Summary:

- The Shanghai-Capella upgrade scheduled for April 12 should unlock over $30 billion in staked ETH on Ethereum’s beacon chain.

- Clients are advised to upgrade their nodes ahead of Shapella’s arrival, core developer Tim Beiko said.

- It’s unclear if selling pressure might increase after the unlock enables withdrawals for over 16 million stETH.

Ethereum’s highly anticipated Shanghai upgrade is scheduled for epoch 194048 at around 11 pm UTC on April 12, barely two days away at press time.

ETH proponents and core developers have angled the Shanghai-Capella update as another watershed moment for crypto’s second-largest blockchain after Bitcoin (BTC). The network already successfully implemented the Merge, Ethereum’s switch from a proof-of-work consensus model to proof-of-stake which happened on September 15, 2022.

Shapella, a mix of the Shanghai and Capella upgrades, will unlock over 16 million ETH deposited in the chain’s staking contract since December 2020, or so developers say. The massive staked ETH fortune is worth nearly $30 billion at current prices. ETH was up 1.30% and traded at $1860 on Monday.

However, withdrawing stETH was impossible and required another technological upgrade – Shapella.

The tokens also make up over 13% of ETH’s total token supply. Entities have locked ETH a staggering amount of ETH since 2020 to secure their place as Ethereum validators – the people who help manage ETH’s network by authenticating transactions and securing the chain.

Ethereum Validators And Centralization

These validators became a crucial part of Ethereum after the Merge, effectively replacing miners who operate similar duties in a PoW blockchain. While the growing number of validators beyond 500,000 and stETH exceeding 16 million tokens could indicate increased interest in ETH, the coming unlock also raises concerns of sell pressure in the market.

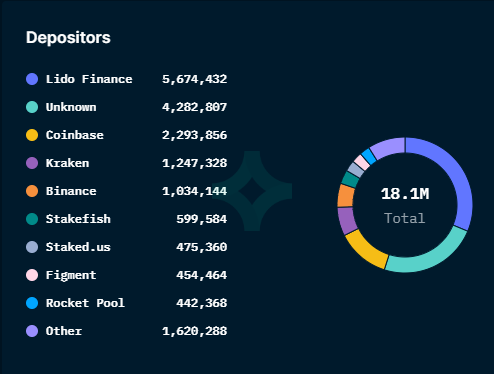

The concentration of stETH in the hands of a few entities also might pose centralization concerns. Indeed, Nansen data shows that services like Lido Finance, Coinbase, Kraken, and Binance are the top five staked ETH depositors.