has been beneficial to the value of ETH.

The team at Glassnode has also identified that demand for Ethereum has reached levels where 2021 has seen over 10 events where 200k ETH has been withdrawn from crypto exchanges in a single day. Such an increase in Ethereum outflows from crypto exchanges proves that investors are more comfortable with the self-custody of their ETH and making use of it in DeFi.

Ethereum Sets a New All-time High of $3,605

With respect to price, Ethereum has just set a new all-time high of $3,604 and looks primed to keep pushing towards the $5k ceiling in the days and weeks to follow.

At the time of writing, Ethereum is consolidating at the $3,400 price area with the possibility of additional gains during the weekend. However, from a technical analysis point of view, a pullback to $3k would be an ideal way for Ethereum to cool down before another leg up.