- Polygon announced its partnership with Warner Music Group and yet-to-launch music NFTs platform LGND Music.

- The network confirmed that it commenced the first batch of one-third vesting and distribution further to its February fundraising.

Blockchain projects seem to be scampering for end-of-the-year wins following the series of problems that have plagued the ecosystem since the beginning of 2022.

Ethereum’s [ETH] sidechain network Polygon [MATIC] was no different as it clinched another partnership with media giant Warner Music Group.

Read Polygon’s [MATIC] Price Prediction 2023-2024

According to a series of tweets published on 6 November, Polygon confirmed that it has partnered with Warner Music Group. It also partnered with the soon-to-launch Polygon-based marketplace LGND Music to offer access to a few artists signed to Warner Music Group to launch “their digital collectibles & connect fans with special content and experiences.”

🎷🎸🎺🎻🥁🎹

A new era in the music industry 🎶@LGND_music announced a multi-year partnership with @warnermusic and Polygon for a new collaborative, digital collectible platform, LGND Music https://t.co/fXxnaPouPH pic.twitter.com/MrdJ4fR8mS

— Polygon – MATIC 💜 (@0xPolygon) December 6, 2022

In a press release, the CEO of Polygon Studios Ryan Wyatt, said,

“Web3 has the power to transform the music industry for both artists and fans. The way that we own and experience music is evolving, by fully embracing decentralized technologies and collectibles, this exclusive partnership between Polygon, LGND, and WMG represents an exciting milestone for the music industry. Polygon is proud to be powering this innovative initiative that will elevate music ownership and bring more music lovers and artists to Web3.”

The year so far has been marked by a series of partnerships between Polygon and leading companies across diverse sectors. It has announced partnerships with Behance, Disney, Coca-Cola, Nike, and even tech giant Meta.

In addition to its partnership with Warner Music Group and LGND, Polygon confirmed another update around its ecosystem. The $450 million funding round announced in February commenced the first batch of one-third vesting and distribution of MATIC tokens in a three-year unlock period two weeks ago.

👇🏿Here’s an update on the strategic token Sale of 2021👇🏿

Last year, we raised $450 mn from Marquee investors in a private token sale. The first batch of vesting & distribution for 2022 unlock happened two weeks ago.

Learn more ➡️ https://t.co/qByviTEg5B

— Polygon – MATIC 💜 (@0xPolygon) December 6, 2022

In February, Polygon raised around $450 million through a private sale of its native MATIC token in a funding round led by Sequoia Capital India. This included a $50 million investment from troubled Alameda Research.

Know this to protect your holdings

MATIC traded at $0.9054 at press time, per data from CoinMarketCap. This represented a 58% decline from its 30-day high of $1.20.

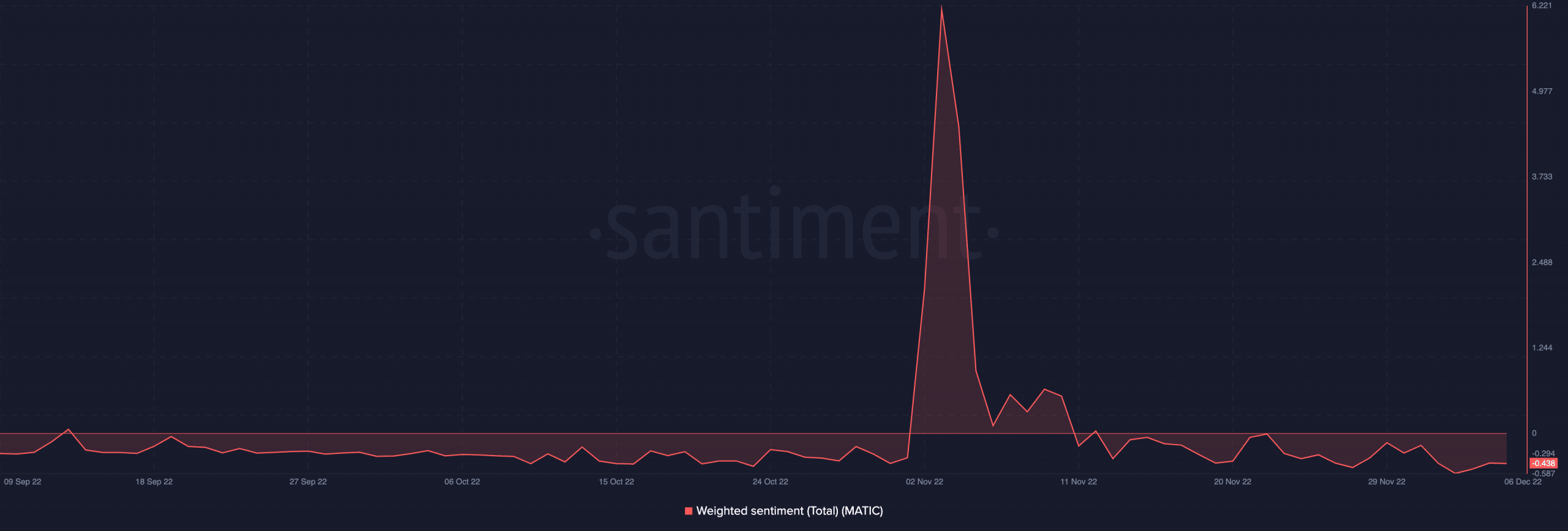

With negative investors’ sentiment trailing the crypto asset since FTX’s implosion, the news of the recent partnership with media giant Warner Music Group failed to impact MATIC’s price. Furthermore, the confirmation that it commenced the vesting and distribution of MATIC tokens also failed to dazzle MATIC.

In the last 24 hours, MATIC’s price declined by 0.51%, and the volume traded was also down by 29%, data from CoinMarketCap showed.

On 5 November, just before the FTX debacle started, on-chain assessment revealed that MATIC’s Network Profit/Loss metric (NPL) touched a high of 283.61 million. This showed that investors – on average – sold at a significant profit. MATIC sold at a high of $1.12 within the same period.

However, following FTX’s implosion and decline in the general market, MATIC’s price plummeted, causing the NPL to fall as well. This represented MATIC’s decline from a local top it recorded prior to FTX’s collapse.

As the market attempts to regain balance following a significantly bearish November, one can expect the series of ecosystem updates within Polygon to restore investors’ conviction before the close of Q4 2022.