Key Takeaways

- Algorand and NEAR are soaring while Bitcoin and Ethereum lag.

- A liquidity mining program on Algorand’s Algofi is bringing in new users.

- The strong price action on these networks appears to be fueled by increased DeFi activity.

Share this article

The alternative Layer 1 networks Algorand and NEAR have surged as new users jump into their DeFi ecosystems.

Alternative Layer 1s Rally

Algorand and NEAR’s native tokens are outpacing the rest of the market.

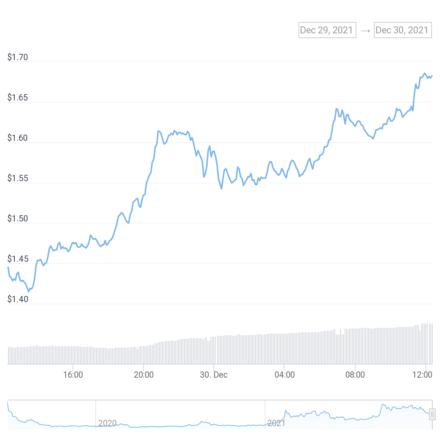

Algorand led the crypto market Thursday, rising 17.6% while Bitcoin and Ethereum lagged. The ALGO token bounced from a low of $1.43 late Wednesday to post a strong recovery, trading at $1.68 at press time.

Algorand’s solid price action is likely fueled by the launch of a $3 million liquidity mining program to drive DeFi adoption on the network. Algofi, a lending and borrowing protocol similar to Ethereum’s Aave, has partnered with the Algorand Foundation to distribute ALGO token rewards to early users.

DeFi on Algorand is growing quickly. The network’s first decentralized exchange, Tinyman, has already secured over $40 million of total valued locked and sees daily trading volumes of over $5 million. Additionally, an Ethereum and Bitcoin bridge called Algomint launched its own liquidity mining program last week, incentivizing users to bridge their funds onto the network.

NEAR Protocol is another standout today, with its native token climbing 10% over the past 24 hours. Like Algorand, NEAR has also seen DeFi activity pick up on its network. According to data from DeFi Llama, the total value locked on NEAR has increased 19.24% over the past week to more than $133 million.

NEAR also received a boost earlier in December when it partnered with fellow Layer 1 network Terra, kicking off its current rally. The partnership means that Terra will deploy its UST stablecoin to the NEAR and Aurora ecosystems, opening up new DeFi strategies.

While activity on Algorand and NEAR is still low compared to more prominent Layer 1s such as Avalanche and Solana, DeFi on these networks is growing fast. Investors are likely speculating that these alternative networks will see increased valuations following the explosion of Layer 1 chains earlier this year in August. Only time will tell if this Layer 1 trend will continue into 2022.

Disclosure: At the time of writing this feature, the author owned LUNA, SOL, and several other cryptocurrencies.

Share this article

Crypto Market Tumbles as Whales Send Bitcoin Below $50,000

Bitcoin has broken below $50,000 again. Other Layer 1 coins like Ethereum, Solana, Terra, and Polkadot are also down today. Bitcoin Faces Resistance Bitcoin is pushing the cryptocurrency market into…

What is a Crypto Airdrop: Why Projects Airdrop Crypto

Crypto airdrops occur when new tokens are freely distributed to different wallets in order to drive initial growth and build a community. They represent a popular marketing tactic that new projects use to spread…

Terra Leads Layer 1 Resurgence Targeting $100

Terra is continuing to trend higher amid a resurgence of Layer 1 chains. NEAR, Fantom, and Cosmos are also showing strong recoveries after trending lower since the beginning of December. …

Layer 1 Coins Lead Market Rally After Fed Meeting

Avalanche, Fantom, Kadena, Terra, and other Layer 1 coins have posted double-digit gains today. Layer 1 Projects Rally on Fed Meeting Layer 1 projects are leading the market again. According…