- Ethereum sharks accumulate a large amount of ETH, and prices surge.

- Data suggests a possible bubble, short-term holders may sell.

A 12 January tweet by Santiment revealed that sharks had accumulated a significant amount of Ethereum [ETH] over the last two months. This led to a surge in ETH’s prices. The trend of ETH accumulation by large holders could also influence overall market sentiment and prices.

🦈 #Ethereum has jumped above $1,400 for the first time since November 7th. Over the past 10 weeks, ~3,000 new shark addresses (holding 100 to 10,000 $ETH) have shown up on the network. 48,556 shark addresses is the highest level recorded since Feb, 2021. https://t.co/yJfTP3QhKI pic.twitter.com/4tzS0nsph9

— Santiment (@santimentfeed) January 12, 2023

How many are 1,10,100 ETH worth today?

Data provided by Glassnode showed an increase in interest from addresses holding over 10 ETH during this period. Moreover, the number of addresses in profit reached a one-month high of 49,079,396.702.

📈 #Ethereum $ETH Number of Addresses in Profit (7d MA) just reached a 1-month high of 49,079,396.702

View metric:https://t.co/9t2b8JZ83s pic.twitter.com/NtSNbGwJ3m

— glassnode alerts (@glassnodealerts) January 11, 2023

Trouble in paradise?

However, this sudden surge in Ethereum prices could be a bubble, according to data by MAC_D on Crypto Quant. Two indicators show that the current situation is overbought. The first indicator is the Short Term Holder SOPR, which measures the sentiment of short-term investors.

A value greater than or equal to one indicates that short-term investors are making a profit when the overall trend is falling. Thus, large holders or “whale investors” are in a good position to make a profit. The current value for this indicator is 1.007.

The second indicator is the ETH dominance index, which measures the relative strength of Ethereum compared to other cryptocurrencies, such as Bitcoin. A rise in the index of over 20% suggests that altcoins are rising excessively compared to Bitcoin, which can be seen as a sign of a bubble. A slight drop in the value of Bitcoin could significantly impact the market.

Downward pressure increases due to overbought

“Excessive rise in $ETH compared to $BTC can be analyzed to have formed a bubble, and even a slight drop in #BTC can shake the market significantly.”

by @MAC_D46035Link👇https://t.co/edkoaA6HWq pic.twitter.com/B2ftM3bSm9

— CryptoQuant.com (@cryptoquant_com) January 11, 2023

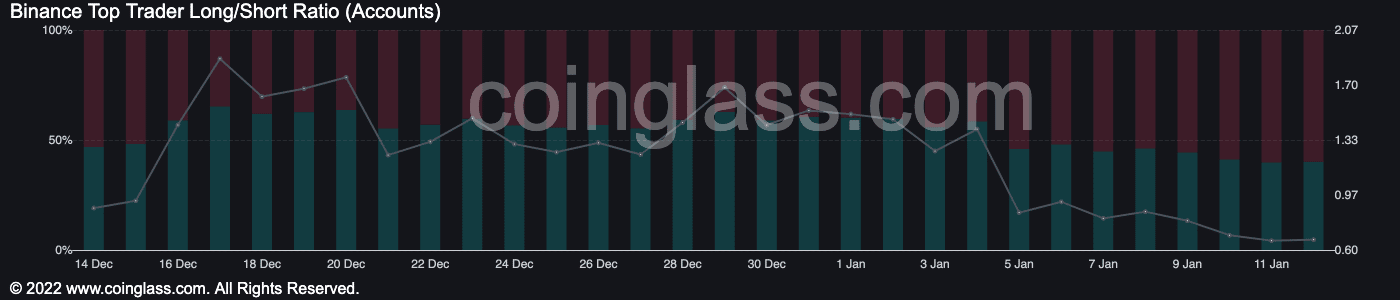

Ethereum traders go short

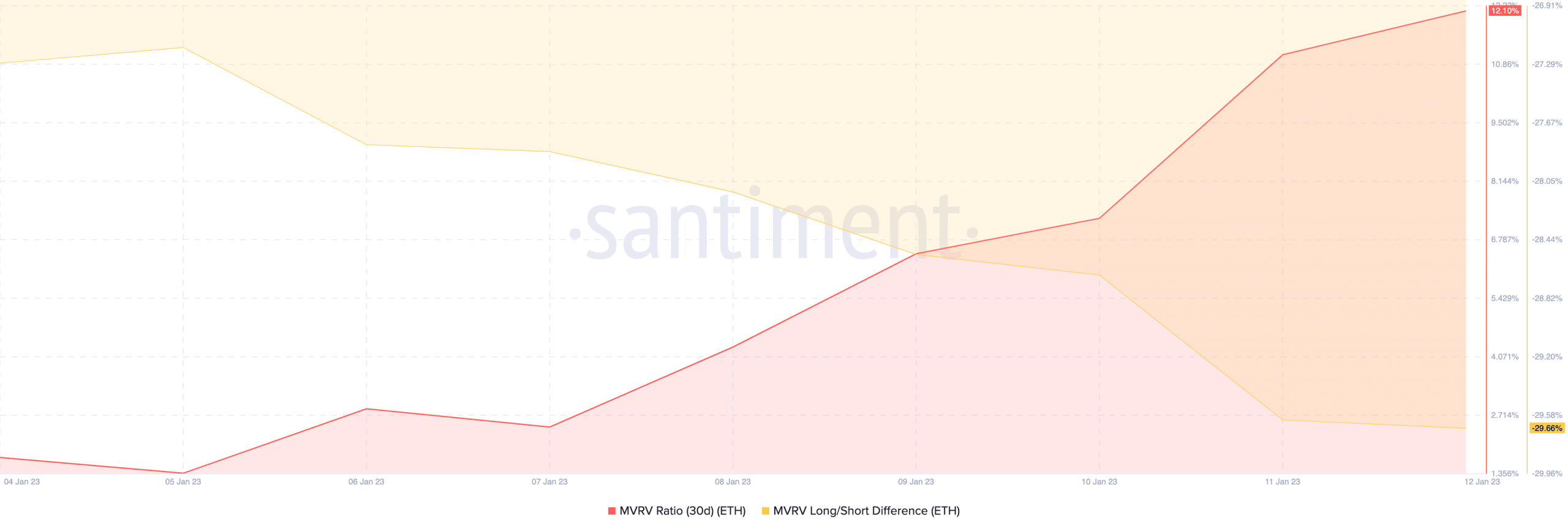

Another indicator of growing selling sentiment would be the increasing MVRV ratio. The increasing MVRV ratio coupled with the growing long/short difference implied that many short-term Ethereum holders could profit from selling their ETH. This could increase selling pressure on Ethereum.

Source: Santiment

This growing selling pressure could be one reason why traders took short positions against ETH. Data provided by Coinglass showed that the number of short positions taken against Ethereum grew considerably over the past few days, with 60.16% of traders shorting Ethereum at the time of writing.

Is your portfolio green? Check out the Solana Profit Calculator

At press time, the price of Ethereum was $1,399.74. ETH grew by 4.80% in the last 24 hours, according to CoinMarketCap.