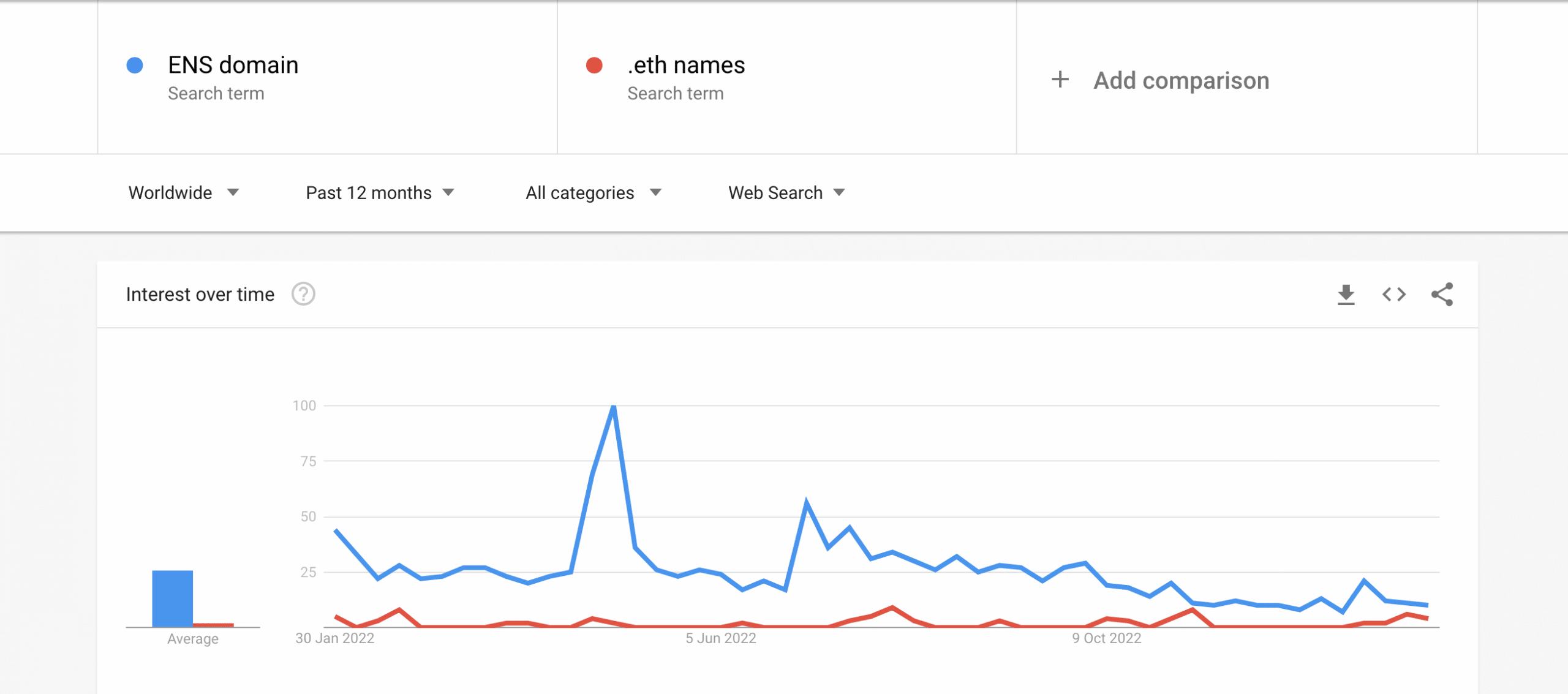

- Interest in ENS domain names remains at a minimum.

- The rally in ENS’ price since the year began has put many of its holders in profit.

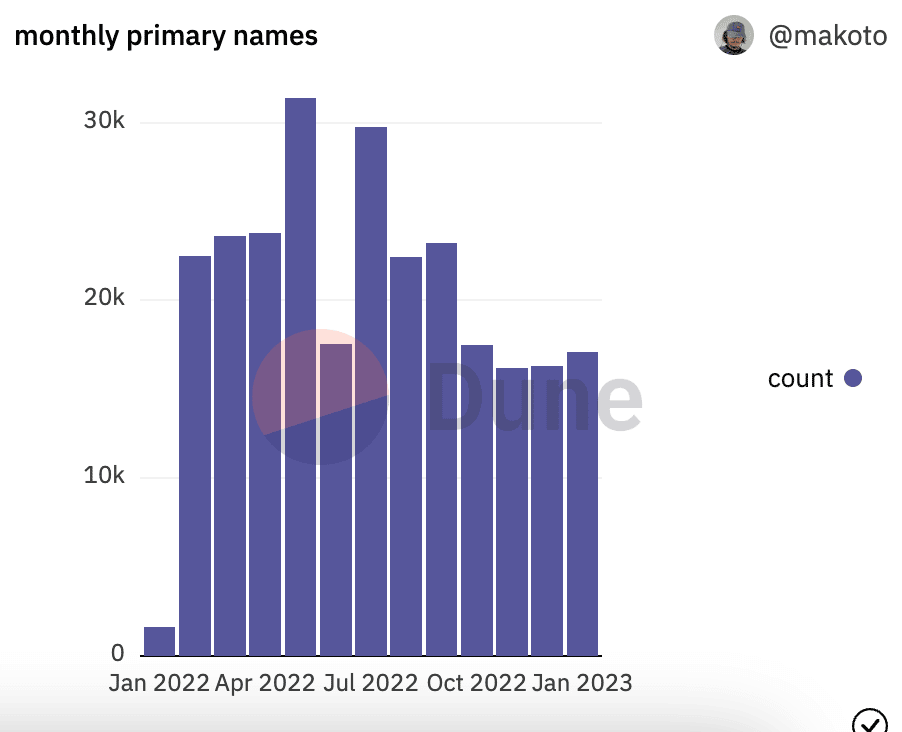

According to data from Dune Analytics, the interest in .eth domain registrations has remained low, with only 53,359 Ethereum Name Service (ENS) registrations recorded thus far in the current year.

Throughout 2022, monthly domain name purchases on Ethereum Name Service embarked on a steady decline to close the tumultuous trading year with just 52,835 registrations in December.

After rallying to a high of 437,365 .eth name registrations in September, it plummeted by 88% within three months.

Read ENS’ Price Prediction 2023-2024

As capital flight intensified amid the significant decline in the market last year, interest in ENS domain names dropped to an all-time low.

Google Trends, though not the most sophisticated of data tools, provided a rough insight into the global internet users’ interest level in ENS domain and .eth names.

Interestingly, primary ENS name registrations saw a spike in the last month. A primary ENS name is a unique, human-readable name that is used to identify and locate a specific Ethereum address.

According to Dune Analytics, primary ENS name registrations hit a two-month record of 17,027 in the last 30 days, yet this marks a 45% decrease from the peak of 31,000 primary names registered in May 2022.

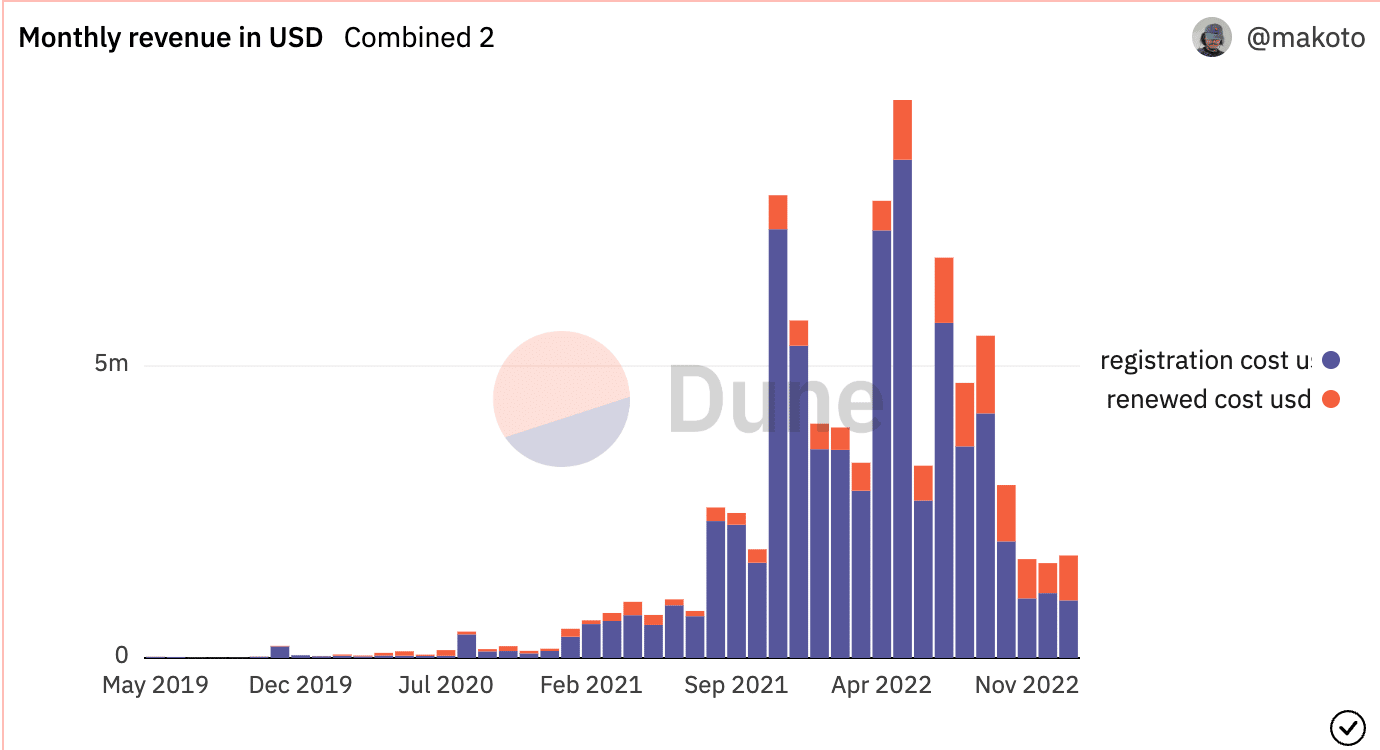

As for revenue made from name registrations on the platform so far this month, the protocol saw a 49% jump in revenue for .eth name renewals but logged an 11% decline in revenue for new name registrations.

Realistic or not, here’s ENS’ market cap in BTC’s terms

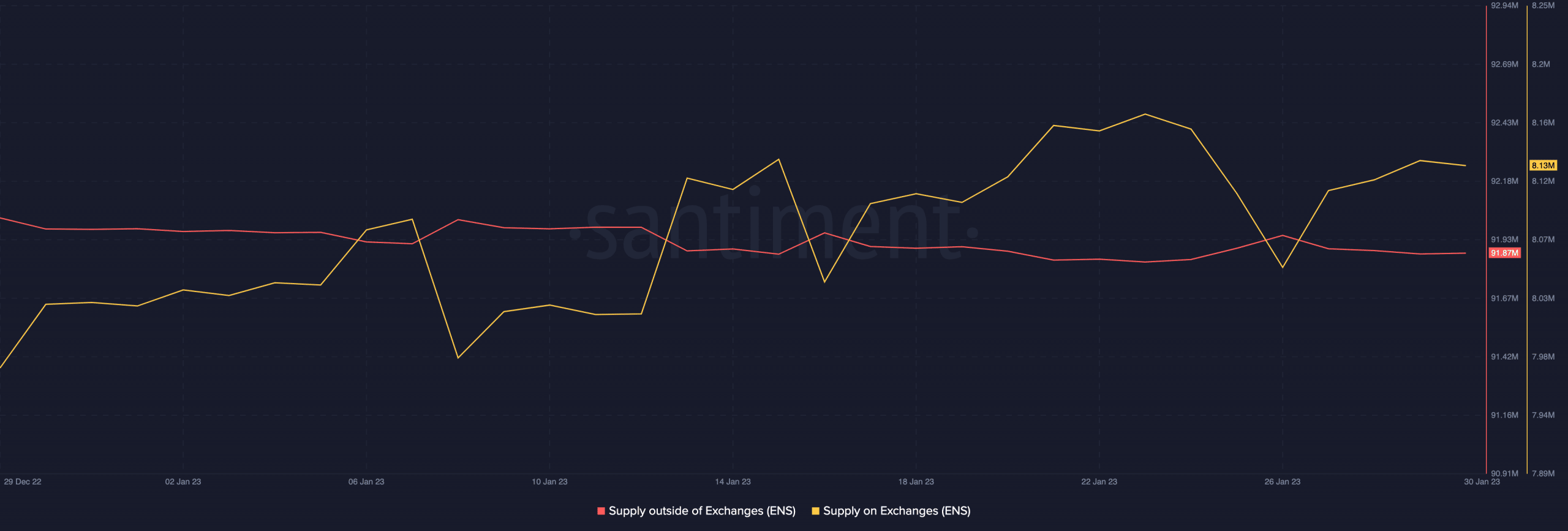

Profit-taking is the order of the day

On a year-to-date basis, ENS’s price has grown by 46%. At press time, the altcoin traded at $15.77, data from CoinMarketCap showed.

Leveraging the unexpected price rally, ENS holders began distributing their holdings to realize profits on their various investments. Data from on-chain data provider Santiment revealed that the ENS’ supply on exchanges has grown steadily since the year began. At press time, 8.13 million ENS tokens sat within cryptocurrency exchanges.

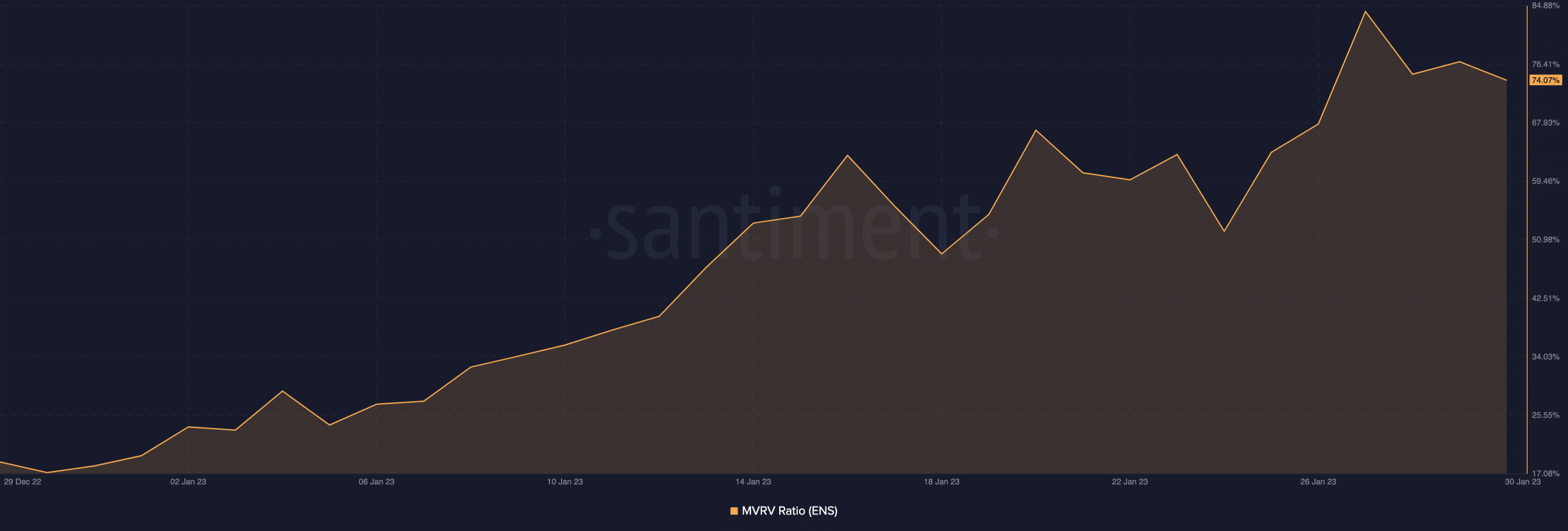

As its price grew, ENS’s MVRV ratio rallied alongside. At press time, the altcoin’s MVRV ratio was 74%. This meant that the asset’s current market value was 74% higher than its realized value.

As a result, if all holders sell their tokens at the current price, they will receive an average return of 2x their initial investment.

However, ENS was overvalued at that level and might be due for a price correction. Generally, experts consider an MVRV ratio above 20% for altcoins to be high-risk. Therefore, they advise waiting for the MVRV to fall below 10% before making a purchase for better risk management.