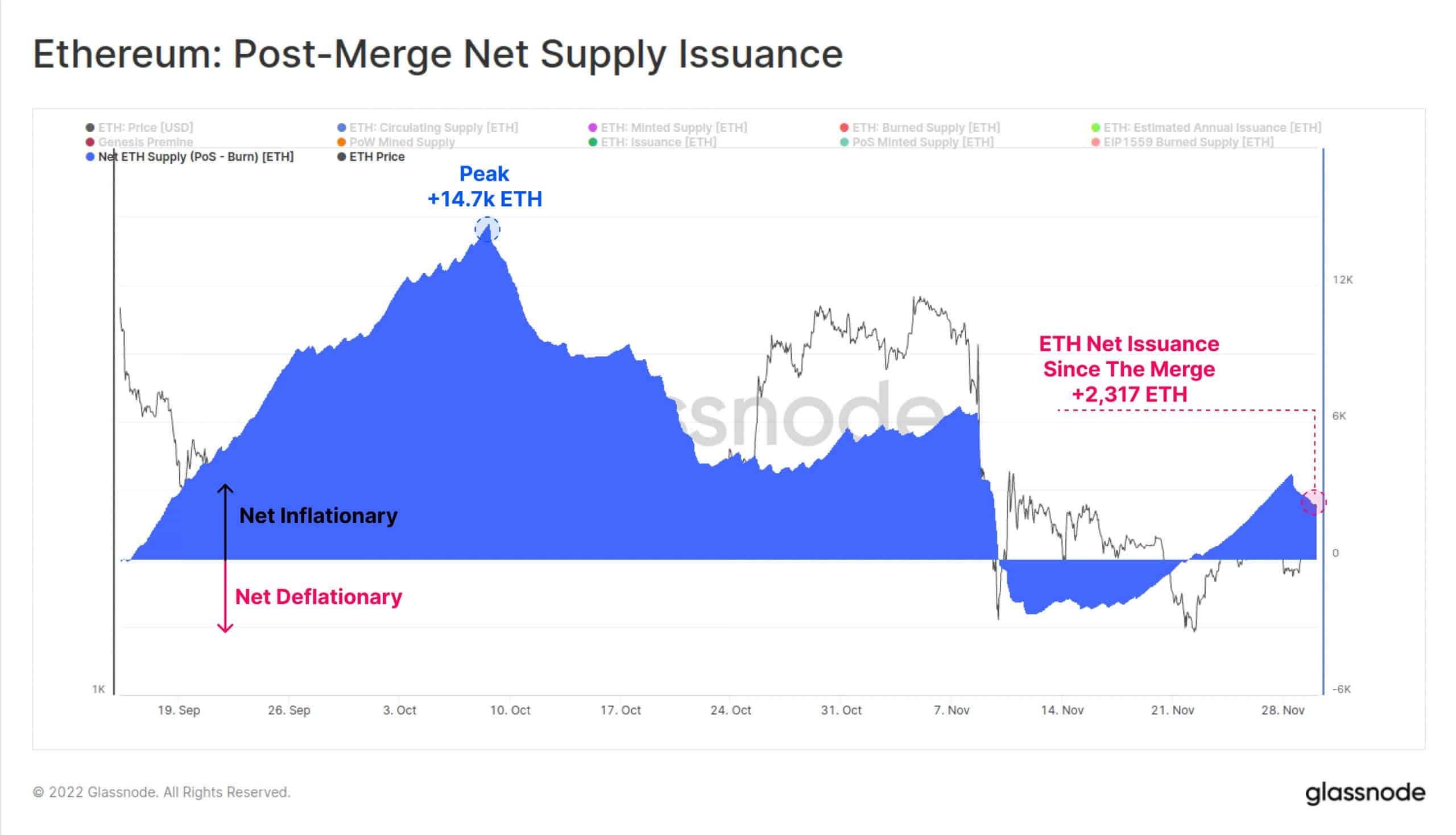

- Ethereum’s total net issuance witnessed a massive spike.

- The number of Ethereum’s retail investors also grew over the past few days.

Glassnode, a crypto analytics firm, reported that over the past few weeks, there was a significant increase in the total net coin issuance of Ethereum.

Read Ethereum’s Price Prediction 2022-2023

As can be seen from the image below, the amount of Ethereum issued to proof of stake validators grew immensely over the past few days. Evidently, this could attract more validators to stake ETH on the Ethereum network.

Source: glassnode

Validation from validators

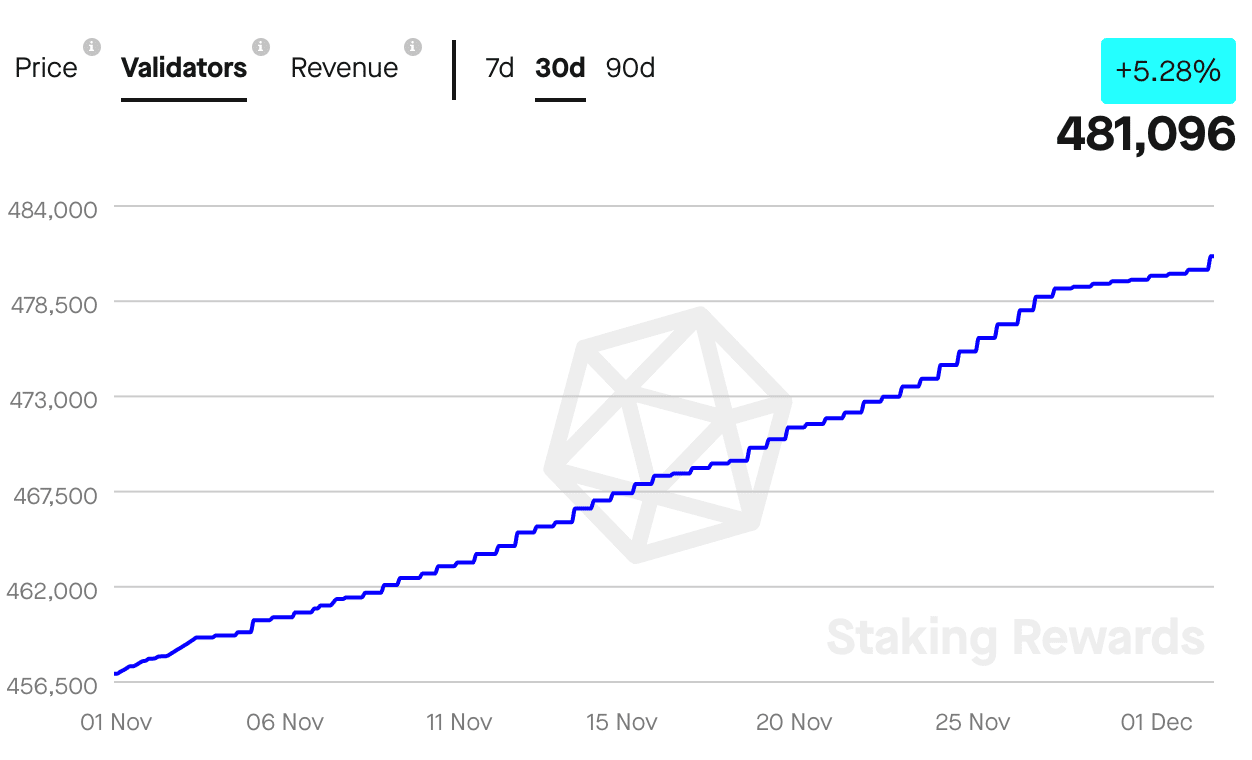

Data gathered by staking rewards suggested that there was a spike in the number of validators on the Ethereum network. The number of validators grew by 5.28% in the last 30 days.

The revenue generated by the validators also took a northward journey. According to data provided by glassnode, the amount of revenue generated by the validators reached a one-month high of $12,098.52 on 30 November.

This spike in revenue along with the growth in the issuance of ETH could continue sustaining validators’ interest in Ethereum.

“Gas”sing ETH up

However, it wasn’t just validators who showed interest in Ethereum, retail investors too were excited about ETH’s ongoing trajectory.

ETH addresses with more than 0.1 ETH saw an increase in their count over the past month. This indicated that small addresses had started showing faith in Ethereum and were willing to buy the altcoin at a discount.

One of the reasons for the interest from retail investors would be the decline in gas prices. At the time of writing, the median gas price for Ethereum had dropped to a 1 month low.

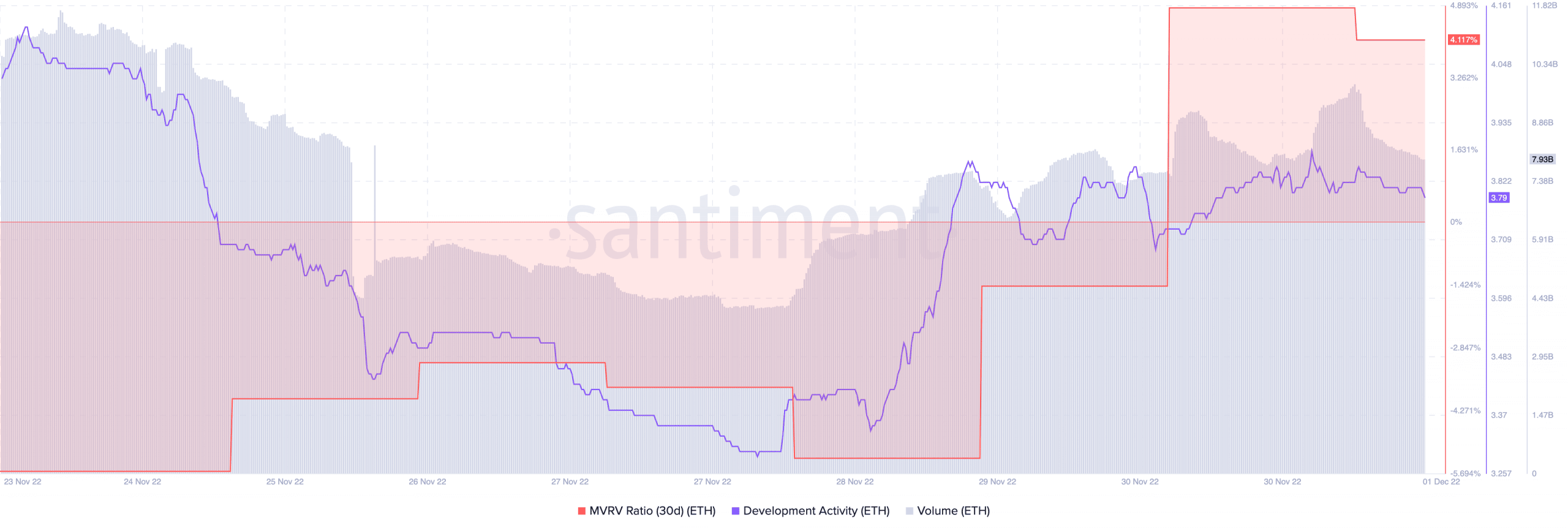

Furthermore, Ethereum’s MVRV ratio climbed significantly over the past few days. Thus, indicating that most Ethereum users would profit from selling their holdings.

Moreover, Ethereum’s development activity also spiked. This implied that the team at Ethereum had been making increasing contributions to their GitHub. Thus, implying that there could be new updates and upgrades in the works for Ethereum in the future.

That said, it’s still to be determined whether Ethereum holders will continue to show faith in Ethereum or take this opportunity to book a profit.