- Ethereum surpassed $3200 at press time.

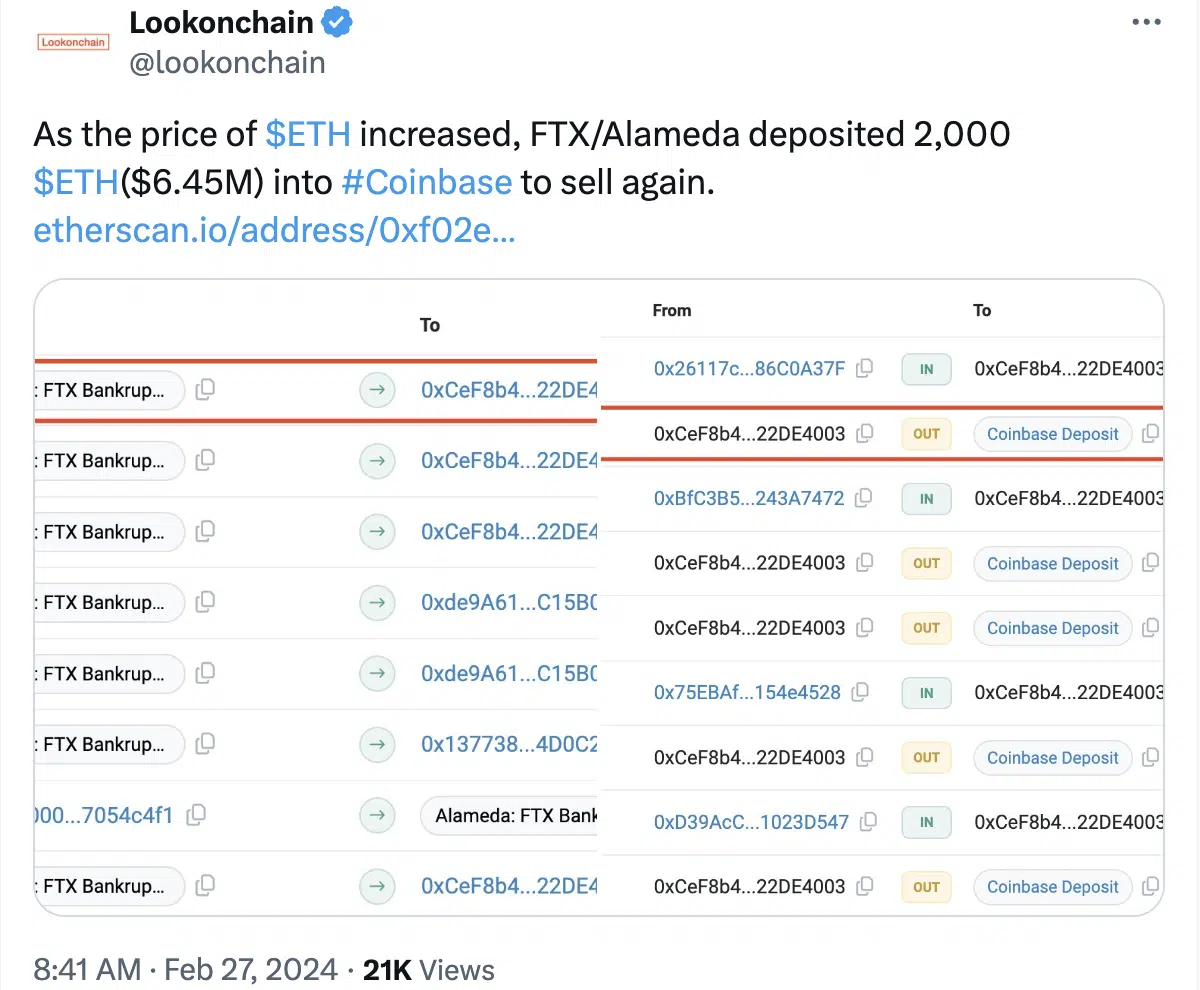

- FTX and Alameda’s ETH deposit raised questions about potential impacts on prices.

Ethereum [ETH] recently surged past the $3200 mark, instilling optimism among holders.

However, lurking beneath this positive momentum were potential challenges, with data revealing interesting moves by significant players that might cast shadows on ETH’s future.

Whales move their holdings

Despite the upward trajectory, concerns grew as FTX and Alameda’s accounts deposited 2,000 ETH (equivalent to $6.45 million) into Coinbase after the price surge.

The deposit into Coinbase could be interpreted as a move by these entities to capitalize on the recent price increase.

If these whales decide to sell their ETH holdings on the open market, it could create selling pressure, leading to a decline in Ethereum’s price.

Large sell-offs triggered by significant players can cause market fluctuations and trigger a chain reaction of selling from other market participants, potentially resulting in a bearish trend.

The timing of this deposit added yet another element of uncertainty.

Source: X

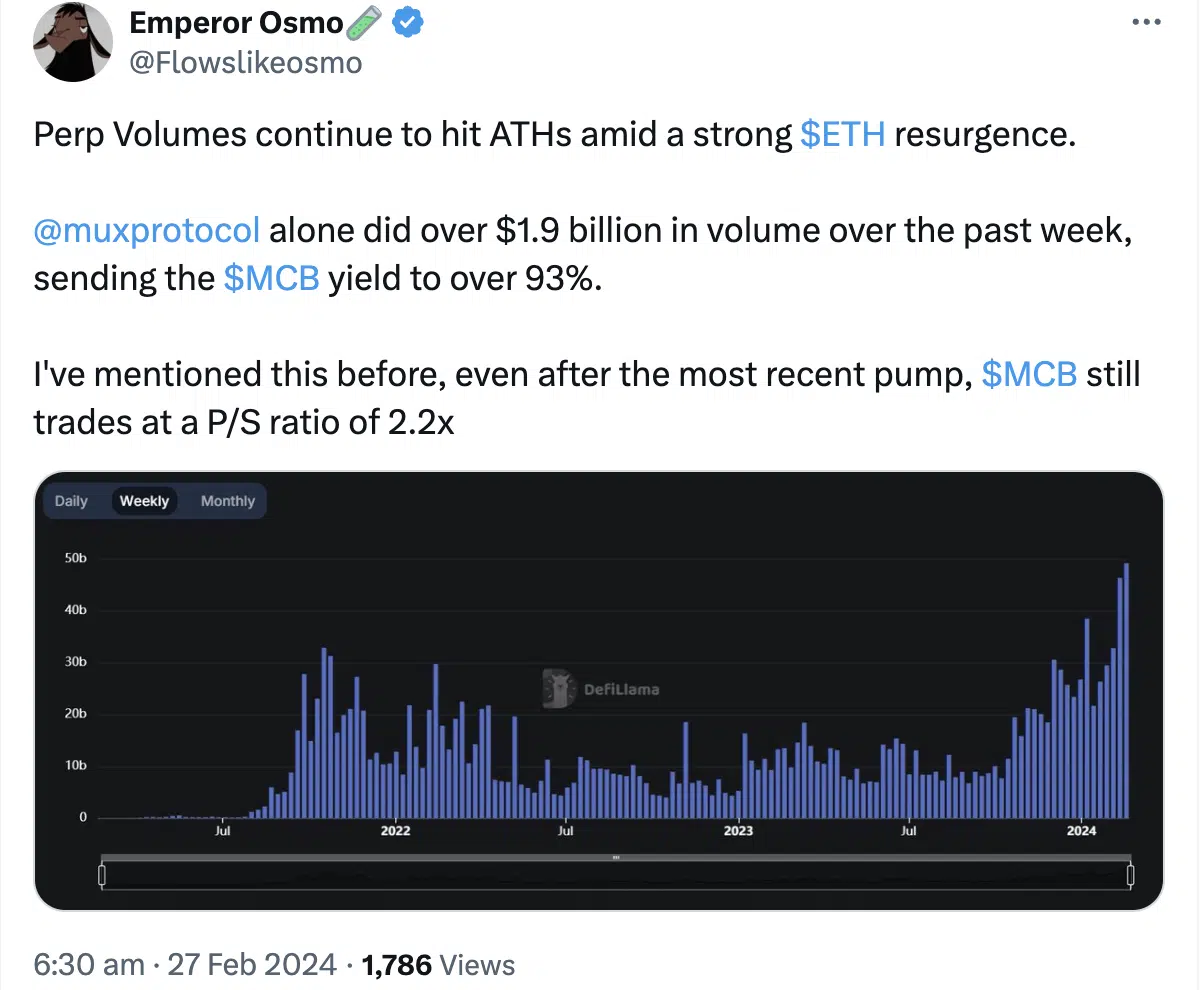

Perpetual volumes, a key indicator, also hit all-time highs amid Ethereum’s robust resurgence.

The performance and valuation of associated projects like Muxprotocol boasted a staggering volume exceeding $1.9 billion in the last week, driving its yield to an impressive 93%.

This rise underscored the rising interest in Ethereum-based projects.

How is ETH performing?

At the time of writing, ETH was trading at $3,227.00, marking a 3.81% increase in the last 24 hours.

The consistent growth, showcasing multiple higher highs and higher lows, signaled a bullish trend in ETH’s price.

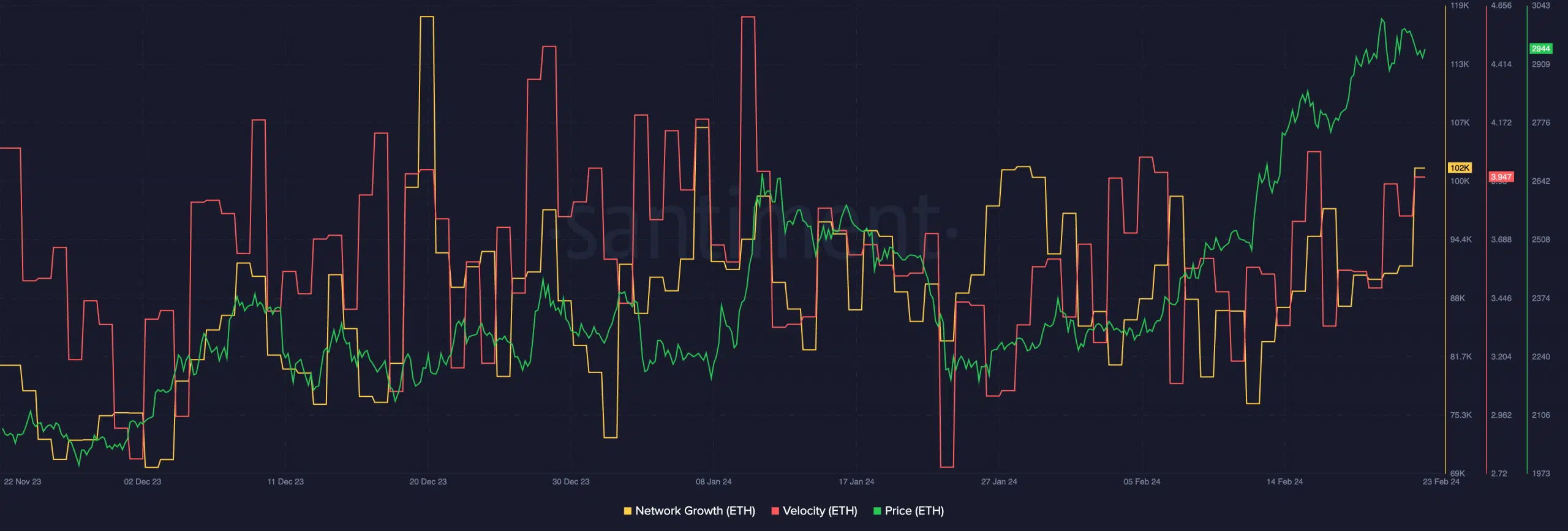

AMBCrypto’s examination of the Ethereum network also revealed positive patterns. Notably, a surge in Network Growth suggested a significant influx of new users accumulating ETH.

Simultaneously, the growing velocity indicated an increased frequency of ETH transfers, portraying heightened activity and engagement within the network.

Is your portfolio green? Check out the ETH Profit Calculator

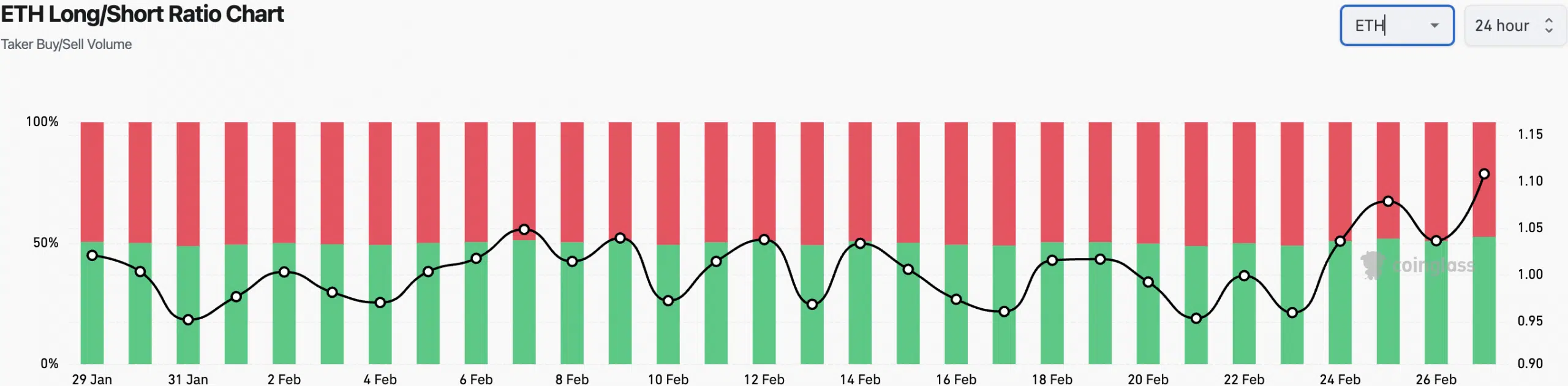

Trader sentiment is crucial in understanding the potential trajectory of ETH’s price. At press time, the percentage of short positions had declined, reflecting a shift in sentiment towards a more optimistic outlook.

This reduction in bearish positions aligned with the overall positive trend observed in Ethereum’s recent price movements.