Quick take:

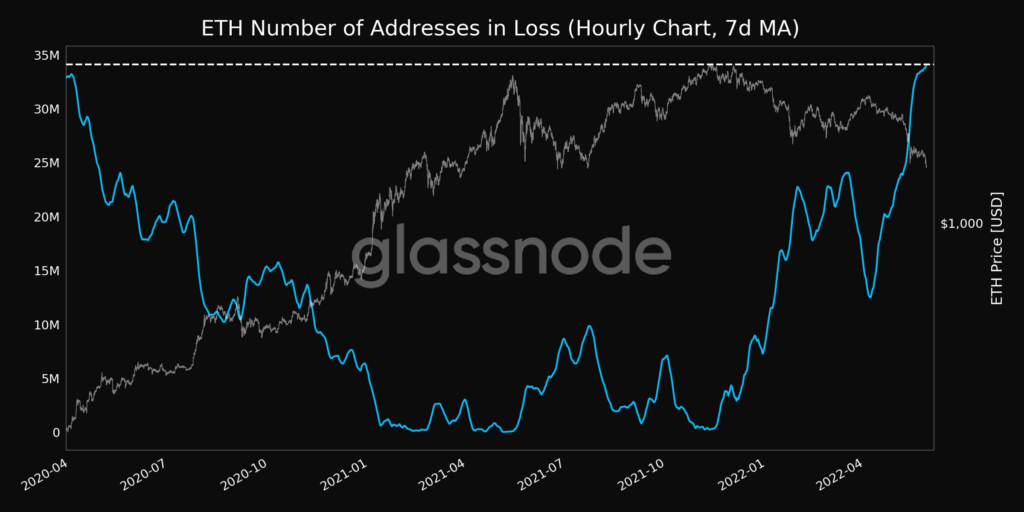

- Over 34 million addresses that hold ETH are in loss positions.

- The second-largest crypto is down over 10% in the last week.

- Other altcoins across the market are also down as the markets hit a lull.

- Ethereum’s transition to PoS could still happen in August despite the reorg attack on the Beacon chain.

- Technical analyst predicts another 50% – 70% dip in altcoin prices as BTC dominance grows.

The number of wallets holding ETH in loss hit a two-year high on Friday (May 27, 2022) following another lackluster week for the cryptocurrency market. Data from Glassnode shows that over 34.1 million addresses now hold Ethereum below the levels they bought at.

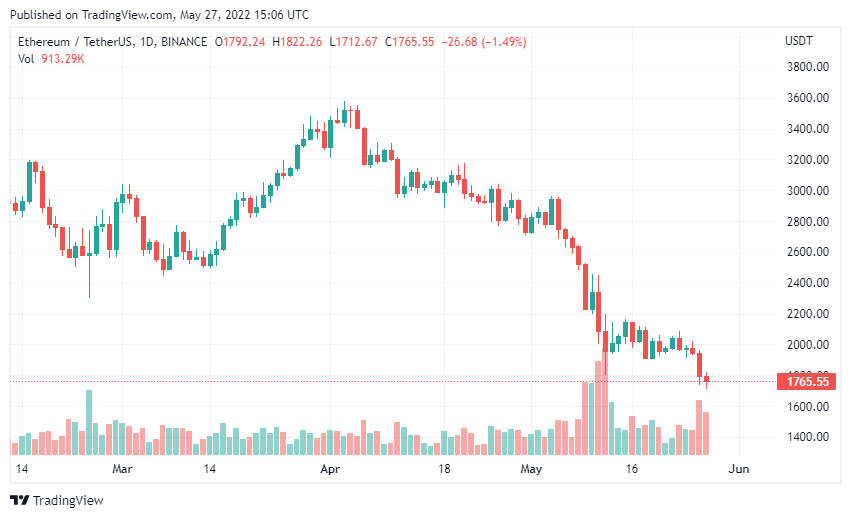

Since around December 2021, the general cryptocurrency market hit a slump and slowly slipped into a downtrend. ETH has fallen far below its November 2021 ATH of $4,891. As of press time, the world’s second-largest crypto trades around $1,810. The token has indeed dipped massively and is down over 10% this week, per data from CoinMarketCap.

Furthermore, a recent report from Santiment revealed that network activity on Ethereum also reduced and transactions on the network recorded significantly low gas fees.

The news comes ahead of ETH’s anticipated transition to a Proof-of-Stake consensus. The update dubbed The Merge is expected to happen in August despite a reorganization attack on Ethereum’s sister chain – Beacon.

However, core ETH developer Preston Van Loon remains optimistic that the event won’t affect progress.

Ethereum and Other Alts Could Dip Another 50% Due To Rising BTC Dominance

As expected following the latest bloodbath in the crypto market, ETH’s market cap lost a few billion and dropped down to $218 billion from around $350 billion at the start of May. Notably, the total crypto market also dipped to $1.27 trillion.

On-chain data shows that the situation triggered a rise in Bitcoin’s dominance over the market as the leading coin now accounts for almost half of the whole crypto market. As of press time, BTC dominance had grown to around 44%.

The situation supposedly forms the main thesis behind technical analyst Jason Pizzino’s prediction that BTC could drain liquidity from the market and trigger another 50% – 70% dump in altcoin prices.