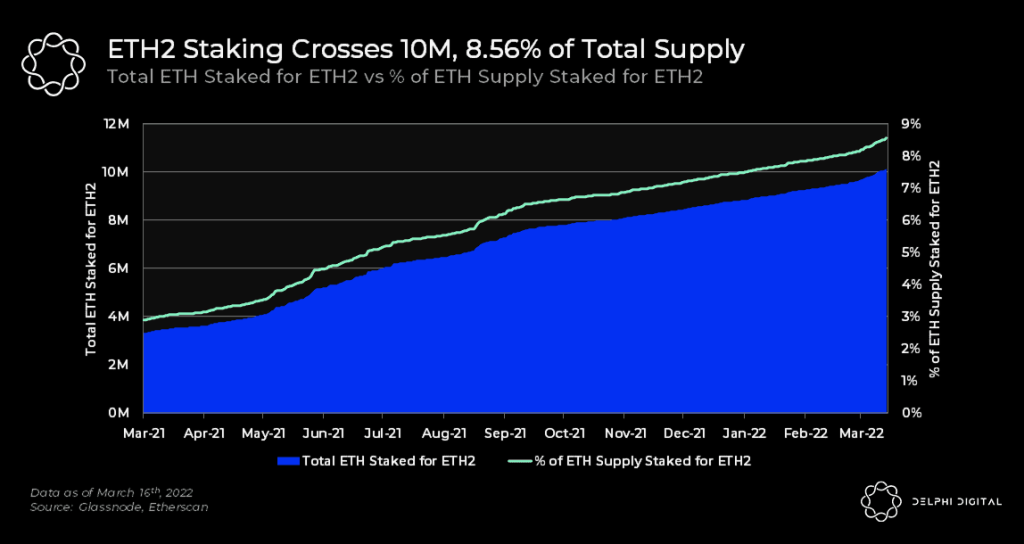

- 8.56% of the total ETH supply is now in ETH2 deposit contracts.

- The merge on the mainnet — expected later this year — would increase the yield in staking ETH.

- The amount of ETH waiting to activate is also at an all-time high.

The amount of Ethereum staked in the ETH2 deposit contract amounts to over 10 million, or about 8.56% of the whole ETH supply. This is an impressive figure that suggests an optimistic forecast for a network that is about to receive a lot of upgrades this year.

An ETH2 merge is also expected at the end of Q2, bringing with it an increase in yield for staking ETH. With more stakers entering the network, the amount previously earned by miners will now go towards the former type of validator, naturally increasing their revenue.

The merge is a huge development that will turn Ethereum into a deflationary asset, bringing a lot of buy pressure that has investors hopeful. There have been multiple signs and discussions about a potential massive change following the merge.

The crypto community carried out an analysis on the triple-halving that the Ethereum merge would bring. Bear in mind that Ethereum will undergo a 90% cut of daily emissions from 12,000 Ξ a day to 1280 Ξ, while rewards for PoS validators will go up from 4.5% to 10–15% in the months after the merge.

There is also more ETH arriving on the horizon, as the amount of ETH waiting to activate is moving towards a new all-time high. The current number of daily active validators is about 315,700, the highest its ever been.

Ethereum Prospects Look Bright

With so many critical developments happening, and signs of growth across a lot of metrics, investors are unsurprisingly bullish about the Ethereum token. ETH has gained about 5.2% in a day, but a much stronger gain over the following weeks is potentially on the table.

The merge has successfully taken place on the Kiln testnet and was celebrated in the Ethereum community. Later this year, it should hit the Ethereum mainnet, and this would mark one of the biggest successes of ETH2 development, finishing the transition to Proof-of-Stake.

Being such a big year for the asset and a huge positive change in terms of speed and cost, ETH could possibly even reach all-time highs. In any case, it is set to be a transformative year, even if the price doesn’t go quite where some analysts believe it will. Proof-of-Stake will boost a network that is vying against multiple other networks in a lot of niches, and which is comfortably the dominant DeFi network despite shortcomings in cost and speed.