- Deep-pocket investors renewed their interest in ETH as the coin hit its highest value in three weeks.

- Buyers from the last few weeks were in slight profits, but on-chain data suggested a possible decrease in the coming days.

Whales interested in topping up their Ethereum [ETH] holdings resumed their activities, according to a 4 January update from Santiment. The development arose as several altcoins increased in value, but the group’s king only registered a 4.12% increase in the last seven days.

Are your holdings flashing green? Check the ETH Profit Calculator

Oddly, the rise was sufficient to skyrocket ETH to a three-week high. Although CoinMarketCap’s data showed that the value had dropped to $1,251 at press time, Santiment highlighted that the whale accumulation was not yet up to the point it was on 16 December 2022.

🐳 As #altcoins have heated up, #Ethereum quietly rebounded back above $1,260 for the 1st time in 3 weeks. Though not quite at the level of the big whale dip buys on December 16th ($ETH’s local price bottom), whales are showing increased interest again. https://t.co/9ihbtrSBbF pic.twitter.com/xBtBJlpxgV

— Santiment (@santimentfeed) January 4, 2023

Is a rise to the crest possible for Ethereum?

On assessing the whale transactions, it was observed that there was some instability since the start of 2023. However, on 4 January, transactions worth $100,000 and above reached the new year peak at 612. However, at the time of writing, there was a dip in that regard as well. This could have also contributed to ETH’s inability to match up with its associates.

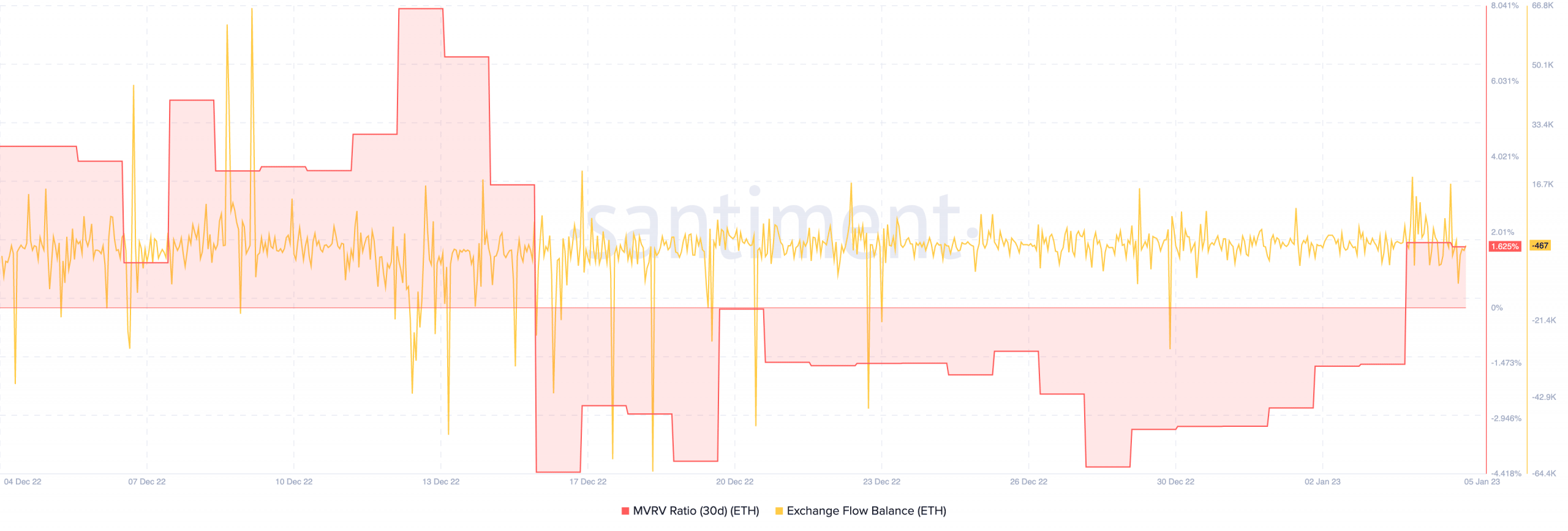

Regardless of the drop, ETH holders who refilled between 16 – 28 December 2022 might have no cause to feel the deterioration. This was the condition revealed by the Market Value to Realized Value (MVRV) ratio.

According to Santiment data, the 30-day MVRV ratio had ascended to 1.625%. While this does not translate to incredible gains, it, at least, implied that some were willing to sell for profits. Meanwhile, the MVRV ratio seemed to follow a downward trend at the time of writing. If it continues in this direction, a possible ETH price correction might be in place.

How many ETH can you get for $1?

Additionally, the ETH exchange flow balance was -476. An interpretation of this metric points to more exchange inflow when the value is positive. On the other hand, higher exchange outflow when the value is negative.

Since there have been more outflows, ETH’s possibility to drop further looked highly probable. Hence, ETH might require a reverse in the opposite direction in hopes of an upturn.

The season to deal with a circulation plunge

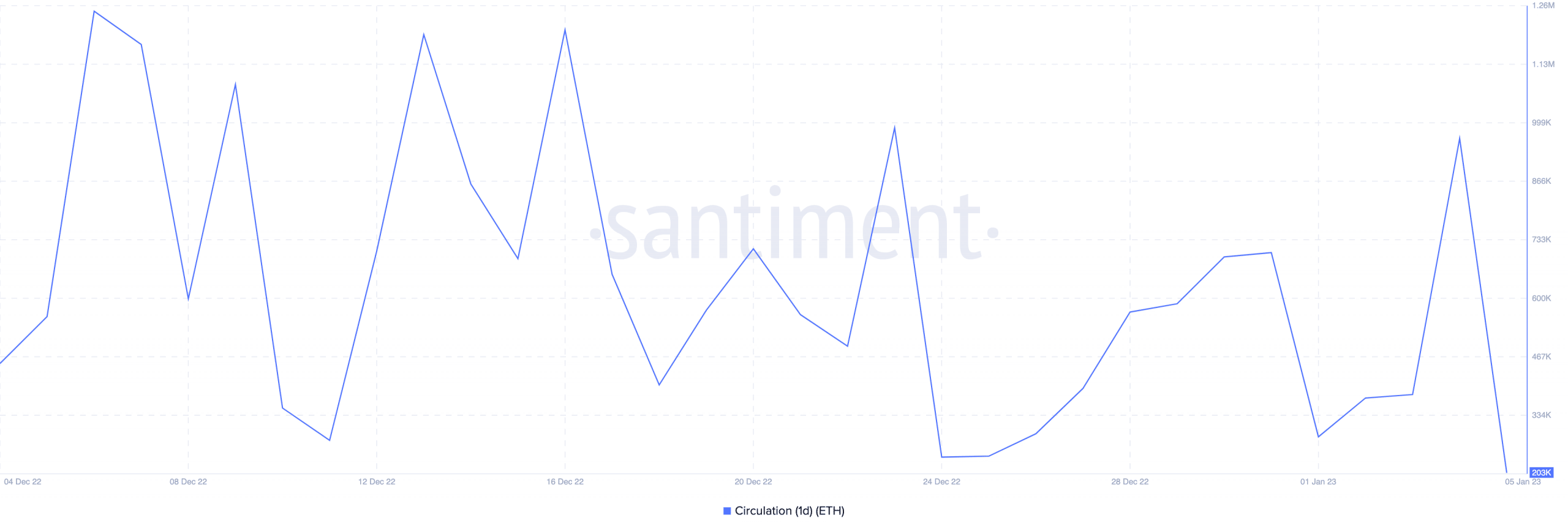

While investors might have hoped for a whale helping hand, retail hung back in its contribution. This was due to the information displayed by Santiment per Ethereum’s one-day circulation.

According to the details, the one-day circulation hit its lowest since 1 January. At press time, it was only above 200,000 and could not align with the 300,000 threshold that has been consistently recorded in the past few days. This implied a massive slowdown in trade. However, the plunge meant that declined interest was unexpectedly massive.