- The total value of ETH staked and validators on the network witnessed substantial growth

- Whales show interest in ETH as the number of transactions witnessed a surge

Ethereum’s [ETH] staking activity continued its upward swing as the total value staked in ETH 2.0. deposit contract reached yet another ATH, data from Glassnode revealed.

📈 #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 16,042,407 ETH

Previous ATH of 16,042,391 ETH was observed on 14 January 2023

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/QRT9ANf6dr

— glassnode alerts (@glassnodealerts) January 15, 2023

How many are 1,10,100 ETHs worth today?

A drill down of the chart further indicated that this value saw a substantial increase since 6 January. This was when developers announced that the Shanghai Upgrade, which will enable the withdrawal of staked ETH, will go live in March 2023.

Notwithstanding the 1.3% drop observed in ETH’s price at the time of writing, the king of altcoins made a remarkable recovery since the FTX contagion hit the crypto market. The bullish cycle also witnessed ETH sprint towards its pre-FTX market cap levels.

Staking gets hot

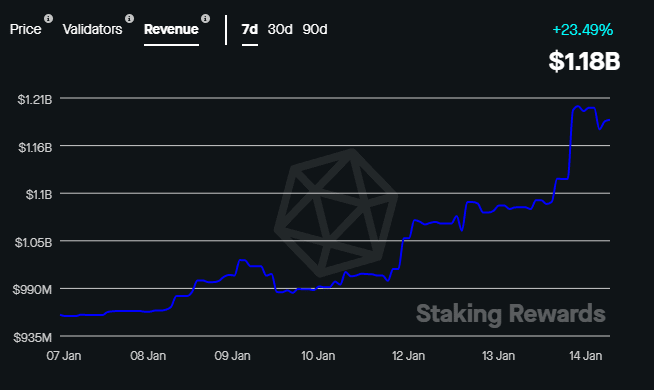

The number of validators on ETH network steadily increased by 0.61% over the seven-day period, per data from Staking Rewards. The revenue from transaction fees also shot up by almost 24% which lent credence to the lucrativeness of ETH staking.

The annualized reward rate or the reward that validators can expect to earn per year was estimated at 3.8%.

Interestingly, the percentage of eligible tokens that were being staked stood at 13.87%, significantly lower than other popular chains like Cardano [ADA] and Solana [SOL] which had as staking ratio of over 70%.

Whales’ transactions surge

On-chain indicators corroborated the growing appeal of the network. Whale transactions registered a sharp uptick to hit their highest value in more than two months. As of 14 January, the transactions hit 5646, a jump of almost 30% over the last month.

The new participants entering the network rose steadily indicating that Ethereum’s adoption was on the rise.

The increased activity was also highlighted by the velocity indicator which steeply increased to 3.99 on 14 January. This suggested that ETH moved more frequently across wallets.

Is your portfolio green? Check out the ETH Profit Calculator

However, ETH investors are wary of the fact that the Shanghai Upgrade could intensify selling pressure in the market. Data analytics firm Bitwise challenged the claim and stated that mass sales will be impossible as the amount of ETH that could be unstaked will be limited at any point of time.

Bitwise also predicted that ETH will turn deflationary in 2023 and its total circulating supply will drop by 1% or more, bringing more relief to investors.