As developers pitch radical long-term scaling upgrades, Ethereum infrastructure builder ConsenSys has announced the alpha testing phase for a new zero-knowledge Layer 2 ZK mainnet, Linea.

According to the MetaMask operator, the Linea network has processed $46 million worth of transactions involving 5.5 million unique wallets.

Will ConsenSys Linea ZK Mainnet Win Developers?

The new ConsenSys Linea network is a so-called zero-knowledge rollup that performs calculations on batches of transactions before posting data to the main Ethereum chain. The network confirms a transaction’s validity without showing details to the Ethereum base layer.

Moreover, developers on Ethereum can port their applications directly to Linea without code changes. The alpha includes deep integration with MetaMask’s Bridge, Swap, and Buy features.

ConsenSys will onboard launch partners onto its Layer 2 before officially launching the network during next week’s ETHCC conference. Even at the launch, ConsenSys will impose withdrawal limits to protect users for 90 days. It warns users to be aware of airdrop scams since the L2 has no native token.

Learn here about Ethereum wallet options.

Notable players in the zkEVM space are Polygon, zkSync, LoopRing, and StarkWare. Starkware’s zk-STARK solution has been favored by the Ethereum Foundation for its scalability over the technology backing Linea, known as zk-SNARK.

Developers Prepare for Long-Term Scaling Solution

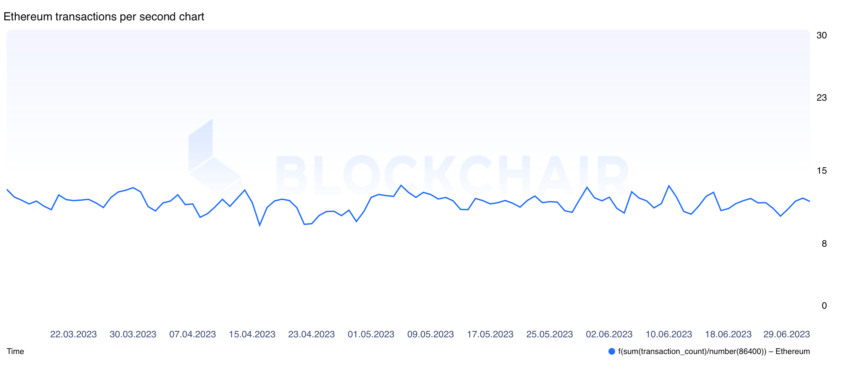

Ethereum co-founder Vitalik Buterin said rollups solve Ethereum’s low transaction throughput while developers create a long-term solution.

The upcoming Cancun upgrade will include building blocks for danksharding, Ethereum’s long-term scaling upgrade after Shapella.

The latest all-core developers’ meeting in June focused on Ethereum’s Deneb upgrade, which will happen simultaneously with Cancun. In addition to pushing Ethereum toward higher throughput, the developers discussed a proposal to include changing the maximum Ethereum validators can stake from 32 ETH to 2,048 ETH.

Node operators currently stake 32 ETH on a smart contract on Ethereum’s Beacon Chain to become validators.

The US Securities and Exchange Commission (SEC) did not list Ethereum in its latest list of crypto assets it considers securities. A recent research paper by JPMorgan suggested that Ethereum is neither a security nor a commodity and may require a separate US regulator.

The SEC sued crypto exchange Kraken for offering US customers its Ethereum staking product as an unregistered security.

Got something to say about the Linea ZK Mainnet or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

The post Will ConsenSys Linea Network Significantly Impact Ethereum? appeared first on BeInCrypto.