- Ethereum whales are accumulating ETH in significant amounts

- Validators show interest in Ethereum, despite declining revenue

With all the attention in the crypto-space being directed towards the FTX saga, whales and sharks have been accumulating ETH under the radar.

Read Ethereum’s Price Prediction 2022-2023

Lots of fish in the sea

Santiment, a leading crypto-analytics firm, recently tweeted that addresses holding 100 to 100k ETH were capitalizing on the altcoin’s price drop. In fact, they have been accumulating $ETH massively. The platform also revealed that the last time whales accumulated so much ETH, there was a price surge of 50% on the charts.

Now, even though whales seem to be accumulating Ethereum aggressively, it remains to be seen whether retail investors will follow suit as well.

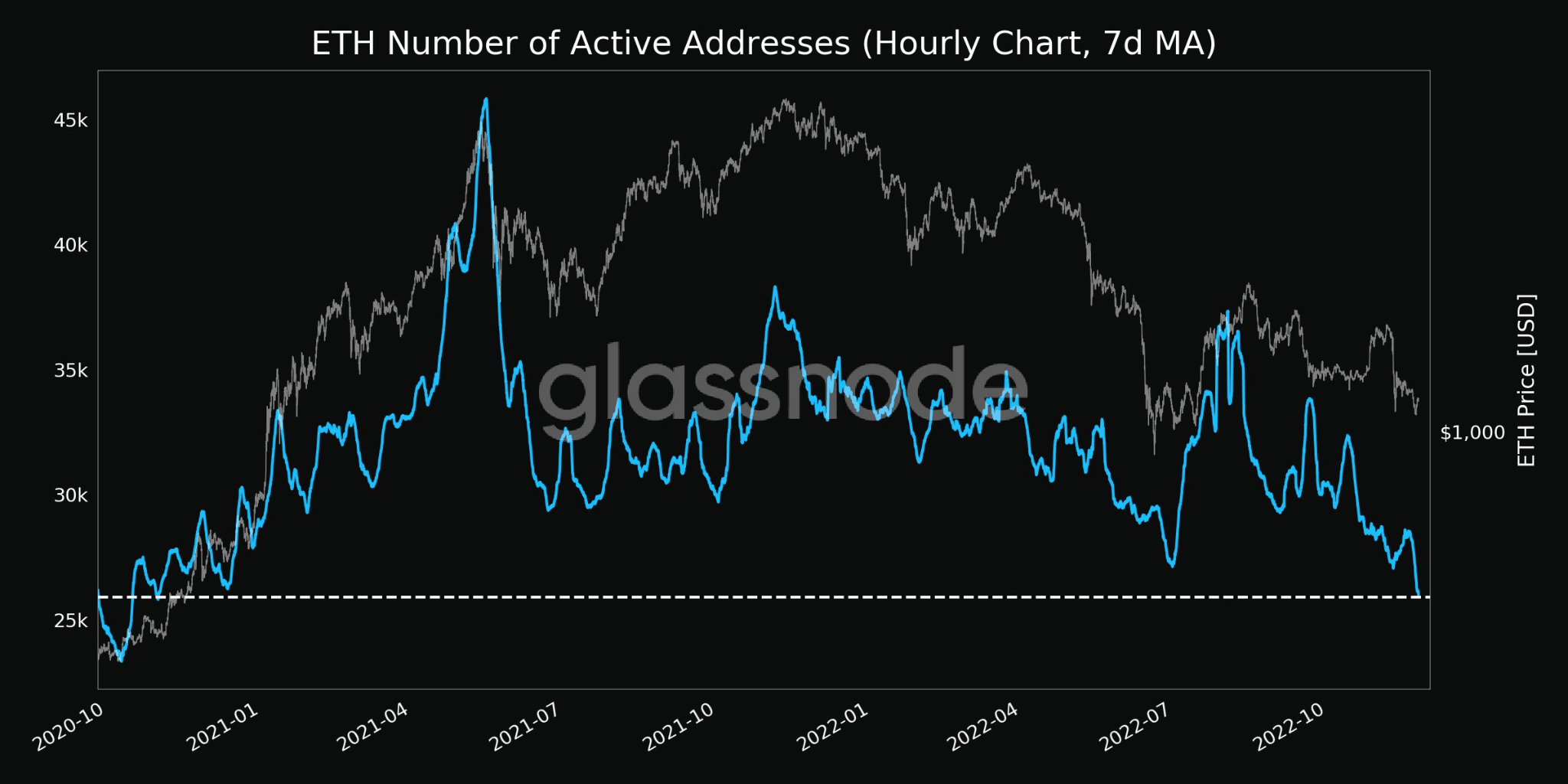

However, at the time of writing, active addresses on Ethereum were declining. As can be seen, the number of active addresses fell dramatically over the past few months. In fact, according to Glassnode, the number of active addresses hit a 2-year low of 25,916.

Along with that, the number of addresses in loss also touched an all-time high. This indicated that most people holding Ethereum would not make a profit, if they were to sell their ETH at this point in time.

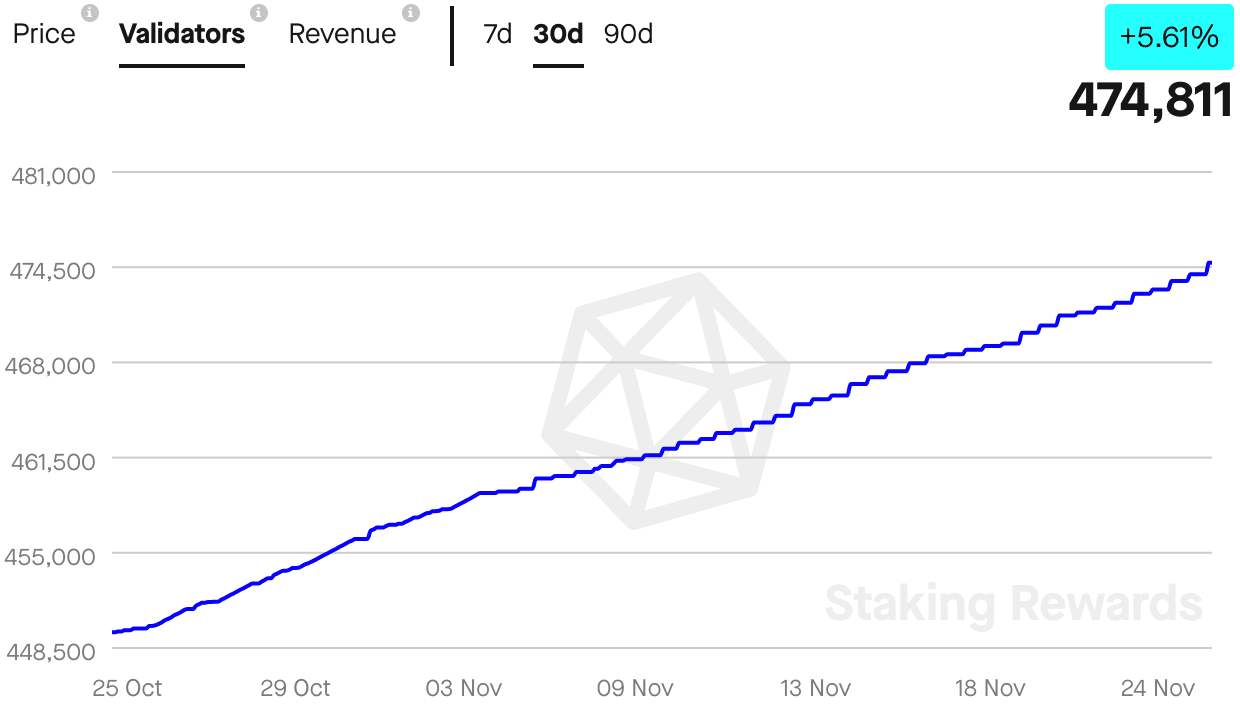

Despite the FUD and drop in price, Ethereum validators have continued to support Ethereum.

In fact, the number of validators on the Ethereum network grew by 5.51% over the last 30 days. At the time of writing, there were more than 474,000 validators on the network. These validators have continued to show faith in Ethereum, despite their declining revenue.

According to Staking Rewards, the revenue generated by Ethereum validators declined by 5.48% over the last 30 days. It remains to be seen whether these validators will continue to be on the Ethereum network.

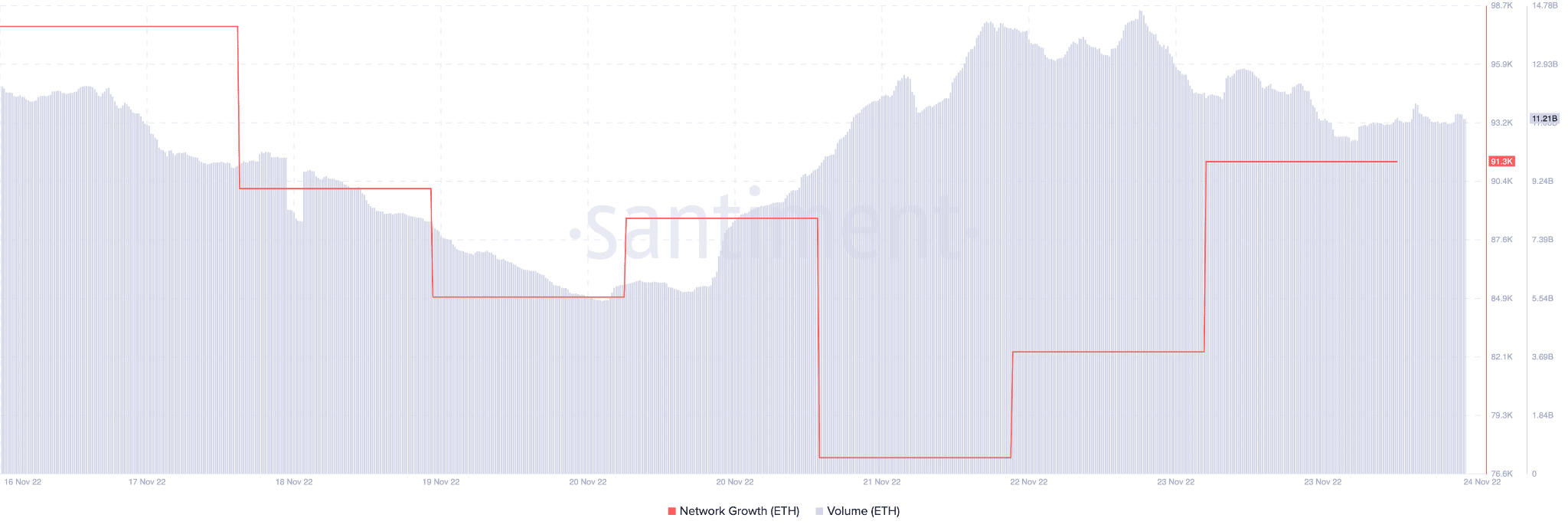

Moreover, Ethereum’s network growth witnessed a spike over the last few days. This suggested that the number of new addresses that transferred ETH for the first time had appreciated over the last few days.

Along with that, Ethereum also recorded an uptick in its volume. From 5.54 billion on the 20th of November, its volume climbed as high as 11.27 billion on 24 November.

At the time of writing, ETH was trading at $1200.14, with its market cap appreciating by 3.09% in the last 24 hours.