- Ethereum witnessed a decline in NFT transactions, but blue-chip collections did well

- Ethereum observed support from retail and large investors

NFT transactions on Ethereum have declined significantly, from 22% NFT dominance to 8.3% according to crypto analytics firm Glassnode. On the other hand, stablecoin transactions grew and took up the space originally conquered by NFTs. This declining interest from traders could affect the overall NFT market negatively.

NFTs on #Ethereum accounted for 18% to 22% of transactions during H1-2022.

However NFT dominance has since declined to just 8.3%, as interest in the space wanes during the bear market.

Stablecoin dominance has spiked since FTX from 10% to 12.5%.

Chart: https://t.co/m0UL2Xo7J5 pic.twitter.com/PgImnSIkRK

— glassnode (@glassnode) December 5, 2022

Read Ethereum’s [ETH] Price Prediction 2023-2024

NFT blue chips remain unaffected

Despite the declining NFT transactions, blue chip NFT collections on the Ethereum network performed relatively well. According to data provided by NFTGO, collections such as the Bored Ape Yacht Club [BAYC] witnessed a massive 337% uptick in terms of volume.

Furthermore, the number of sales went up by 325% over the last week. Mutant Ape Yacht Club [MAYC], another collection, also witnessed a similar growth in terms of volume and sales.

This indicated that the lower transactions on the Ethereum network had not affected blue chip NFTs, but may have influenced smaller and upcoming collections.

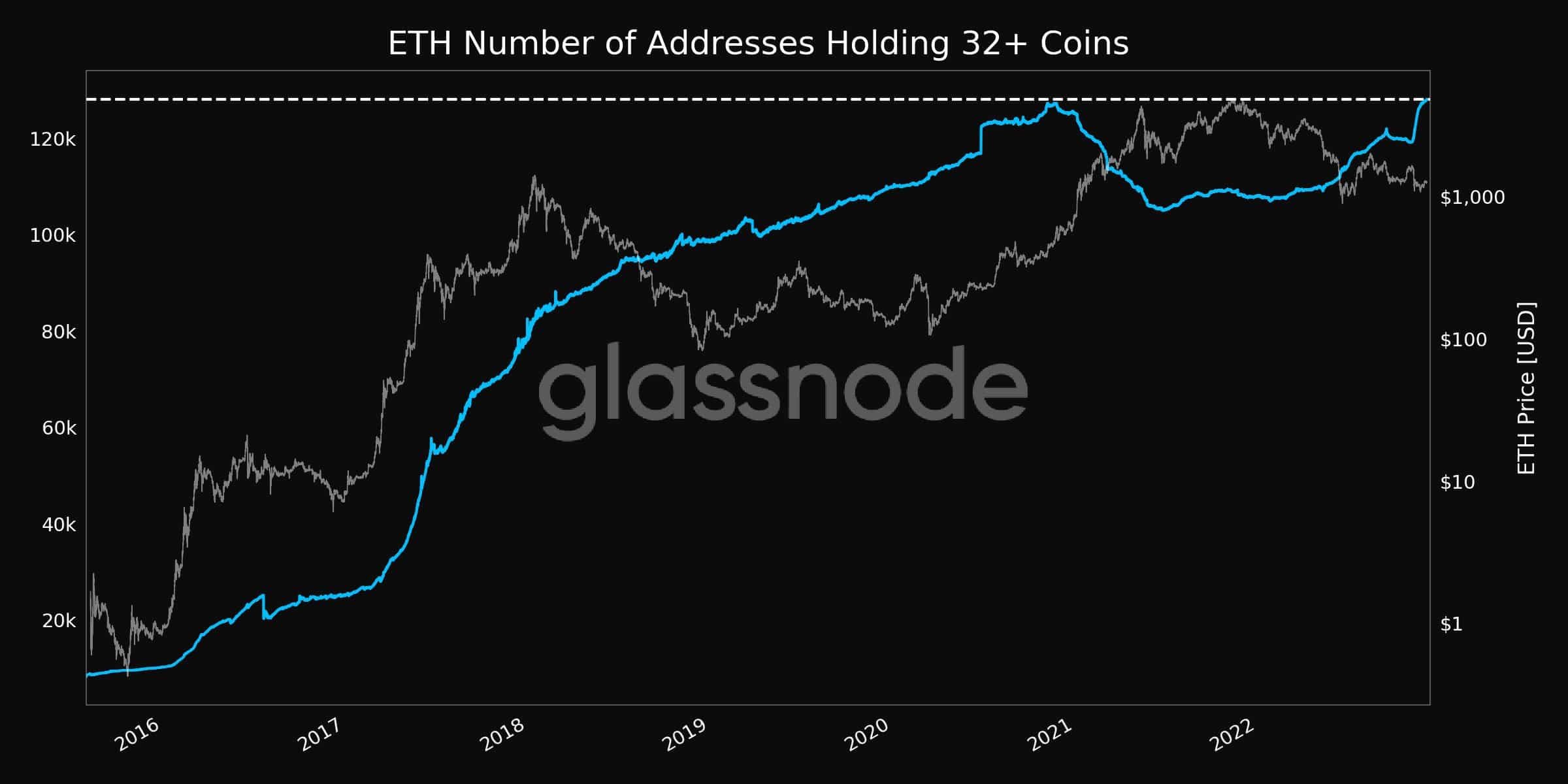

Thus, at the time of writing, large addresses continued to support ETH. As can be seen from the image below, the number of addresses holding over 32 coins reached an all-time high of 128k addresses at the time of writing.

Additionally, retail investors showed faith in the altcoin as well. According to Glassnode‘s data, the number of addresses holding 0.01 coins increased significantly and had reached a three-month high of 22.3 million addresses.

Source: Glassnode

Traders start ‘Long’ ing for Ethereum

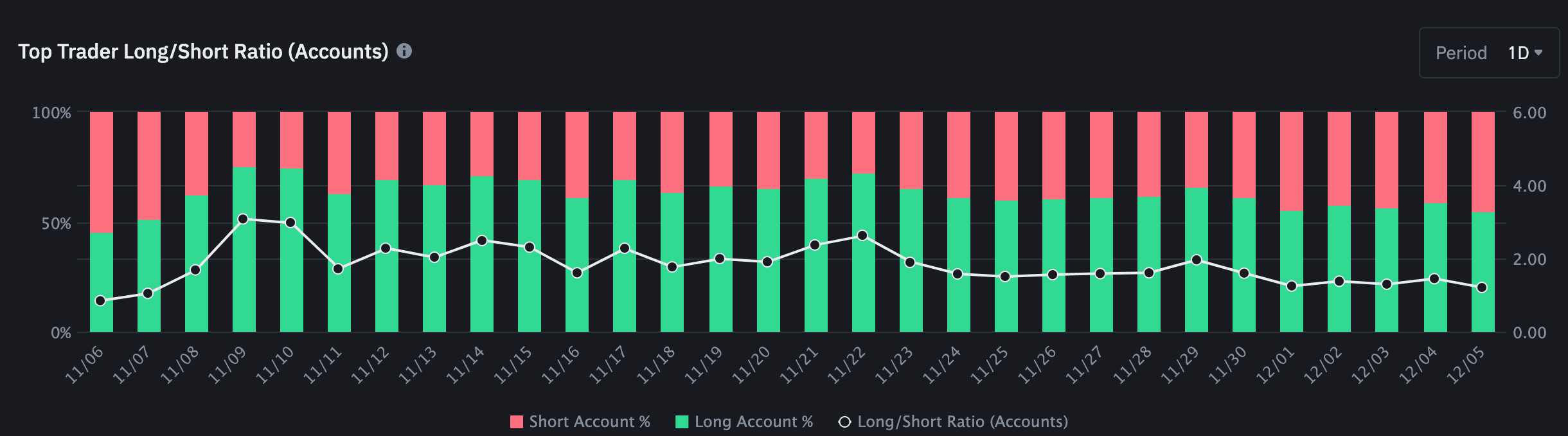

Traders have always shown faith in Ethereum. Top traders on the Binance exchange took advantage of a declining ETH and went long on Ethereum.

At the time of writing, over 50% of the overall traders on the Binance exchange had held long positions on Ethereum.

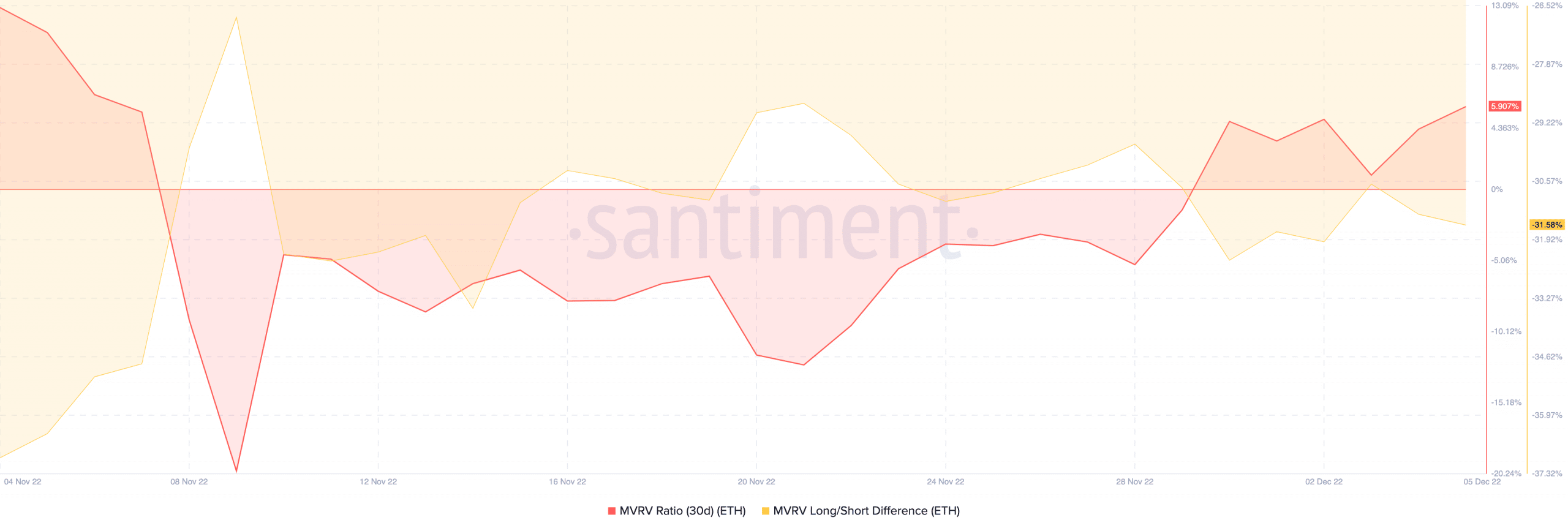

Moreover, Ethereum’s Market Value to Realized Value (MVRV) ratio suggested that the tide was turning in favor of addresses holding ETH. This suggested that some Ethereum holders could take profits if they ended up selling their position.

However, the Long/Short difference indicated that it would mostly be short-term holders that would end up profiting if they decide to sell their ETH.