- New data suggests that the majority of Ethereum staked was handled by four providers

- Staking revenue declines however traders continue to show interest

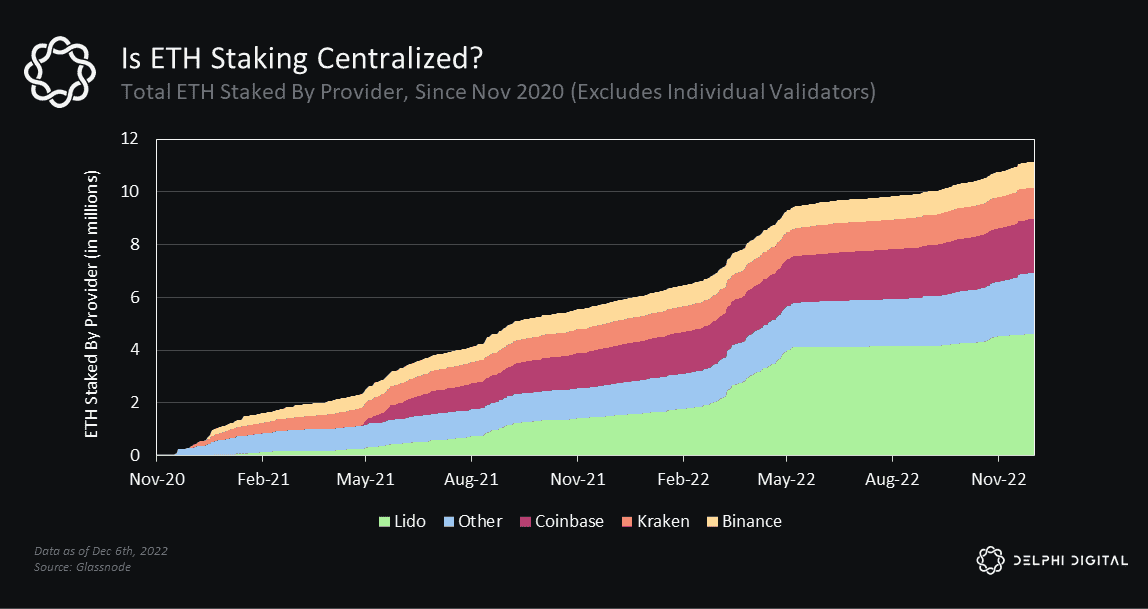

According to new data majority of all ETH staked was handled by four staking providers. This development could pose a threat to the decentralization of Ethereum. This data was shared by Delphi Digital, a crypto research organization, via Twitter.

57% of all $ETH staked is handled by 4 staking providers, with @LidoFinance alone representing 30%. pic.twitter.com/h5nKuIXDKb

— Delphi Research (@Delphi_Digital) December 24, 2022

Read Ethereum’s [ETH] Price Prediction 2023-2024

Power of the majority

From the data provided by Delphi Digital, it was observed that 57% of all Ethereum staked was being handled by providers such as Lido Finance, Coinbase, Binance, and Kraken. Out of these providers, Lido Finance was responsible for 30% of the overall ETH staked by these institutions.

Source: Delphi Digital

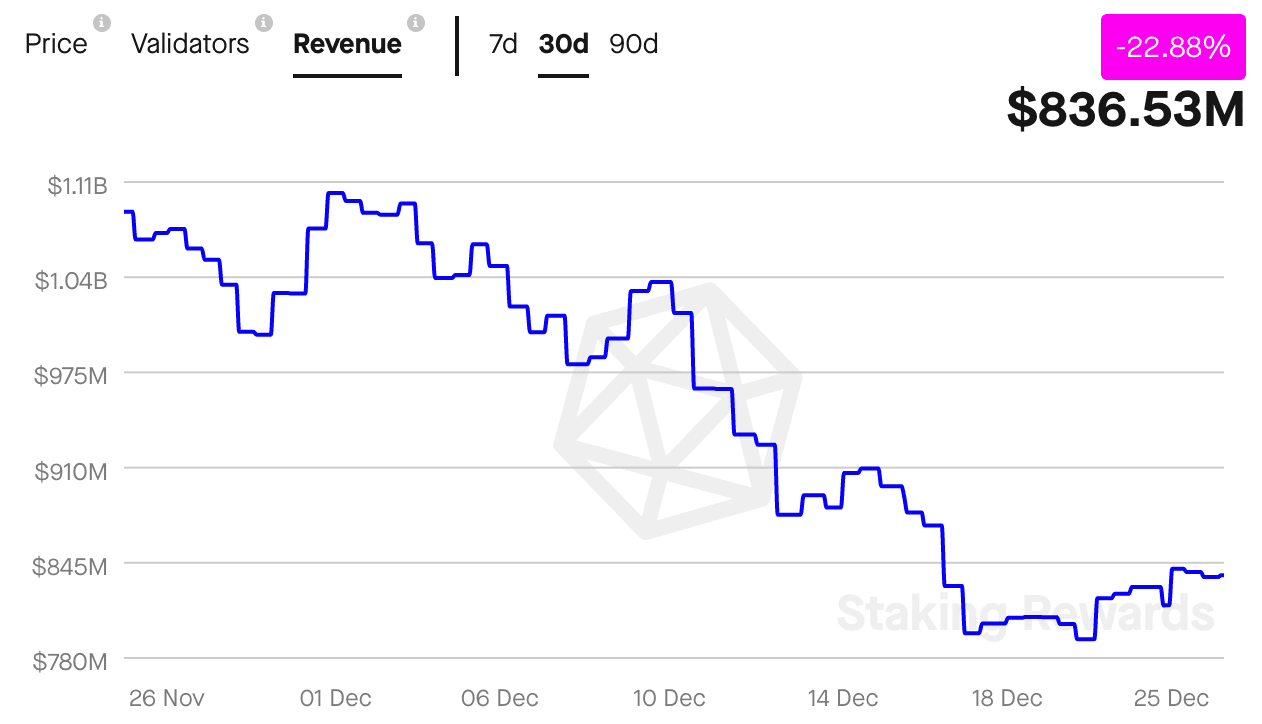

Along with the centralization of Ethereum staking, another cause of concern would be the declining revenue generated by the Ethereum stakers.

Based on the information provided by Staking Rewards, it was observed that the revenue generated by Ethereum stakers had declined by 22.88%. At the time of writing, the overall revenue collected by the stakers was $863.5 million.

Despite a dwindling state of the revenue generated by Ethereum at press time, things could take a turn for the better for Ethereum in this regard. This would be because there was an uptick observed in the amount of gas being used for Ethereum transactions.

According to data provided by Glassnode, the median gas usage for Ethereum had reached a one-month-high. If this gas usage continues to grow, the fees generated from the gas spent can improve the revenue that is being generated.

📈 #Ethereum $ETH Median Gas Usage (7d MA) just reached a 1-month high of 49,912.399

View metric:https://t.co/23i2EjKSqS pic.twitter.com/V1eT2YC6zr

— glassnode alerts (@glassnodealerts) December 23, 2022

Present and the Future(s)

Although the revenue generated by Ethereum was declining, the futures and derivatives market continued to show interest in Ethereum. Data gathered by CryptoQuant showed that open interest in Ethereum had increased. Furthermore, it was observed that most traders had held long positions on Ethereum.

How much Ethereum can you get for $1?

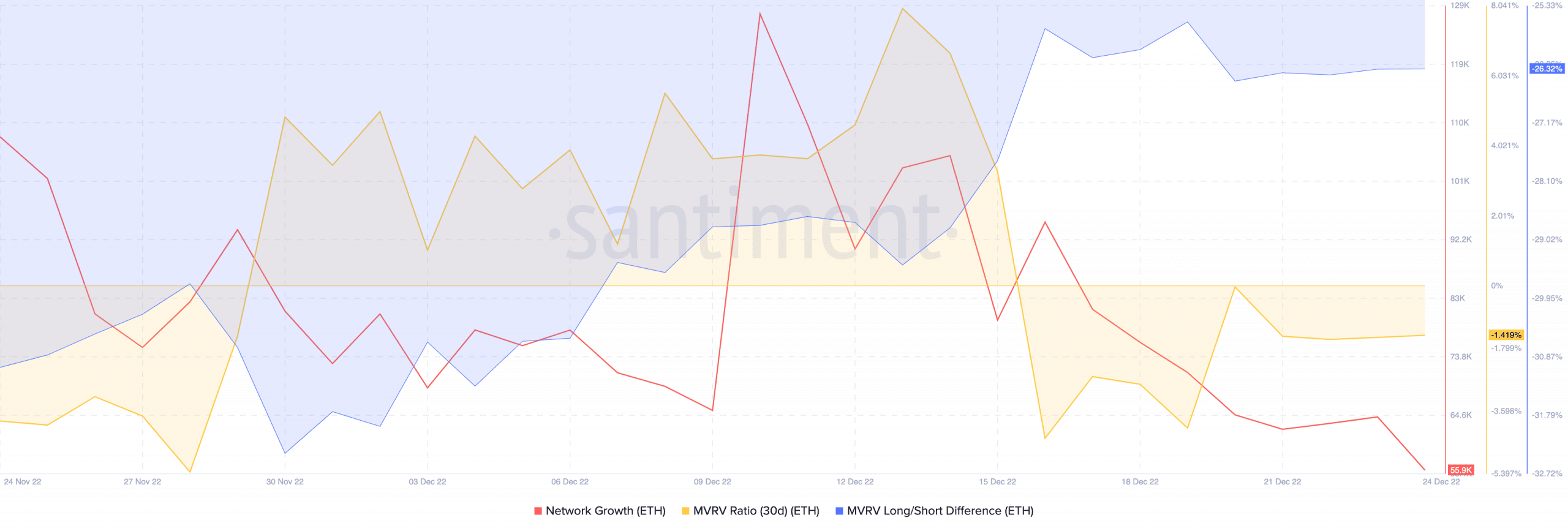

Despite the general optimism being shown by traders holding long positions, Ethereum’s activity amongst new addresses declined. This was indicated by the declining network growth on Ethereum. A declining network growth suggested that the frequency at which new addresses had transferred ETH had reduced.

The decreasing activity from new addresses could be due to the fact that most of these addresses were holding their $ETH at a loss. This was implied by the declining Market Value to Realized Value (MVRV) ratio. It inferred that most ETH holders would be taking a loss if they decided to sell their positions.

The negative long/short difference implied that most of the holders that were not profitable, were primarily new addresses.

Thus, it remains to be seen whether these new addresses will sell their positions at a loss or continue to hold on to their ETH.

At the time of writing, Ethereum was trading at $1219.31 and its price had increased by 0.21% in the last 24 hours.