Summary:

- Major derivatives marketplace CME Group announced an addition to its crypto offerings on Thursday.

- The firm plans to launch options on Ether futures around September 12.

- Users can already trade Bitcoin futures options and ETH futures via CME.

- The news comes as demand for Ether options trading activity hit an eight-month high in August.

Chicago Mercantile Exchange (CME) Group, one of the world’s leading platforms for crypto derivatives products, has announced the launch of options for Ether (ETH) futures on September 12, a few days before the Ethereum network transitions to a Proof-of-Stake consensus.

According to Thursday’s announcement, CME plans to provide a broader range of crypto offerings for customers with its latest addition. At press time, the service already boasts options for Bitcoin, as well as futures products for BTC and ETH.

CME’s newest offering would feature contracts that deliver one ETH futures. The group revealed a 50 ETH per contract structure for interested investors.

The firm’s Global Head of Equity Tim McCourt said CME’s latest product could tap extensive liquidity floating in the booming futures market. So far, the firm has traded over 1.8 million contracts with demand increasing ahead of the Merge.

As we approach the highly anticipated Ethereum Merge next month, we continue to see market participants turn to CME Group to manage ether price risk.

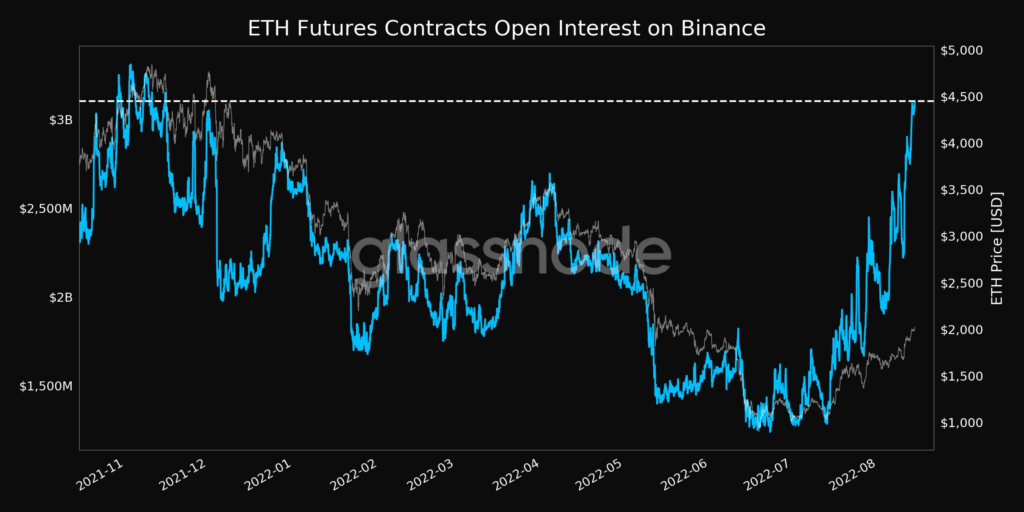

Ether (ETH) Open Interest Hits Record High Weeks Before The Merge

Ethereum has arguably assumed center stage in the world of digital assets. The network is on the road to a landmark moment as developers prepare for a switch to a Proof-of-Stake consensus from a Proof-of-Work mechanism.

While the price of ETH has hovered around the $1800 range over the past few days, open interest on ETH futures contracts on Binance hit an eight-month high. Data from Glassnode showed that ETH options peaked at around 4 million in August 2022, beating the previous record of 3.5 million.