After a display of strength in the past weeks, Ethereum dropped below $2,000 for a brief moment. The cryptocurrency seems to be recovered, but the crypto market could still face some resistance to return to its pre-crash levels.

A report by Wu Blockchain claims that ETH’s price barely escaped from a bigger fall. Data provided by Philippe Castonguay shows that Justin Sun, CEO at the Tron Foundation, has a $1 billion position on the Ethereum-based Liquity Protocol.

This 606,000 ETH position was almost liquidated and, due to its size, could have caused the price to crashed below $1,500 or $1,000 approximately. Castonguay said:

There was about a 2 minute window where Liquity Protocol went into recovery mode and Justin Sun’s $1B dollar position could’ve been liquidated, but it didn’t happen. He just rebalanced his Trove 5 minutes ago, paying $300m back of debt.

However, Castonguay later clarified that the protocol’s liquidation mechanism would have prevented ETH’s price from plunging. Liquity operates with entities called stability providers. Once a position is liquidated a 0.5% percent goes to the liquidators and 9.5% is distributed to every stability provider. Castonguay added:

His ETH would’ve been purchased by the Stability Providers at *market price*. Buyers would’ve met seller at the same spot price.

JustinSun said in Chinese community: Like a bullet passing through the scalp, I saved the cryptocurrency… https://t.co/vG7GTeoeKF pic.twitter.com/FRMmaExnuq

— Wu Blockchain (@WuBlockchain) May 19, 2021

Justin Sun Buys Bitcoin And Ethereum’s Dip

Sun took advantage of the drop in Bitcoin and Ethereum’s price. Via his Twitter account, he announced two major BTC and ETH purchases. He made the announcement in the same fashion as major corporations have disclosed their crypto holdings.

For the former, Sun claimed to have bought 4,145 BTC at an average price of $36,868 for an estimated $152 million. Sun said:

I have bought many on a dip today, this is only my #BTC purchase. Keep BUIDLING, buy the DIP.

The second purchase was made for 54,153 ETH at an average price of $2,509 for an estimated $135 million. Quoting MicroStrategy’s CEO, Michael Saylor, Sun said: “I’m not selling”.

At the time of writing, ETH trades at $2,621 with a 21.6% loss in the daily chart. In the weekly chart ETH has a 37.1% dropped and in the monthly chart maintains a 17.2% profit.

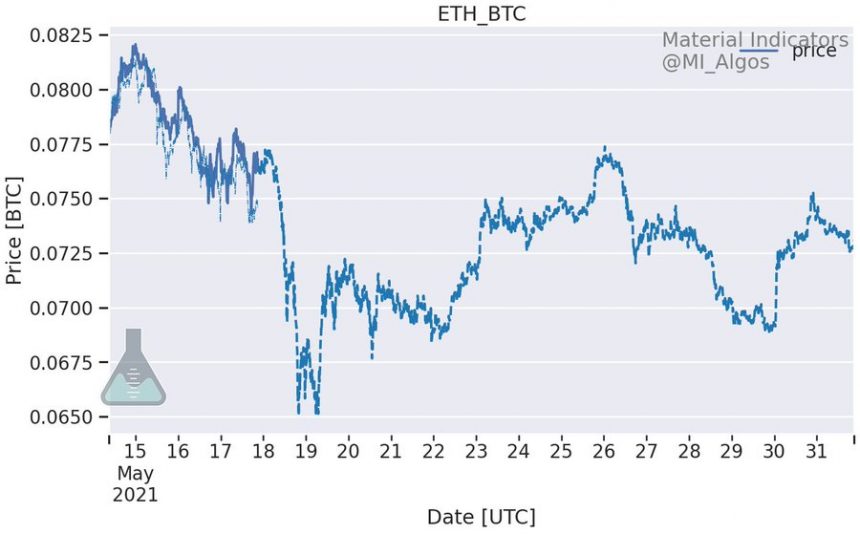

While the recovery has been impressive, the market might not be out of the woods. Data provided by Analyst Material Scientist on May 17th predicted a pullback on ETH against BTC. As the chart below shows, ETH had a retracement on this pair and could see further volatility in the coming days.

Moreover, ETH and the rest of the market seem to have increased their level of correlation with Bitcoin, as it usually happens when any major price action occurs. In that sense, Material Scientists also expect BTC price to move sideways at current levels, at least, until June.