- ETC is at its lowest hashrate since the merge took place.

- ETC’s price has also declined by more than half since then.

As miners undergo trying times on major Layer 1 blockchains, Ethereum Classic’s [ETC] hashrate clinched its lowest level since the merge, data from CoinWarz revealed.

At a hash rate of 99.82 TH/s at press time, ETC’s hash rate has since declined by 50% since the Ethereum network transitioned into a proof-of-stake network on 15 September.

Read Ethereum Classic’s [ETC] price prediction 2023-2024

More than enough trouble for ETC

A further assessment of ETC’s on-chain performance revealed that the network struggled with inactivity since Ethereum’s move to PoS. This migration ended the requirement for miners on the Ethereum network, which led many of them to migrate to Ethereum Classic and the newly forked network Ethereum Proof-of-work (ETHPOW).

Per data from CoinWarz, as migration intensified after the merge, ETC’s hashrate rallied to an all-time high of 199 TH/s by 16 September. The surge in hashrate was, however, ephemeral as it embarked on a decline afterward.

Source: CoinWarz

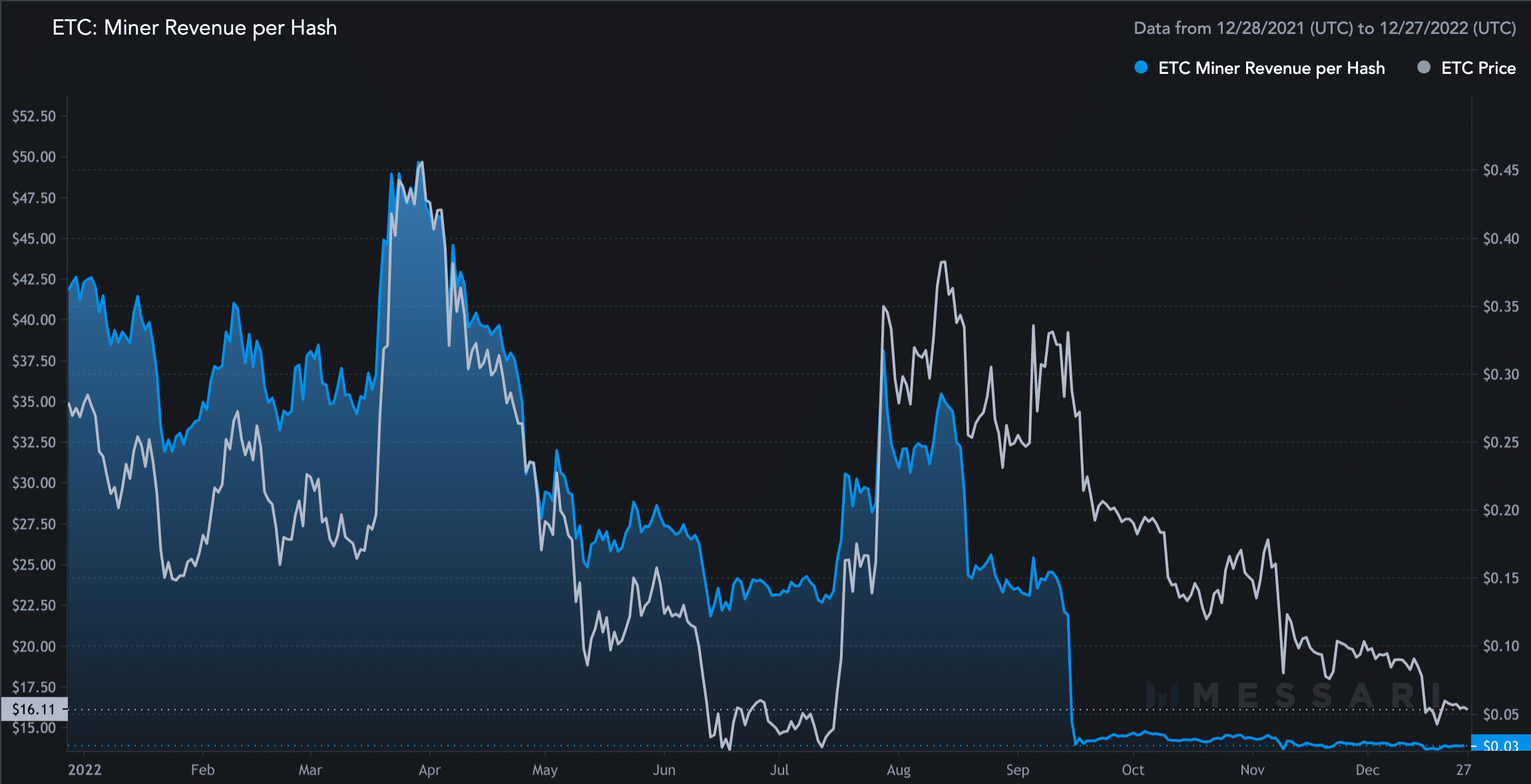

With a decline in hashrate, miner revenue per hash dropped as well, data from Messari showed. This refers to the reward paid to miners per hash unit performed within a specified period.

At $0.03 at press time, this fell by 80% since the merge took place.

In addition to a drop in hash power on ETC network, the count of active addresses on the chain also followed the same path. Per Messari, shortly after the merge, the count of active addresses on ETC peaked at a daily high of 41,855 addresses on 22 September.

With 22,984 addresses active on the network at press time, this figure fell to 45% in the last three months.

Furthermore, as of this writing, five decentralized finance protocols were housed on Ethereum Classic with a total value locked (TVL) of $295,000. In the last three months, the TVL on the network has fallen by over 65%.

How much ETC can you get for $1?

ETC holders bear the brunt

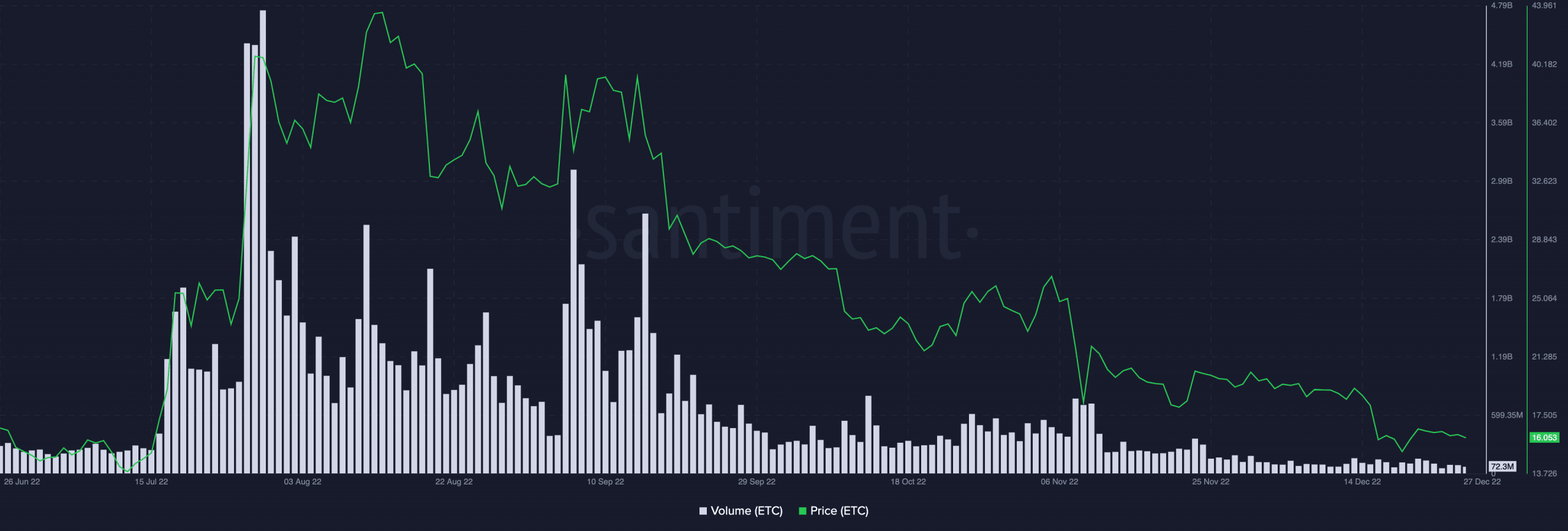

On-chain decline on Ethereum Classic negatively impacted ETC’s price as the altcoin’s value dropped by more than half since the merge took place. At the time of writing, ETC traded at $16.05. For context, on the day of the merge, it exchanged hands at $38.6.

The price decline can be coupled with a severe decimation in daily trading volume, which also fell by 96%. At press time, daily volume traded stood at $72 million, the lowest in six months.