- Ethereum traders are showing signs of impatience and doubt as Ethereum keeps ranging in the $2k price area

- $3k is proving elusive for Ethereum with $2,800 providing stiff resistance

- All eyes are on Ethereum’s London Upgrade in July which introduces EIP1559

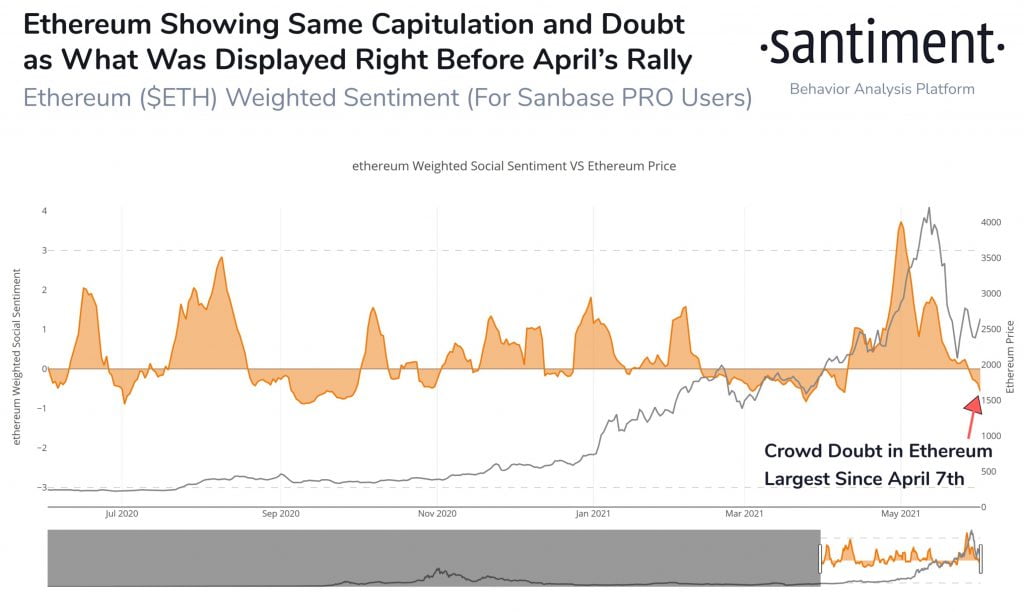

Trader sentiment surrounding Ethereum has flipped to one of doubt, impatience, and exhaustion as ETH continues to range in the mid to lower $2k price zone. This is according to analysis shared by the team at Santiment which pointed out that Ethereum traders and investors had capitulated to levels last seen on April 7th this year and right before ETH’s price went on to increase by 100% in the same month.

The full statement by the Santiment team can be found below alongside a chart demonstrating the drop in sentiment surrounding Ethereum.

Ethereum traders are showing signs of impatience and exhaustion as the price has chopped in the low to mid $2k range. This kind of capitulation and crowd doubt was last seen April 7th, when ETH‘s price then proceeded to doubled over the next month!

$2,800 Proves to be a Stiff Resistance for Ethereum

$2,800 Proves to be a Stiff Resistance for Ethereum

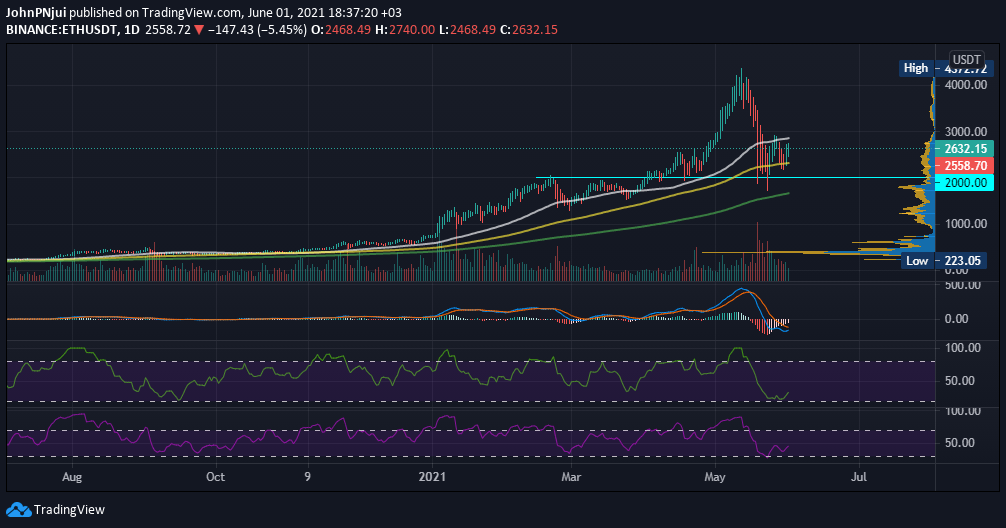

With respect to price action, $2,800 is proving to be a tough obstacle for Ethereum as it attempts to reclaim the $3k psychological level. Earlier today, ETH managed to hit a local high of $2,740 before suffering a pullback to its current level of $2,550.

However, and unlike Bitcoin, Ethereum is comfortably trading above both the 200-day (green) and 100-day (yellow) moving averages as seen in the following ETH/USDT daily chart. Ethereum managing to maintain a level above these two MAs provides a window of hope that Ethereum still has some fuel left to reclaim various levels above $3k.

From the chart, it can also be observed that the 50-day (white) moving average, converges with the aforementioned $2,800 resistance area. The daily MACD, RSI and MFI are also pointing towards a trend reversal for Ethereum into the month of June.

All Eyes are on Ethereum’s London Upgrade in July

In terms of fundamentals, ETH traders and investors have the Ethereum London upgrade to look forward to which is scheduled for July this year. The upgrade will introduce EIP1559 that aims to tackle high gas costs as well as turn Ethereum into a deflationary asset by burning the base fee with each transaction once implemented.

Therefore, Ethereum could very well continue to outperform Bitcoin for the next few weeks as the hype surrounding EIP1559 starts to envelop crypto discussions.