- DeFi users have stuck with Polygon despite lower gas fees on Ethereum

- DeFi on polygon continues to experience record growth due to its affordability

- Total DeFi users on MATIC have exceeded 420k

- On June 15th, the total value locked on Polygon hit an all-time high of $11.85 Billion

DeFi users that have interacted with Polygon (MATIC) are choosing to keep using the protocol despite the current drop in gas fees on Ethereum. This observation was made and shared by the team at DaapRadar who explained the situation as follows.

Ethereum’s woes have turned into Polygon’s wins lately as the sidechain has experienced record growth amidst high gas fees. Now, as gas fees start to return to normality many expected investors to flood back to Ethereum dapps – instead we see Polygon DeFi experiencing record growth.

The team at DappRadar went on to explain that users are increasingly being forced to experience DeFi on other networks as Dapps on Ethereum become unusable for the average investor, due to unpredictable fees. Such a perfect situation has resulted in the DeFi users, switching to Polygon due to ‘cheaper fees, high introductory returns, and a deluge of competing DeFi apps’.

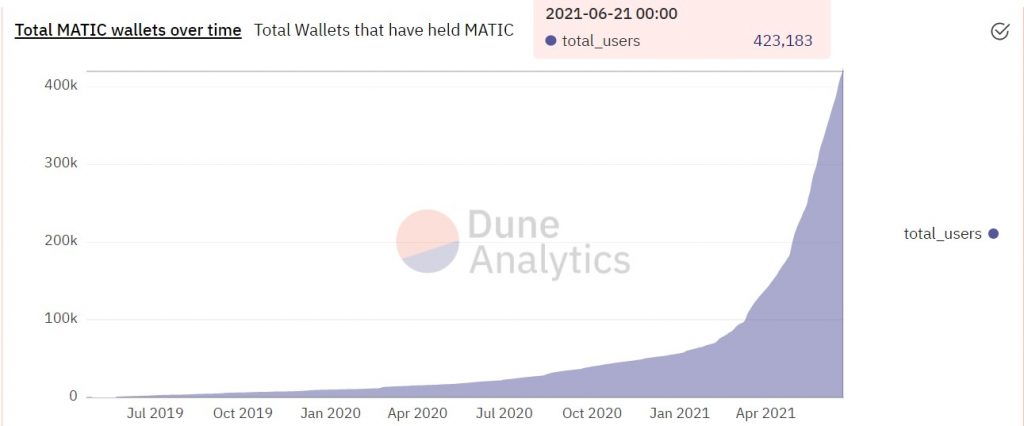

Total Polygon (MATIC) Wallets Exceed 420k

The growth of Polygon (MATIC) is best exemplified by the parabolic increment in unique wallets on the network. According to data from Dune analytics, Polygon hosts over 420k unique addresses as highlighted in the following chart.

Total Value Locked on Polygon Hits All-time high of $11.84 Billion

In terms of total value locked on Polygon (MATIC), the protocol has demonstrated remarkable growth in the second quarter of 2021 reaching a peak value of $11.84 Billion on June 15th. At the time of writing, the total value locked on Polygon stands at $8.65 Billion.

The chart below, courtesy of DeFiLlama.com, provides a visual cue of the significant growth of funds locked on Polygon in the second quarter of 2021.