Deribit Ethereum (ETH) options contracts with a strike price of $2,550 are set to expire on Friday. There are over 24,600 outstanding contracts worth more than $62 million at this price, even as the ETH’s price is $2,541.79 ahead of an exchange-traded fund (ETF) approval deadline in May.

The large volume of contracts appears to reflect market sentiments around the potential approval of exchange-traded funds that track the price of ETH directly.

ETH ETFs May Not Live Up to Expectations

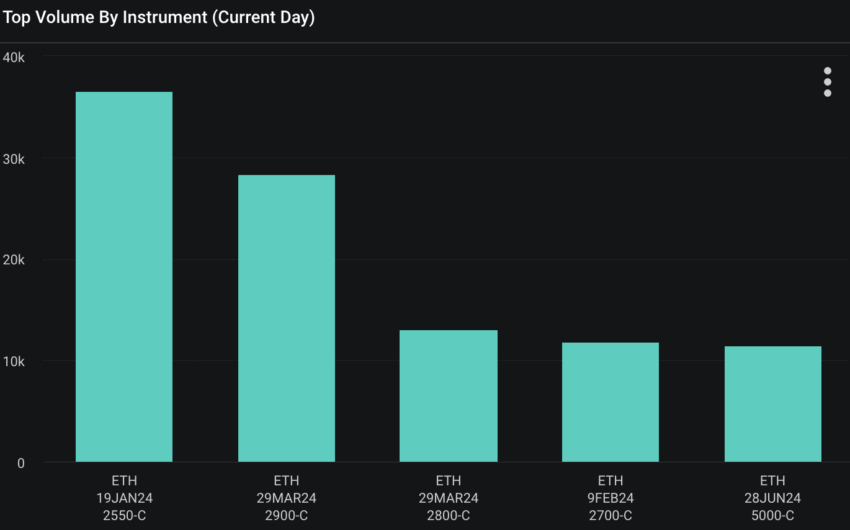

The market expects the ETH price to rise to $2,900 on March 29, 2023, and $5,000 by June, following the first wave of anticipated ETF approvals in May 2024. A call option gives a contract holder the right, but not the obligation, to buy an underlying asset before or on the contract expiration date.

Read more: An Introduction to Crypto Options Trading

Before the US Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs last week, Ethereum investment products saw a healthy inflow of funds. Corporate products saw inflows of $29 million in the first week of January.

Bullish signals for the network include advancements in scaling and the push toward cheaper transactions made possible by proto-danksharding. In the meantime, several so-called rollups, blockchains that expand Ethereum’s throughput, are set to grow in diversity and number in 2024.

In October, ETH futures ETFs launched to a lackluster reception, raking in only $6.6 million on the first day. By comparison, the ProShares Bitcoin Strategy ETF saw inflows of $1 billion in the first two days.

ETH Price Bullish For the Medium Term

Some commentators think markets are getting ahead of themselves in predicting overly bullish prices for Ethereum. However, some, like QCP Capital, expect ETH to outperform Bitcoin in the medium term.

“We expect ETH to continue outperforming BTC over the medium term as the narrative rotates to potential ETH Spot ETF approvals.”

But the SEC’s approval of a spot Ethereum ETF is not just a formality. As a network, Ethereum is arguably more centralized than Bitcoin and offers staking yields that could be considered securities. Last year, the SEC sued crypto exchange Kraken for providing US investors with its staking product as an unregistered security.

Read more: Staking Crypto: How to Stake Coins and Grow Your Income

Bitcoin bull Michael Saylor opined that ETH is a security because a few core developers can change its properties. On the other hand, people want to keep Bitcoin’s properties the same.

Do you have something to say about what impact the expiry of ETH options will have on the ETH price, the ETH ETF outlook, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

The post What Impact Will Expiry of $60M in Ethereum (ETH) Options Have on the Price appeared first on BeInCrypto.