Summary:

- Uniswap’s trading volumes for Ether skyrocketed to $1.21 billion, beating centralized exchange Binance.

- $31 billion worth of transactions happened at decentralized exchange venues over the past week.

- “Not your keys, not your coins” crypto participants echo as FTX’s crash unravels further.

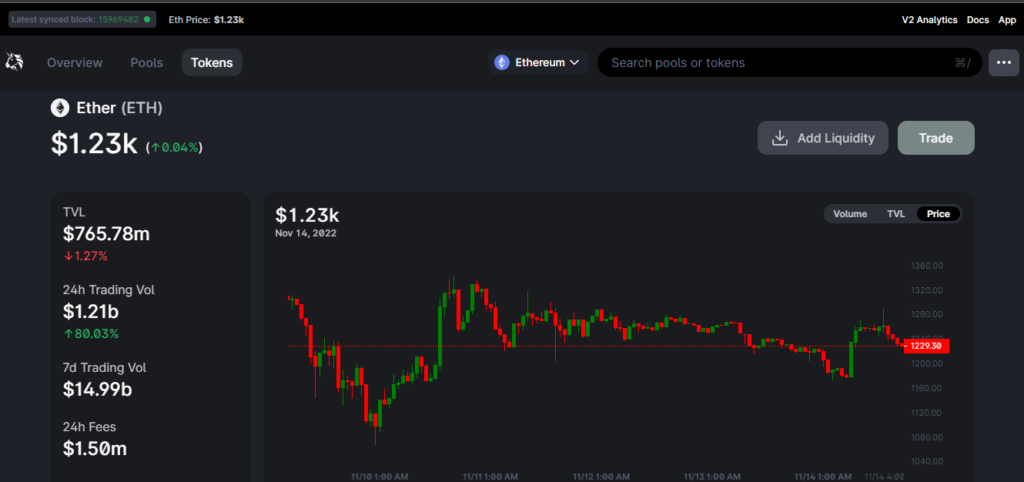

Decentralized cryptocurrency exchange Uniswap facilitated over $1.21 billion in Ethereum transactions as of Monday, up 80% in the past 24 hours. This means Ether (ETH) traders and users prefer to deploy their digital assets on DEXs like Uniswap following FTX’s implosion.

Sam Bankman-Fried’s crumbled after funding Alameda’s high-risk trading strategies with billion in customer funds. FTX paused withdrawals and filed for chapter 11 bankruptcy, as did Celsius and Three Arrows Capital after Terra’s failure. SBF also resigned as CEO as estranged users hope for recovery in court.

“Not your keys, not your coins” – Ethereum traders and Crypto Users

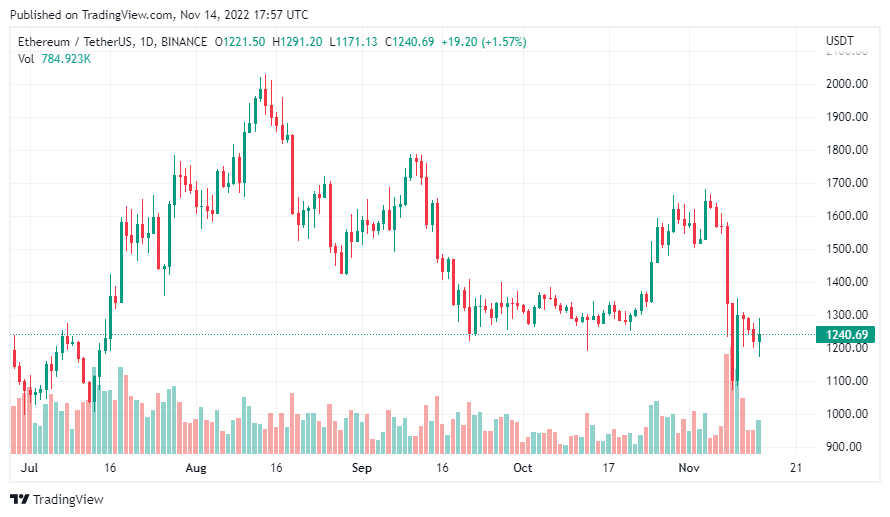

Ethereum volumes for the ETH/USDT pair on Binance rose some 9.49% at $1.1 billion, per Coingecko data. Dune Analytics also reported a 178% boom in weekly ETH volumes on DEXs like Uniswap and Curve Finance. ETH traded around $1,200 on Monday, data pulled from TradingView showed.

Ethereum users and crypto traders alike flocked to decentralized trading venues after FTX’s crash left billions in retail deposits and balances in limbo. Unlike centralized exchanges (CEX) where third-party custodians – the exchanges themselves like Binance and Coinbase – store user assets, decentralized exchanges (DEX) like Uniswap offer a trading venue and access to liquidity.

DEX users maintain greater custody of their digital tokens via web3 wallets like MetaMask and other self-custody solutions.

Binance CEO Changpeng Zhao – like other prominent crypto proponents – stressed the need for self-custody in the wake of FTX’s collapse. “Not your keys, not your crypto”, the so-called rallying cry for DeFi proponents pushing for greater decentralization and transparency in crypto.