- AAVE’s V3 to offer more flexibility for users

- AAVE witnesses some demand from top whales in anticipation of the rollout

The Aave Protocol and its community are currently preparing for the rollout of the Aave Protocol V3. The latter will particularly target the Ethereum [ETH] market, where it might be a big deal. A recent update by Aave’s founder, Stani Kulechov, revealed why the rollout is of great significance.

Read AAVE’s Price Prediction 2023-2024

A historic overview of Aave might be useful in understanding why Aave Protocol V3 is important. According to the founder, DeFi summer and flash loans were pivotal in the network’s growth after Aave’s V1 rollout. The V2 launch was backed by more innovation and heavy staking. However, it also underscored some risks, which developers plan to address in Aave V3.

Now that the @AaveAave Community is preparing for Aave Protocol V3 deployment for Ethereum market 👻 its good time to review why V3 as a flexible architecture is much appreciated 👇🏼

— Stani.lens (🌿,👻) (@StaniKulechov) December 3, 2022

Kulechov noted that one of the key features planned for Aave V3’s Ethereum mainnet rollout is more flexibility for users. The new version will offer more flexibility when staking, especially during risky market conditions.

Aave v3 users will be better positioned to implement measures for mitigating risks during volatile and unfavorable market conditions. This move showcases the protocol’s efforts towards making its platform safer for users in the future.

What are the potential implications for AAVE?

Adding an extra layer of security for users might be encouraging for future users. If that turns out to be true, then Aave will likely achieve a high TVL in a short time, just like it did with previous iterations.

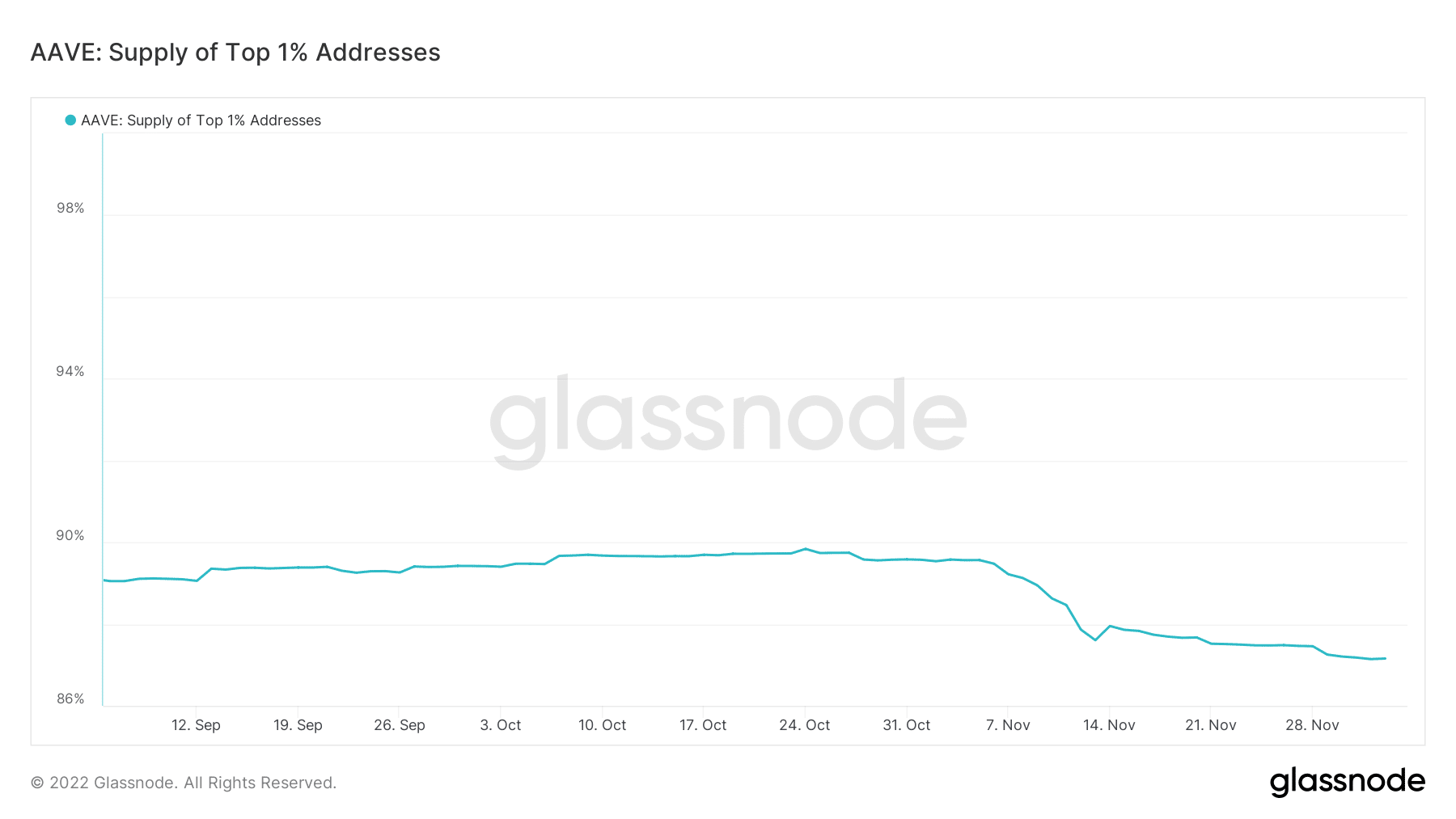

However, at the time of writing, AAVE was still struggling to bounce back after its crash in the first half of November. The upgrade might reignite whale interest in the token.

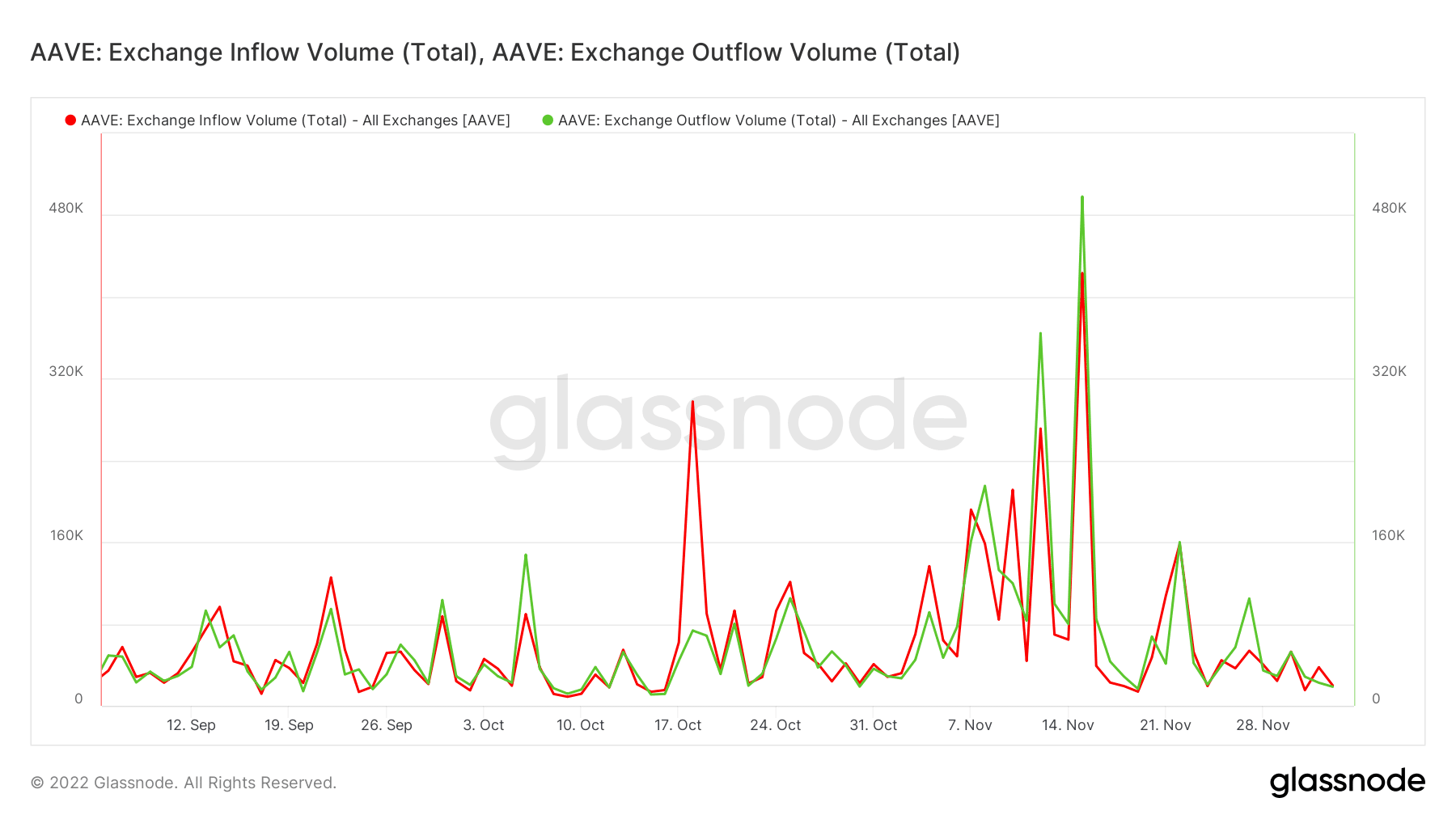

Source: Glassnode

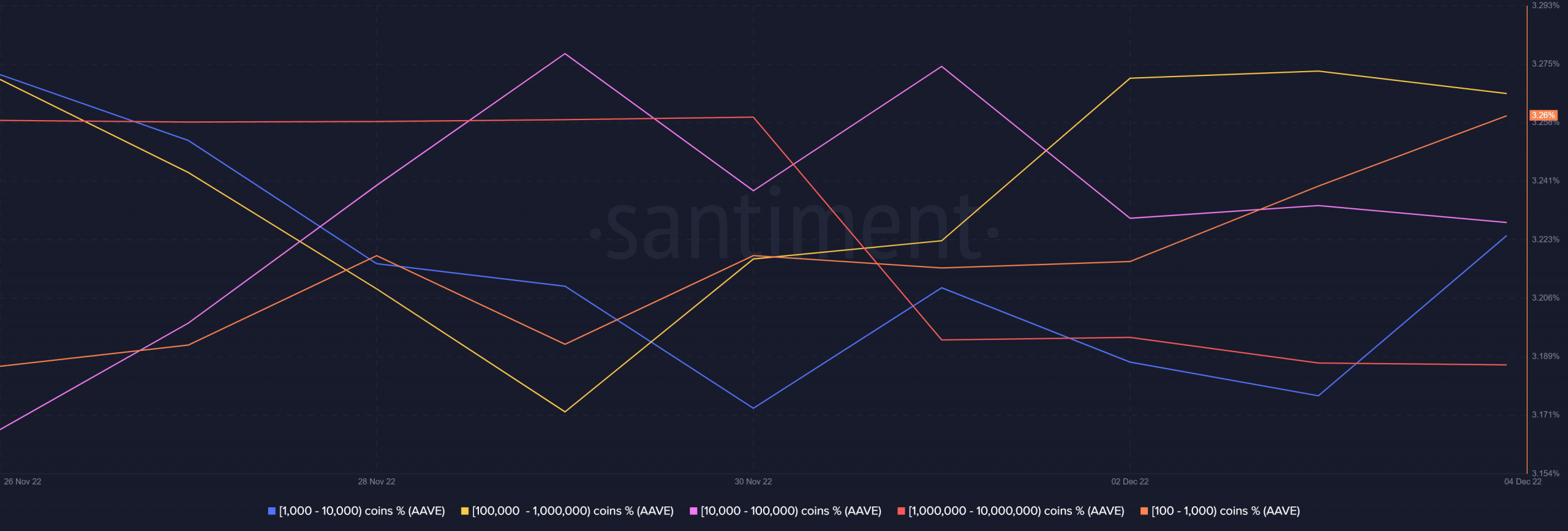

If the top addresses buy up AAVE once again, it can have a positive price action. AAVE’s supply distribution this week already indicated that there was some demand from top whale categories.

For example, addresses holding between 100 and 10,000 coins added significantly to their balances in the last 24 hours until press time.

There were, however, some outflows from higher address categories. Despite this, exchange flows indicated that sell pressure slightly outweighed the prevailing buy pressure. Exchange flows have not recovered from the sharp drop in November. Slightly higher exchange inflows than outflows suggested a net flow in favor of the downside.

Investors should note that AAVE’s demand was also heavily correlated with the rest of the market. This meant AAVE’s ability to bounce back may depend on DeFi’s market demand, which will require market conditions to improve first.