- 2 February saw ETH hit $1,713 for the first time in four months.

- The inflow of ETH into exchanges exceeds the outflow signifying sell pressure.

Ethereum [ETH] experienced a price increase before the close of the trading session on 2 February, bringing it to its highest level in more than four months. How did traders respond to it, and how might their responses impact the future price of ETH?

Read Ethereum’s (ETH) Price Prediction 2023-24

Breaking resistance briefly

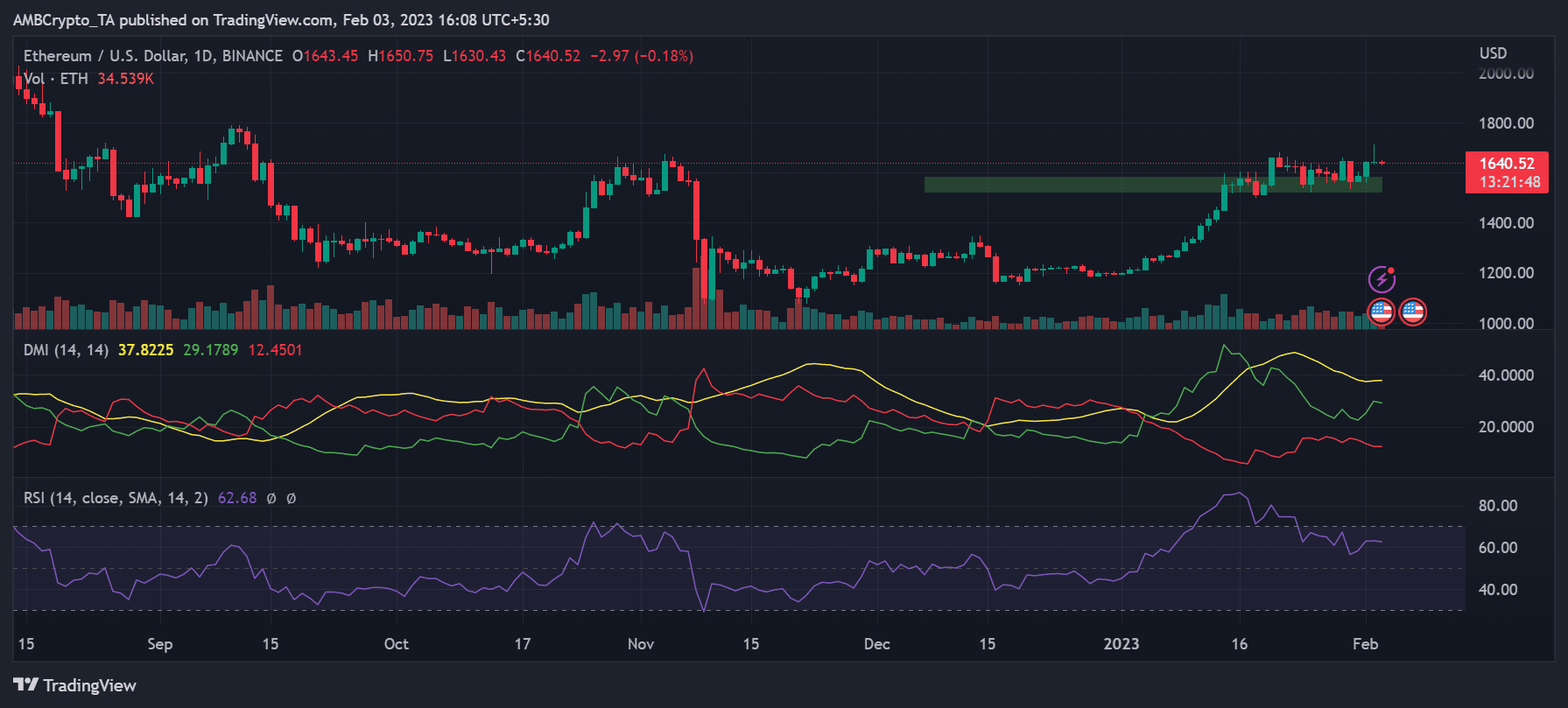

The daily timeframe price chart for Ethereum [ETH] may not have indicated any significant price movement on 2 February. When that timeframe is examined more closely, it could be observed that ETH broke the $1,700 barrier and briefly traded at $1,713.

For the first time in more than four months, the price exceeded $1,500, which prompted traders’ reactions.

The asset was trading at roughly $1,640 as of the time of this writing, and it appeared to have lost a small value. The price was still trading above the support line that was established near $1,500 despite the modest value drop.

Additionally, according to the Relative Strength Index, Ethereum was still moving in a bullish direction. As of the time of writing, the RSI was above 60 on a daily timeframe.

Scramble for profit

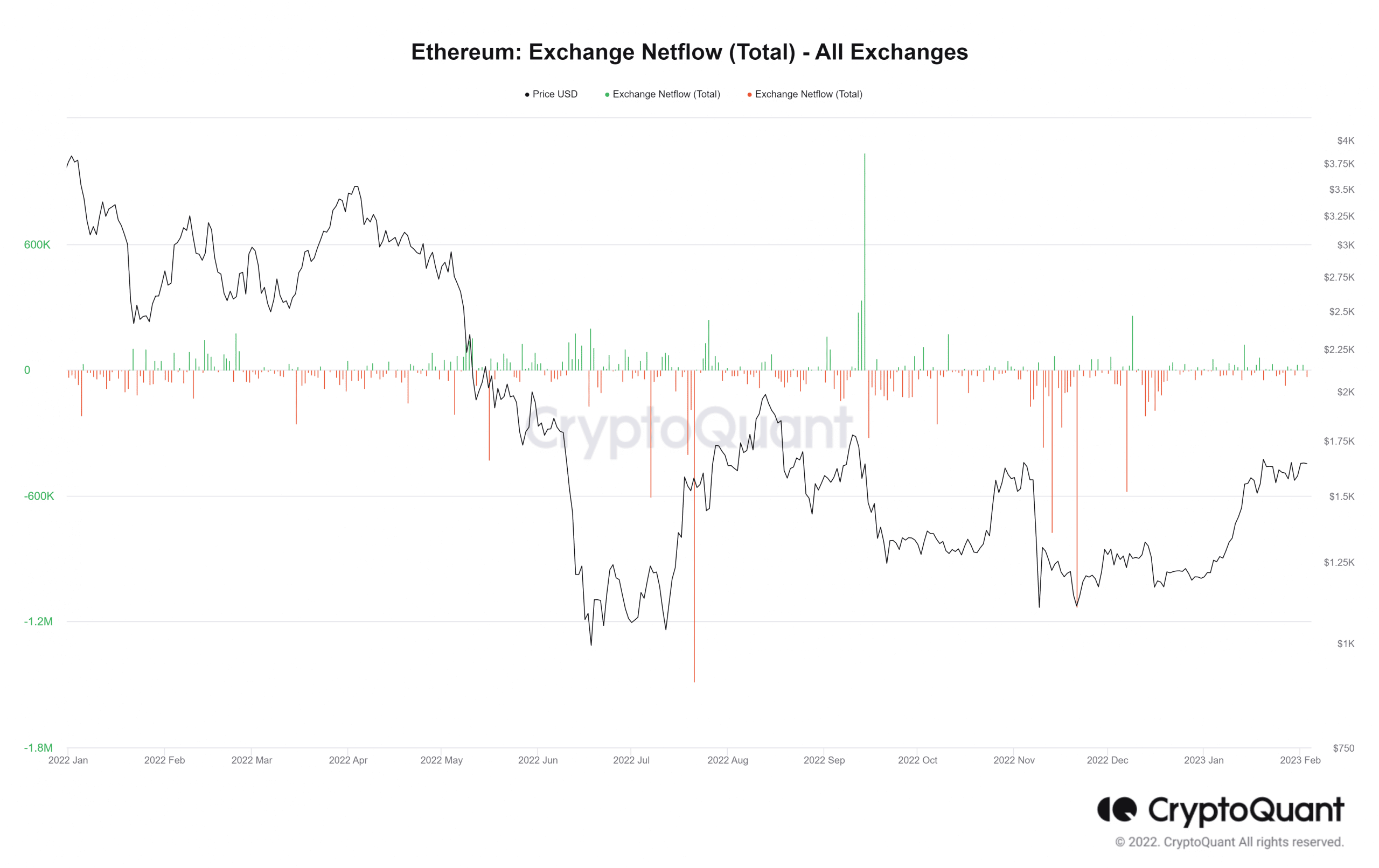

The Netflow measure may be a more accurate reflection of how investors reacted to Ethereum’s (ETH) modest gain on 2 February. The observed Netflow data shows that on 2 February, more Ethereum (ETH) flowed into exchanges than leaving them.

Sellers were ready to cash in since the inflow was over 29,000. The observed influx, however, was consistent; there was no noticeable surge.

The lack of a spike could indicate that the inflow is insufficient to affect the price of ETH significantly. At the time of this writing, the trend line had turned, and outflow exceeded inflow.

Exchanges see 11% of the total supply as supply in profit rise

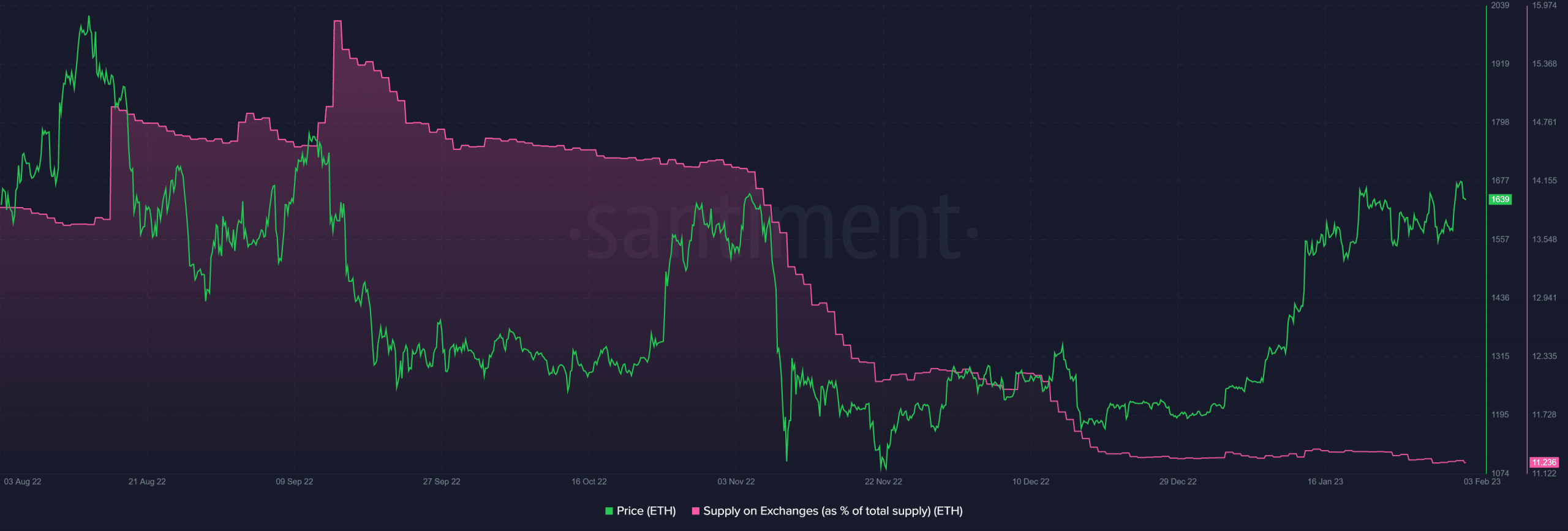

CoinMarketCap estimates that there is currently more than 122 million Ether in circulation. The amount now available on exchanges represents about 11% of the overall supply.

Even though there was a scramble to cash in when the price of ETH spiked, this suggests that only a tiny fraction of the overall supply made its way to trading platforms.

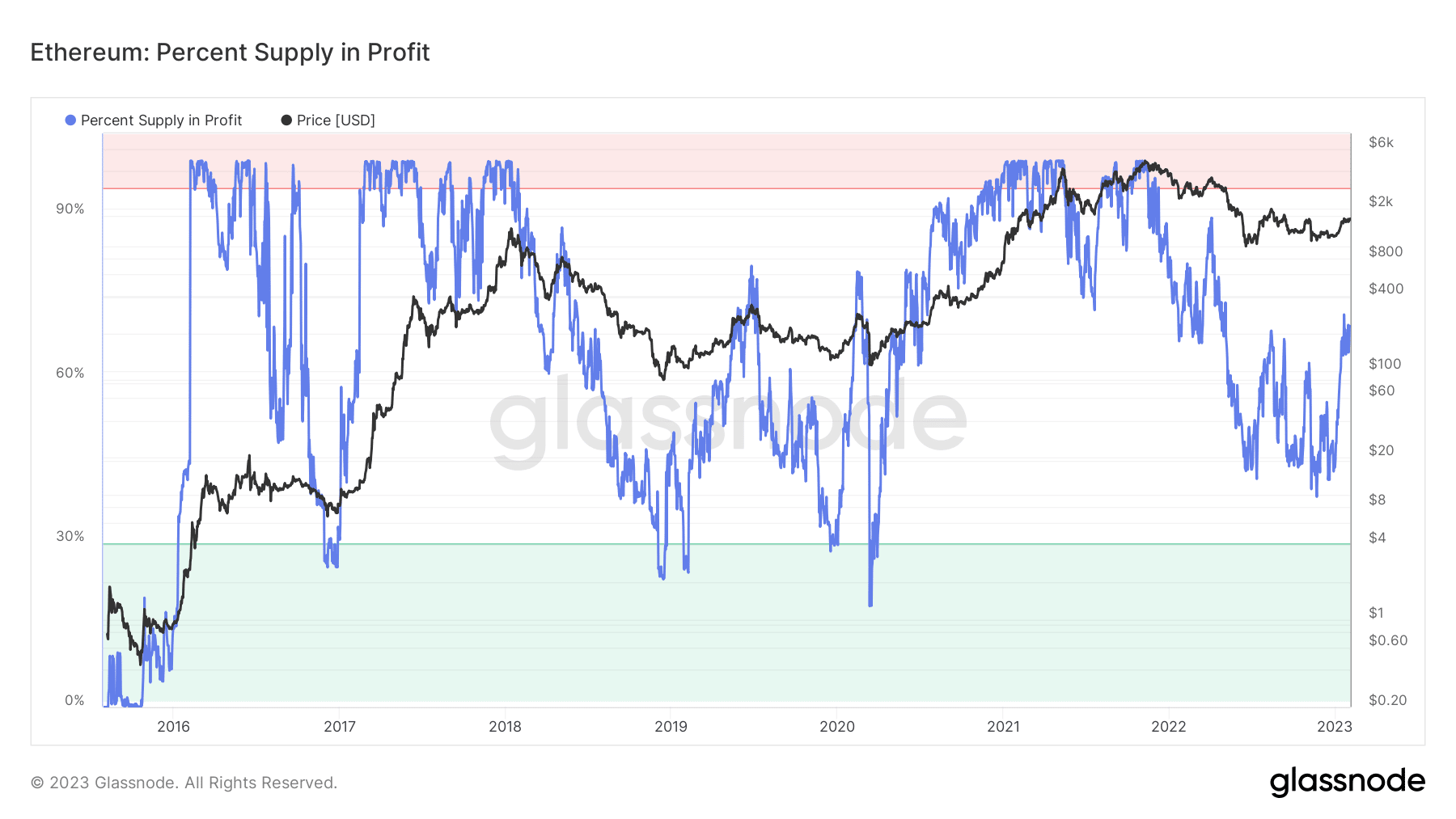

Looking at Glassnode’s Percent Supply in Profit also revealed that a sizable portion of the ETH supply is currently earning interest. Over 64% of the supply, as seen in the observed graph, was profitable as of this writing.

Is your portfolio green? Check out the Ethereum Profit Calculator

Short-term investors may be tempted to cash out their ETH holdings now that the price is at its highest point in months. Observed indicators suggest that more ETH are being held than sold, so this development should not have a profound effect on the price of ETH.