- Coinbase clarifies stance on staking, ETH faces uncertainty.

- Validators remain positive, however, traders remain pessimistic about the king altcoin.

Coinbase, of late, has been found at the heart of the massive FUD surrounding the crypto market. The FUD was stirred due to SEC’s investigation into Coinbase’s rival firm, Kraken.

Now, after the Kraken incident panned out, questions around Coinbase started to arise.

Read Ethereum’s Price Prediction 2023-2024

Recently, Coinbase came out with a statement clarifying its stance on staking and securities, amidst SEC’s increasing litigations.

According to the exchange’s statement, staking is not a security under the U.S. Securities Act, nor under the Howey test. The Howey Test is a framework used by the SEC to determine whether an asset is a security or not.

Coinbase stated that superimposing these securities laws onto a process like staking will be detrimental to users. According to Coinbase, these actions could force U.S. consumers to move to offshore unregulated markets.

These statements will likely reduce the amount of FUD around the matter.

Ethereum validators unaffected

Even though these developments occurring before the Shanghai Upgrade could prove to harm Ethereum, the validators on the network have remained undeterred.

According to Staking Rewards, the number of validators on the Ethereum network continued to rise. Over the last 30 days, it increased by 3.54%.

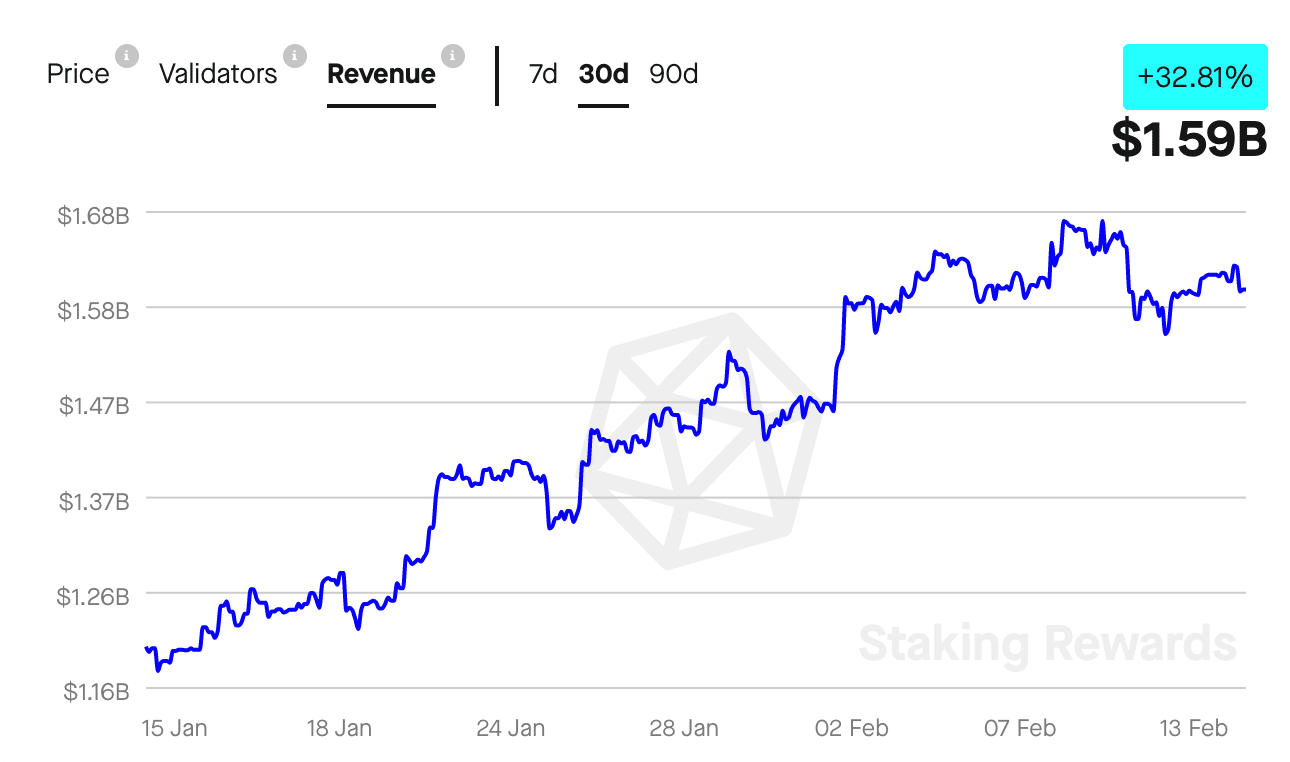

One of the reasons for the interest from validators was the revenue generated by them. Consider this- In the past month alone, the revenue generated by the validators increased by 32.81%.

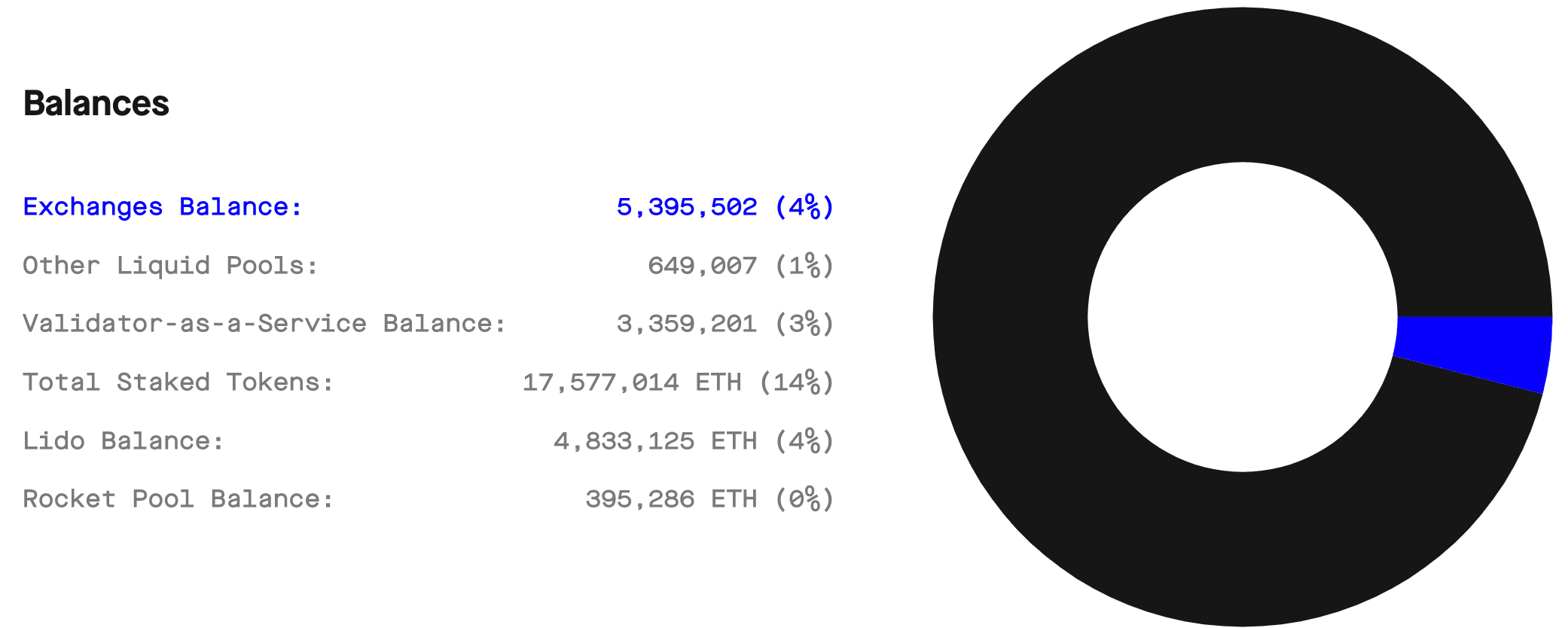

Subsequently, the overall ETH staked also increased. At press time, 14% of the overall Ethereum supply was staked. After the Shanghai upgrade, this number could change. The majority of the staked ETH was staked through Lido or other centralized exchanges.

After the upgrade, more retail interest in staking could increase, which would likely change the current distribution of staked Ethereum.

Even though stakers were positive about the state of Ethereum, traders remained pessimistic. It appeared that the FUD was enough to sway traders’ opinions.

At press time, the number of short positions taken against ETH increased. According to coinglass, 51.24% of traders had taken short positions against ETH.

How much are 1,10,100 ETH worth today?