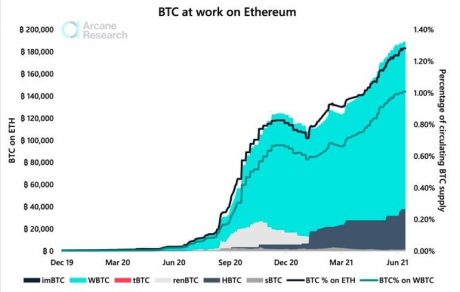

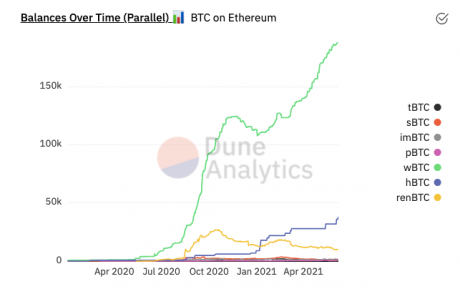

As wrapped Bitcoin approaches 189,000 BTC, the leading form of BTC on Ethereum now makes up for nearly 1% of the total supply of the cryptocurrency.

The total supply of WBTC was only around 4,000 coins last June, and today it is 47 times that. The gigantic growth has made the token the most popular form of Bitcoin on the Ethereum blockchain.

WBTC touches the 1% mark | Source: Arcane Research

Overall, around 240,000 BTC has been tokenized into Ethereum protocols, of which 80% of the supply comprises of WBTC.

Why The Need For WBTC?

Tokenized BTC is becoming increasingly popular because the Bitcoin blockchain lacks some functionality that Ethereum does not.

As the Ethereum DeFi ecosystem is highly lucrative, it’s not surprising that investors are looking to get their hands on some of those yields.

WBTC isn’t the only BTC token on Ethereum. HBTC and RENBTC are some of the other examples. However, only WBTC is noticing such massive growth.

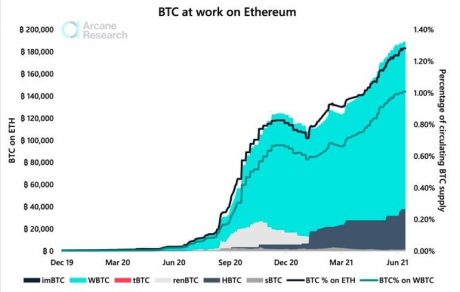

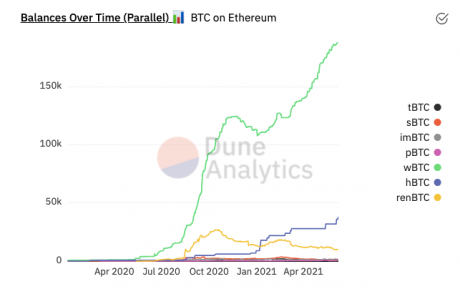

Below is a chart that visualizes the difference between WBTC and other tokens:

WBTC runs away from the rest | Source: Dune Analytics

As is clear from the chart, the competition of the token is largely stagnant, and drastically lesser in circulation, making up for only 20% of the total BTC supply on Ethereum.

Related Reading | Privacy Protection: The Future of DeFi

BadgerDAO

BadgerDAO is a decentralized autonomous organization that aims to build the products and infrastructure necessary to bring Bitcoin as collateral to other blockchains.

BadgerDAO has played an important part in Wrapped Bitcoin’s rise above its competition. The platform currently has $632 million in tokens locked in.

There are 13 vaults (called “setts”) in total on the website where you can deposit your tokens. A lot of these setts are liquidity pairs of WBTC and some other token. As a natural consequence, not all the value is locked under the wrapped token.

Nonetheless, there is a WBTC-only sett that is powered by Yearn Finance. The vault is now the biggest one on the platform with about $200 million tokens deposited.

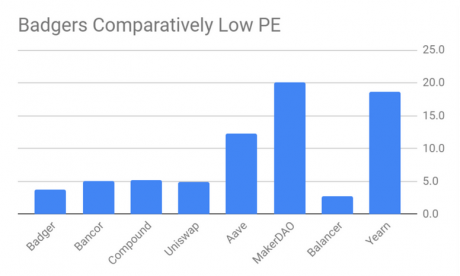

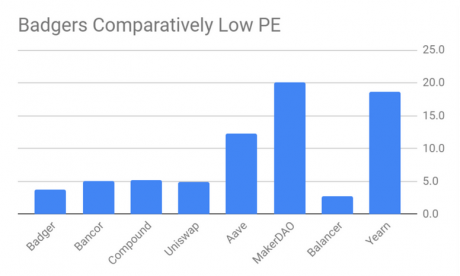

Badger offers quite low price-to-earning ratio | Source: BadgerDAO

The above chart is from a BadgerDAO report that shows that they have one of the lowest price-to-earning ratios when compared to other DeFI businesses.

Related Reading | Top 10 DeFi Projects in Q2 2021

Bitcoin Price

In the past 30 days, the value of the cryptocurrency has dropped by 14%.

However, the general trend seems to have changed towards up in this past week of June so far. Below is a chart showing the variation in the cryptocurrency’s value:

BTC seems to be on a slight upward trend | Source: BTCUSD on TradingView

As per a Voyager Digital survey, 87% of the respondents plan to buy more cryptocurrency in the coming months. 7 out of 10 respondents also believe market sentiment is bullish in the next three months.

However, other investors like Rich Bernstein feel that we are looking at a bearish market.