Summary:

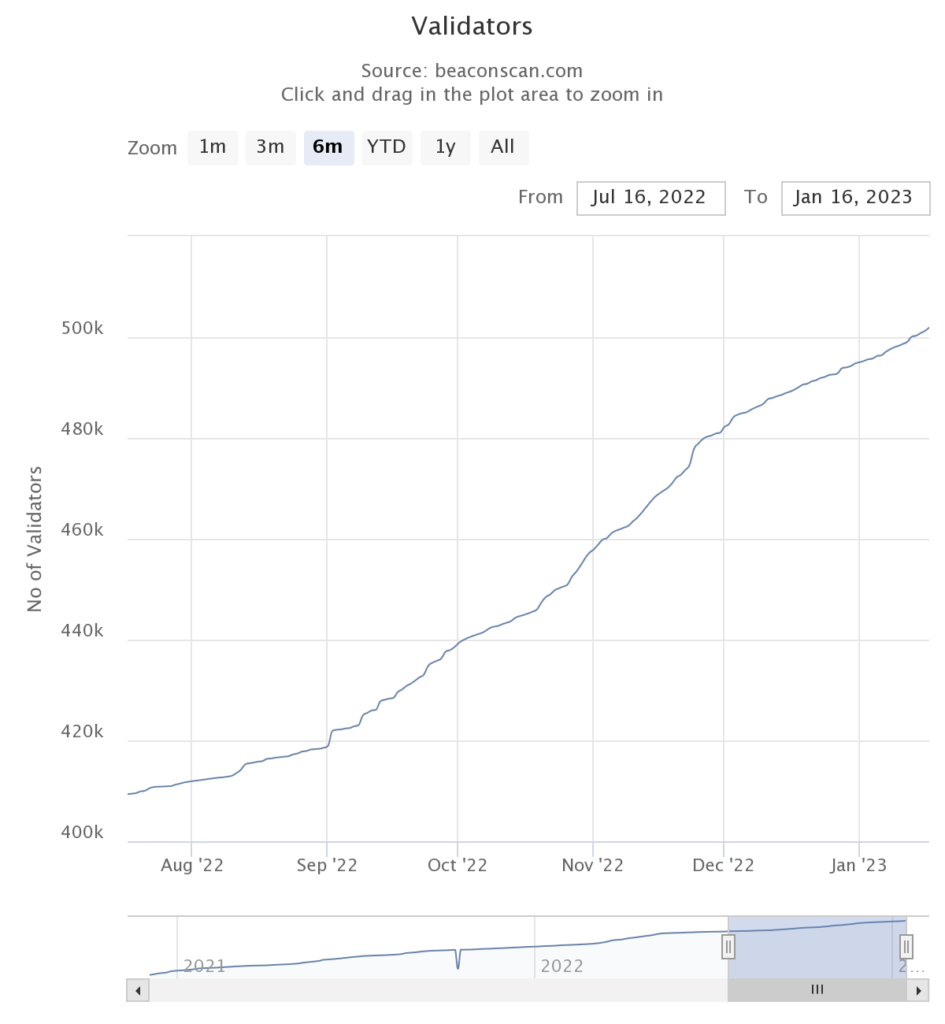

- Validators on the network increased from 428,000 around September 15 when Ethereum upgrade from proof-of-work to proof-of-stake.

- The news comes ahead of staked Ether withdrawals expected to roll out with the Shanghai update in March 2023.

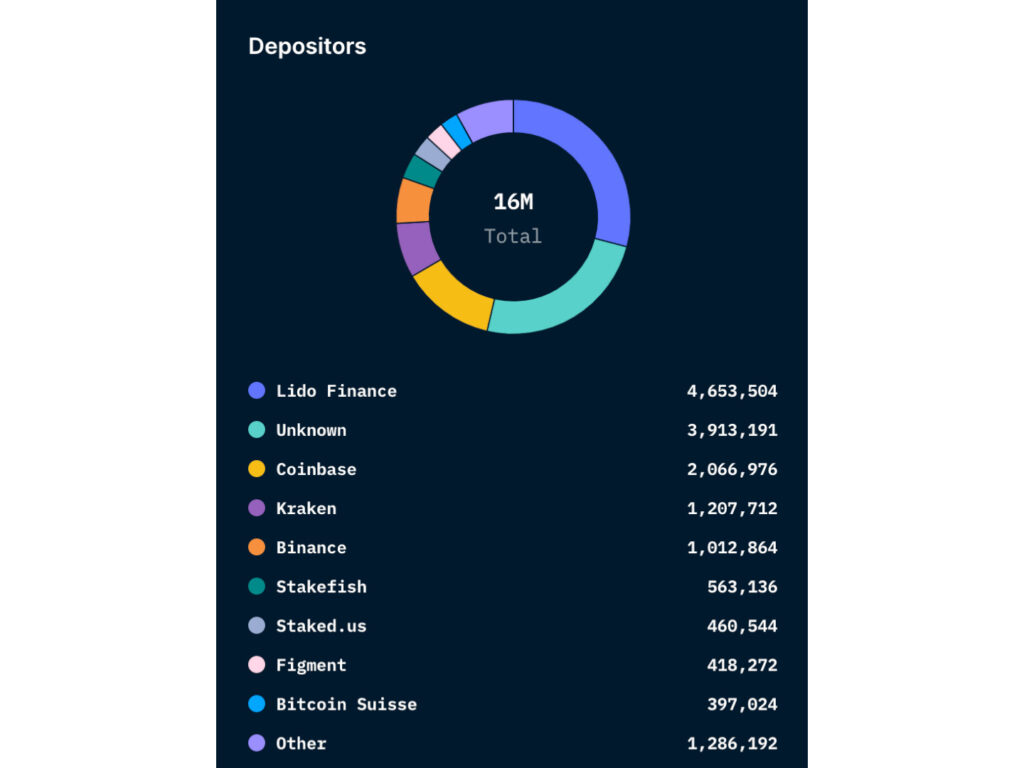

- Validators have staked over 16 million ETH worth roughly $25 billion with Ether trading around $1500 on Tuesday.

According to BeaconScan data, the number of validators on Ethereum surpassed 500,000 on Tuesday. The news marked a landmark moment for the leading altcoin blockchain as anticipation for staked Ether (ETH) withdrawals grows.

Validators are a key component of Ethereum’s network after the Merge which switched ETH’s chain from a proof-of-work (PoW) consensus to a proof-of-stake (PoS). Similar to miners on a PoW blockchain, validators are responsible for confirming transactions and maintaining network security among other crucial PoS blockchain needs.

Ethereum core developers said the withdrawal function for staked ETH should roll out with a post-merge update dubbed Shanghai slated for March 2023. ETH engineers released a testing area called “devnet 2” to allow client and validator teams to test the withdrawal process before the feature goes live in a few weeks.

Interested clients were required to deposit a minimum of 32 ETH before becoming Ethereum Validators. The deposit worth approximately $50,000 at today’s prices was then locked up in a staking contract, allowing clients to earn rewards and other perks when withdrawals become possible.

16 Million ETH Staked Ahead of Ethereum’s Shanghai Upgrade

The staked ETH contract which launched in 2020 held over 16 million Ether on Tuesday, per data from EtherScan. ETH traded around $1500, pegging the massive locked ETH at a valuation north of $25 billion. The 16 million staked ETH also accounts for about 13.28% of the leading altcoin’s total supply.

Nansen data highlighted over 92,000 unique staking depositors as of January 12. Furthermore, liquid staking protocol Lido Finance was the top depositor with around 4.6 million ETH staked via the platform.

Major crypto exchanges Coinbase, Kraken, and Binance also featured on the top five staked ETH depositors, per Nansen.