Bernstein, a prominent brokerage firm, has recently showcased a bullish outlook on Ethereum (ETH). This perspective aligns with the significant purchase of Ethereum, worth approximately $66 million, by a noted crypto whale wallet – 0x7a9.

As Ethereum gains momentum, the focus shifts from Bitcoin’s ETF-driven rally to the potential for Ethereum’s institutional adoption and the approval of a spot exchange-traded fund by the US Securities and Exchange Commission (SEC).

Whale Accumulates Ethereum Amidst Positive Sentiments

The report from Bernstein highlights Ethereum as a prime candidate for SEC-approved spot ETFs. Moreover, the analysts believe there is a 50% likelihood of Ethereum ETF approval by May, with near certainty within a year.

Notably, giants in traditional finance, such as Franklin Templeton, Blackrock, and Fidelity, compete to launch Ethereum ETFs in the US, indicating bullish medium-term prospects for Ethereum. Still, the interest in Ethereum extends beyond ETFs. Institutions aim to use the Ethereum network to develop transparent, tokenized financial markets. This ambition goes well beyond simple asset gathering.

“Ethereum with its staking yield dynamics, environmentally friendly design, and institutional utility to build new financial markets, is well positioned for mainstream institutional adoption,” Bernstein analysts Gautam Chhugani and Mahika Sapra stated.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Likewise, BlackRock CEO Larry Fink voiced his support for an Ethereum ETF. He emphasized the transformative potential of tokenization in asset management and transactions. Fink’s backing highlights Ethereum’s increasing importance in digital finance, pointing towards a shift in investment strategies towards blockchain technologies.

Another development that is set to enhance Ethereum’s appeal further is the forthcoming Dencun upgrade, which promises to slash transaction costs by 50%-90%.

The recent acquisition of 22,719 ETH by the whale 0x7a9, at an average price of $2,893, underscores the growing investor confidence in Ethereum. This purchase includes significant transactions through Binance and 1inch, indicating a robust investment strategy.

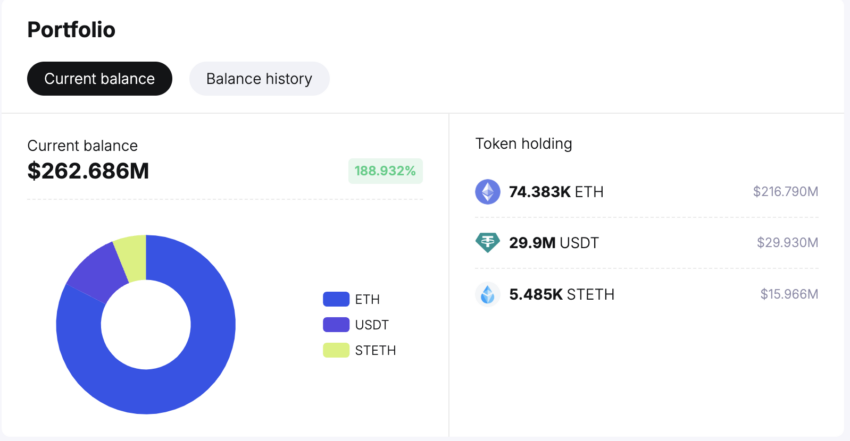

Presently, the whale’s portfolio boasts 74,383 ETH and 5,485 stETH, valued at roughly $233.8 million. The whale has an unrealized profit of $12.38 million.

The post Bernstein Is Bullish on Ethereum as Crypto Whale Buys $66 Million appeared first on BeInCrypto.