Key Takeaways

- GMX is a decentralized exchange built on Avalanche and Arbitrum.

- It lets DeFi users trade with up to 30x leverage in a permissionless manner.

- GMX offers a smooth user experience that’s perfectly suited to retail DeFi traders.

Share this article

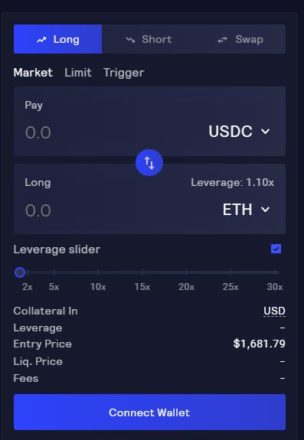

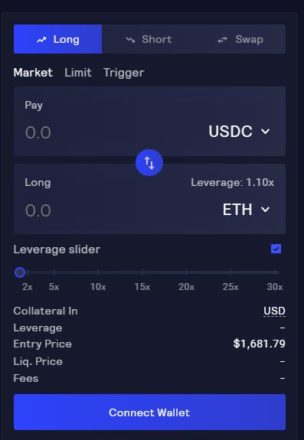

GMX users can “long” or “short” up to 30 times the size of their collateral by borrowing funds from a large liquidity pool.

Decentralized Leverage

GMX is a popular decentralized exchange that specializes in perpetual futures trading. Launched on the Ethereum Layer 2 network Arbitrum in late 2021 and later deployed to Avalanche, the project has quickly gained traction by offering users leverage of up to 30 times their deposited collateral.

Leverage trading—the act of borrowing funds from financial platforms in order to increase one’s exposure to price movements—has become an essential part of the crypto ecosystem in recent years. Among other things, it allows market participants to profit from price downturns, reduce risk in uncertain conditions, and bet big on an asset when they have conviction.

There are several ways of taking on leverage in crypto. Binance, FTX, and other centralized exchanges offer customers the ability to borrow funds for trading purposes. Binance and FTX both let customers borrow a maximum of up to 20 times their initial deposit. DeFi protocols like Aave and MakerDAO issue loans against crypto collateral in a permissionless manner. More recently, traditional finance companies like GME Group and ProShares have started offering their institutional clients access to leveraged products such as options on Ethereum futures contracts and Bitcoin Short ETFs to their institutional investors.

GMX differs from such services in that it’s a decentralized exchange that offers leverage trading services. In that respect, it combines a similar experience to other DeFi exchanges like Uniswap with the leverage trading services offered by the likes of Binance. On GMX, users can take up to 30x leverage on BTC, ETH, AVAX, UNI, and LINK trades. In other words, if a trader deposited $1,000 worth of collateral to GMX, they’d be able to borrow up to $30,000 from its liquidity pool. In this guide, we unpack GMX’s offering to ascertain whether it’s safe, and if you should use it for your next high conviction bet.

Trading on GMX

Trading on GMX is supported by a multi-asset GLP pool worth more than $254 million at press time. Unlike many other leveraged trading services, users borrow funds from a liquidity pool containing BTC, ETH, USDC, DAI, USDT, FRAX, UNI and LINK rather than a single entity.

Users can go “long,” “short,” or simply swap tokens on the exchange. Traders go long on an asset when they expect its value to increase, and they short in expectation of being able to buy an asset back at a lower price. On GMX, users can select a minimum leverage level of 1.1x their deposit and a maximum level of 30x on long and short trades.

GMX is powered by Chainlink Oracles. It uses an aggregate price feed from leading volume exchanges to reduce liquidation risk from temporary wicks. A liquidation occurs when a user’s collateral becomes insufficient to maintain a trade; the platform then forcefully closes the position and pockets the deposit to cover its losses.

When a user opens a trade or deposits collateral, GMX takes a snapshot of its dollar value. The value of the collateral does not change throughout the trade even if the price of the underlying asset does.

Trading fees to open or close a position come in at 0.1%. A variable borrow fee also gets deducted from the deposit every hour. Swap fees are 0.33%. As the protocol itself serves as the counterparty, there’s minimal price impact when entering and exiting trades. GMX claims it can execute large trades exactly at mark price depending on the depth of the liquidity in its trading pool.

When a user wants to go long, they can provide collateral in the token they’re betting on. Any profits they receive are paid in the same asset. For shorts, collateral is limited to GMX’s supported stablecoins—USDC, USDT, DAI, or FRAX. Profits on shorts are paid in the stablecoin used.

Tokenomics and Liquidity

The protocol has two native tokens: GMX and GLP.

GMX is the utility and governance token. It can currently be staked for a 22.95% interest rate on Arbitrum and 22.79% on Avalanche.

Stakers can earn three types of rewards when they lock up GMX: escrowed GMX (esGMX), multiplier points, and ETH or AVAX rewards. esGMX is a derivative that can be staked or redeemed for GMX over a period of time, while multiplier points reward long-term GMX stakers by boosting the interest rate on their holdings. Additionally, 30% of the fees generated from swaps and leverage trading are converted to ETH (on Arbitrum) or AVAX (on Avalanche) and distributed to staked GMX holders.

The GMX token also has a floor price fund. It’s used to ensure that the GLP pool has sufficient liquidity, provide a reliable stream of ETH rewards for staked GMX and buy and burn GMX tokens in order to maintain a minimum price of GMX against ETH. The fund grows thanks to fees accrued through the GMX/ETH liquidity pair; it’s also supported by OlympusDAO bonds.

At time of writing, the total GMX supply stands at 7,954,166 worth more than $328 million, 86% of which is staked. The total supply varies depending on esGMX redemptions, but the development team has forecasted that the supply will not exceed 13.25 million. Beyond that threshold, minting new GMX tokens will be conditional on DAO approval.

The second token, GLP, represents the index of assets used in the protocol’s trading pool. GLP coins can be minted using assets from the index, such as BTC or ETH, and can be burned to redeem these assets. GLP holders provide the liquidity traders need to get leverage. This means they book a profit when traders take a loss, and they take a loss when traders book a profit. Additionally, they receive esGMX rewards and 70% of the fees the protocol generates. The fees are paid in either ETH or AVAX. GLP tokens are automatically staked and may only be redeemed, not sold. The current interest rate is 31.38% on Arbitrum and 25.85% on Avalanche.

GLP’s price is contingent on the price of its underlying assets, as well as the exposure GMX users have toward the market. Most notably, GLP suffers when GMX traders short the market and the price of pool assets also decreases. However, GLP holders stand to profit when GMX traders go short and prices rise, GMX traders go long and prices decrease, and GMX traders go long and prices rise.

Final Thoughts

GMX is user-friendly. The trading experience feels smooth, and the system provides users with thorough data. Whenever entering or closing a position, it’s easy to find the collateral size, leverage amount, entry price, liquidation price, fees, available liquidity, slippage, spread, and PnL (profits and losses). The protocol’s interface supplies an abundance of information related to its assets under management, trading volumes, fees, and trader positions. The website also details GMX and GLP’s market capitalizations and highlights the project’s partnerships, integrations, and related community projects. The website also includes a documentation section, which provides information on the exchange’s various components, and suggests methods to bridge to Arbitrum or Avalanche, or to acquire GMX and GLP tokens. Thanks to its detailed website, GMX gives off an impression of transparency. As a result, the protocol’s mechanisms are relatively simple to grasp.

With its permissionless accessibility and leveraged trading offering, GMX combines the experience of both decentralized and centralized exchanges, showing that DeFi protocols are still breaking new ground every day. The protocol’s trading volume has more than tripled in the past two months and now ranges between $290 million and $150 million daily, indicating growing interest among crypto natives. As GMX doesn’t yet handle billions of dollars of volume like its centralized counterparts, it’s currently a product best suited to small retail traders. Still, after rapid growth over recent months, GMX could soon attract the institutional market as more big players start to experiment with DeFi. With more room for growth ahead, it’s well worth keeping an eye on.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.

Share this article

Beginner’s Guide: Perpetual Trading on dYdX

Crypto Briefing explains how to use dYdX, one of the fastest-growing platforms for decentralized perpetuals trading on the Ethereum blockchain. An Introduction to Perpetual Trading on dYdX Since launching in…

DeFi Exchanges dYdX, Uniswap Soar Amid China Crackdown

The decentralized exchanges dYdX and Uniswap have jumped in value after experiencing a significant increase in trading volume following China’s latest announcement of a crackdown on virtual assets. Chinese Investors…

Arbitrum Leads Ethereum Layer 2 Race With $3.3B Locked

Arbitrum, an Optimistic Rollup, has strengthened itself as the top Layer 2 solution on Ethereum. The total value locked on the network reached has $3.3 billion, jumping 17.78% in the…