Ethereum, the second-largest cryptocurrency by market cap, is facing another bout of turbulence as it experiences a fresh influx of coins into exchange addresses.

According to recent data, this surge in Ethereum inflows is reminiscent of a similar occurrence that coincided with a drop in the cryptocurrency’s value below the $2,080 mark.

The question on the minds of traders and enthusiasts alike is, will this latest wave of inflows lead to a similar outcome?

Ethereum Inflow Analysis

In the past week, Ethereum experienced a decline of 3.51%, with bulls barely managing to keep prices above the $2,000 support zone. However, when Bitcoin was rejected at the $30,000 mark, Ethereum also saw a drop in value.

Despite this bearish trend, the cryptocurrency managed to post a 1% gain in the last 24 hours and is currently priced at $1,886 according to CoinMarketCap.

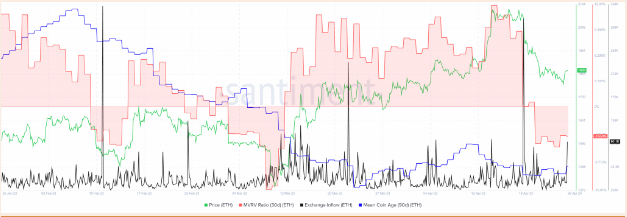

The 30-day MVRV (Market Value to Realized Value) ratio for Ethereum, which measures the average profit or loss of all addresses that acquired ETH within the past month, retreated from a three-month peak in mid-April to negative values at the time of writing.

This drop was a result of intense selling pressure over the past two weeks, which saw ETH’s value decline from $2,125 to $1,820.

The MVRV values indicated that short-term holders of ETH were at a loss, and that the average age of the coins has not changed much in the last week, but it has gone up a little bit in the last few days.

Based on the data of exchange inflow over the past week, it appears that there is a high likelihood of further selling taking place soon.

Source: Santiment

Ethereum Could See Further Losses; Sentiment Bearish

Given the current market sentiment and technical indicators, it’s possible that Ethereum could see further losses in the coming days. If the bears continue to dominate the market, the cryptocurrency could break through the $1800 support level and head towards the $1,600 range.

However, if the bulls manage to gain momentum, Ethereum could potentially see a price movement towards the $2,000 range. The 4-hour chart shows a resistance level at $1,890, which, if broken, could lead to a potential price increase.

ETH total market cap currently pegged at $226 billion on the daily chart at TradingView.com

It’s important to note that cryptocurrency markets are notoriously volatile and unpredictable, and unexpected events could always occur that impact the price of Ethereum. As always, traders should exercise caution and carefully analyze market trends before making any investment decisions.

While Ethereum has experienced losses in the past week, there is still potential for a price increase if the bulls manage to gain momentum. However, the current market sentiment and technical indicators suggest that further losses could be in store.

It remains to be seen how the market will develop in the coming days and weeks, and traders should remain vigilant and adapt to changing conditions.

-Featured image from TipRanks