Ethereum average transaction fee has hit its lowest point of the year, a change that aligns with reduced on-chain activity. Notably, this drop comes when the supply of ETH has transitioned back to an inflationary phase.

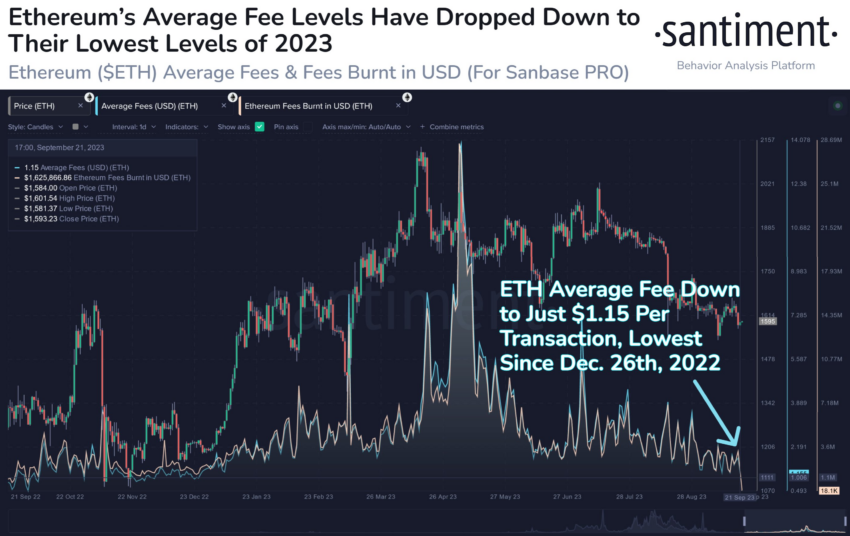

Blockchain analytical firm Santiment revealed that the transaction fees on the Ethereum network dropped to $1.15 per transaction, the lowest level since last December.

Ethereum Average Transaction Fee Drops

Ethereum’s reduced transaction fees can be attributed to a recent decline in network activity. To provide context, on September 21, Binance elevated the network’s average transaction fee above $10 while conducting routine asset consolidation across various wallets.

Had these transactions occurred earlier in the year, amidst the meme coin craze or the peak of NFT trading volumes, their impact on network fees might have been less pronounced.

Binance’s actions notably influenced the gas fees because no other significant network activities coincided with the event. This underscores the cooling of Ethereum’s network activity in response to the current market conditions.

Market observers interpret this decrease in network activity as a potential positive for Ethereum. Santiment noted that declining Ethereum fees frequently align with increased network utilization. According to the firm, this could potentially boost the price of ETH and contribute to a market cap recovery.

“Ethereum network fees have dropped down to its lowest level of 2023, at just $1.15 per transaction. Historically, we see utility begin rising as ETH becomes more affordable to circulate. Increased utility can then lead to recovering market cap levels,” Santiment said.

ETH Network Turns Inflationary

With Ethereum network fees dropping to a yearly low, the digital asset has turned inflationary as fewer tokens are being burned. In the last seven days, Ethereum’s supply has increased by 6,371 ETH, according to Ultrasoundmoney.

The lead developer at Blockchair, Nikita Zhavoronkov, explained that ETH was inflationary because of the network fees.

“Ethereum fees, which are supposed to burn ethers, are everywhere but not on Ethereum: its own L2s (Arbitrum, Polygon, etc.) and EVM competitors (BNB, Avalanche C, etc.),” Zhavoronkov said.

Ethereum’s move to a proof-of-stake algorithm last year aimed to reduce its supply through burning. However, the decrease in network activity has hindered this burn rate. Likewise, the proliferation of layer-2 networks is increasingly seeing most of the network activity and relegating ETH’s mainnet to the background.

The post Ethereum Average Transaction Fee Plummets: What It Means for ETH Price appeared first on BeInCrypto.