- The total annualized issuance rate of ETH reduced substantially

- Circulation also decreased, adding to Ethereum’s deflationary nature

Many speculations were made regarding what would lie ahead for Ethereum [ETH] post the Merge. One of the doubts that most had was around ETH’s deflationary nature. However, there was some clarity seen on that front as according to official sources, ETH achieved a nearly zero total annualized issuance rate.

____________________________________________________________________________________________

Read Ethereum’s [ETH] Price Prediction 2023-24

____________________________________________________________________________________________

Last year, Ethereum developers pushed the London upgrade that enabled the Ethereum burning. The reduced issuance rate, when coupled with the Ethereum burn, added to its deflationary nature and painted a positive picture for Ethereum’s future.

Deflationary characteristics amplified

As per Messari’s data, ETH’s supply also reduced considerably over the last few days. This further supported its deflationary characteristics.

#ETH reached a declining supply this week.

Is the “ultra-sound” narrative no longer a meme? 🦇 🔊 pic.twitter.com/Tez25ZjEi6

— Messari (@MessariCrypto) November 13, 2022

Interestingly, while the supply continued to decrease, Ethereum’s number of addresses holding 10+ coins just reached an ATH of 326,899. This development was positive, as it showed the confidence of investors in ETH.

📈 #Ethereum $ETH Number of Addresses Holding 10+ Coins just reached an ATH of 326,899

Previous ATH of 326,856 was observed on 12 November 2022

View metric:https://t.co/6ggy1nLJIb pic.twitter.com/7T3DSrg6fO

— glassnode alerts (@glassnodealerts) November 13, 2022

In theory, everything looked to be working in favor of ETH. However, these new updates did not seem to impact ETH’s price, as it was down by over 21% in the last week. At press time, ETH was trading at $1,259.72, with a market capitalization of over $153.5 billion.

Hold on! This can be concerning for ETH

The king of altcoins’ metrics suggested that things might get even worse for ETH. This was because there was a possibility of a further price decline in the days to come. According to CryptoQuant, the net deposits on exchanges were high compared to the seven-day average, which was a negative sign as it indicated higher selling pressure.

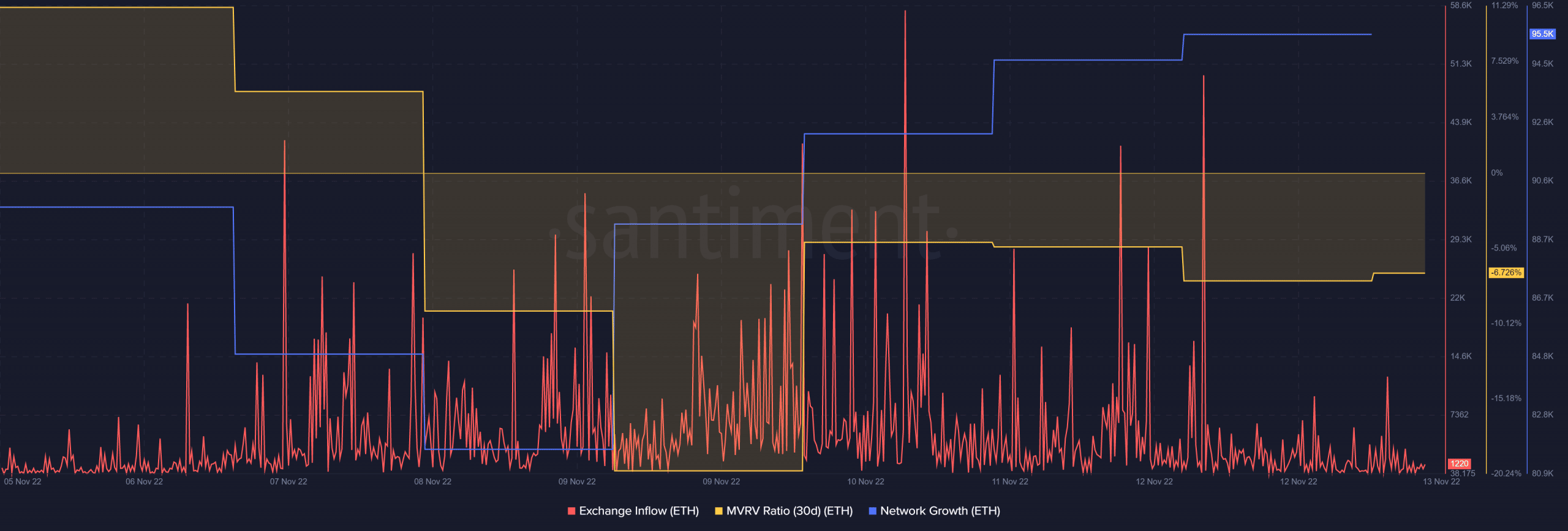

Ethereum’s number of active addresses went down. This suggested a lower number of users on the network. The total number of transactions also followed a similar route, which was yet another bearish signal. Santiment’s chart also supplemented the aforementioned metrics. Though ETH’s Market Value to Realized Value (MVRV) went up over the last week, it was still not adequate. ETH’s exchange outflow also registered a spike, which was a bearish sign too.

Regardless, not everything was against Ethereum, as a few metrics indicated towards a trend reversal. For instance, ETH’s exchange reserve was declining. This was a positive sign indicating lower selling pressure.

Moreover, ETH’s network growth registered a considerable uptick in the last few days, suggesting the possibility of better days in the near future.