Key Takeaways

- Crypto analytics firm Elliptic has published a new report that surveyed DeFi losses between 2020 and 2021.

- At least $12 billion has been lost to various attacks and incidents, with $10.5 billion stolen this year alone.

- Elliptic’s estimates are considerably higher than other similar surveys for reasons that are unclear.

Share this article

Crypto analytics firm Elliptic has published a new report suggesting that the DeFi sector has seen $12 billion in losses over the past two years.

Most Theft Took Place This Year

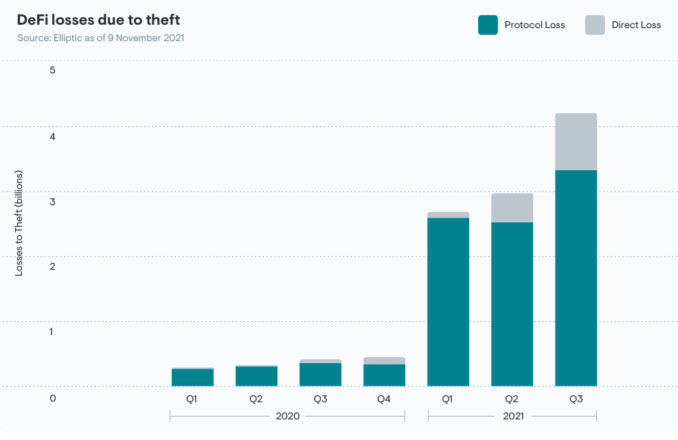

Elliptic says that more than $12 billion has been lost through DeFi crime. Though the survey accounts for both 2020 and 2021, the majority of losses took place this year with $10.5 billion in losses.

Most of the losses were the result of protocol losses, with $10 billion of losses falling in that category. This category concerns project tokens that lose market value as the result of fraud.

Just $2 billion was lost through direct losses—that is, attacks that directly targeted DeFi projects and stole money from the project and its users. This category of incident would include recent attacks on Anubis DAO and Cream Finance, for example.

Elliptic noted that $721 million of the funds lost through direct losses were eventually recovered, making this category less significant.

Attack Strategies and App Types Varied

Those who carried out DeFi attacks employed various strategies. $5.5 billion in losses came from code exploits, while another $5.3 billion came from economic exploits. Admin key exploits accounted for another $1 billion in losses, while “rug pulls,” or exit scams, accounted for just $18 million in losses.

Different types of DeFi apps were targeted to different degrees. Lending apps accounted for 34% of the losses. DEXes accounted for 17.1% of losses, asset management apps accounted for 16.4% of losses, and cross-chain bridges accounted for 13.5% of losses.

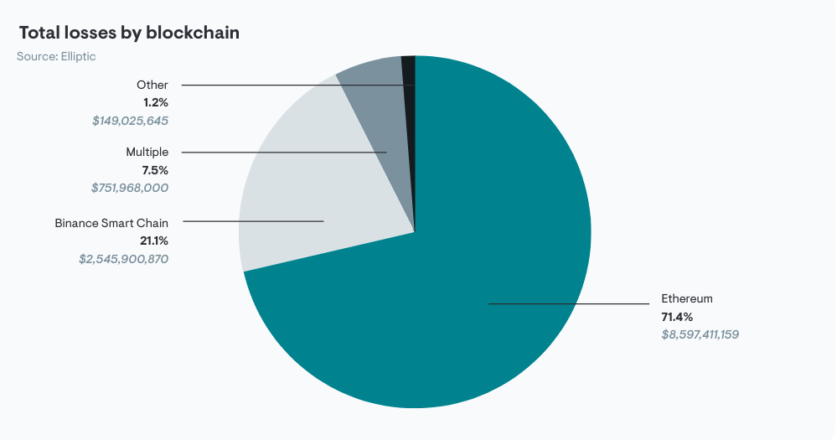

Two blockchains were the primary target of the losses tallied by Elliptic. Ethereum-based DeFi apps made up 71% of the total with $8.6 billion in losses, while Binance Smart Chain-based apps made up 21% of the total with $2.5 billion in losses.

Other Estimates of DeFi Theft

Elliptic’s numbers are higher than other estimates. In August, CipherTrace suggested that DeFi crime accounted for $361 million in losses in 2021 and $129 million in losses in 2020.

Meanwhile, The Block’s live data tracker suggests that $629 million of funds have been stolen through DeFi exploits since 2020.

Those discrepancies may suggest that Elliptic has surveyed the DeFi terrain more closely than its competitors. Alternately, the fact that it includes token value loss may have driven up its estimate.

Disclosure: At the time of writing, the author of this piece owned less than $100 of BTC, ETH, and altcoins.

Share this article

Maple Finance Launches DeFi’s First Syndicated Loans With Alamed…

Maple Finance has launched the first DeFi-focused syndicated loans, allowing large-cap institutions to access debt capital markets on Ethereum. Maple Finance Launches Loan For Alameda Research Capital efficiency in DeFi…

Valkyrie Is Launching a $100M DeFi Hedge Fund

Valkyrie Investments is planning to offer a new hedge fund that is connected to the performance of various DeFi assets. Fund Will Go Live Next Week The investment vehicle will…

DeFi Project Spotlight: Vesper Finance, the Yield Aggregator Built for…

Vesper Finance is a yield aggregator offering an accessible, secure, and conservative experience for DeFi newcomers and institutions. It aims to provide a suite of yield-generating products that allow users…

MDEX: Overlooked Decentralized Exchange That Pays You to Trade

Based on statistics from DeBank and dapp.com, one of the top-performing decentralized exchanges by TVL and trading volume this year is MDEX—an AMM-based DEX functioning across the Huobi Eco-chain (HECO), Binance Smart Chain…