Leading cryptocurrency exchange, Coinbase has released a new report delving into the restaking trends in Ethereum. The report, authored by analysts David Han and David Duong, explores how restaking could reshape validator incentives, potentially unlocking new opportunities and introducing complex risks.

Coinbase analysts explain why restaking has emerged as a major theme within the crypto industry. Ethereum’s switch to proof-of-stake (PoS) has created a vast pool of staked ETH, far outpacing the requirements for network security.

However, the introduction of restaking, particularly through liquid restaking tokens (LRTs), brings to the forefront both opportunities and risks for validators and the broader decentralized finance (DeFi) ecosystem.

Restaking’s Growth and the Rise of LRTs

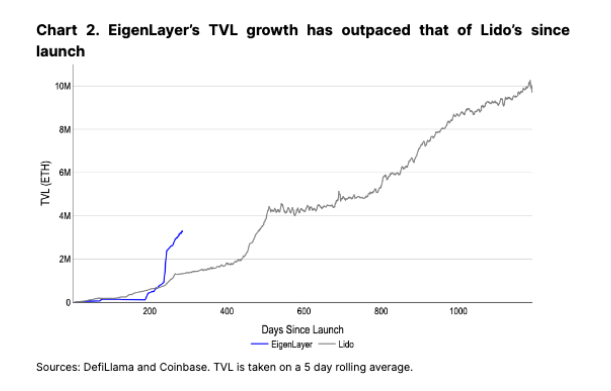

Restaking lets Ethereum validators earn extra rewards by securing additional services on top of the network’s base layer. This concept has taken hold with the rise of EigenLayer, a restaking protocol that has become the second-largest Ethereum DeFi platform with $12.4 billion in total value locked (TVL).

Read more: What Is EigenLayer?

EigenLayer has seen explosive growth despite a lack of live actively validated services (AVS) – the additional protocols validators can secure to boost rewards. This suggests short-term farming opportunities might drive some interest. Coinbase analysts predict a short-term drop in EigenLayer’s TVL when farming ends or if initial AVS yields disappoint.

Restaking has fueled the parallel emergence of LRTs. These tokens represent claims on restaked ETH and offer holders flexibility and the potential for further DeFi gains. Multiple LRT protocols now compete, mirroring the trend seen in the liquid staking sector.

The Complexities and Uncertain Rewards

While restaking’s potential is clear, Coinbase’s analysis highlights financial and security risks. The involvement in various AVSs may complicate the understanding of financial and security repercussions, raising the stakes more than before.

Coinbase’s concerns echoed what Vitalik Buterin, the co-founder of Ethereum, stated in May 2023.

“In some cases, if they misbehave according to the other protocol’s rules, their deposit also gets slashed. In other cases, there are no in-protocol incentives and stake is simply used to vote,” Buterin wrote.

Furthermore, it remains to be seen how lucrative the initially available AVSs will be. Some LRT platforms could face unsustainable fee structures if the returns from AVS are insufficient to cover costs.

Additionally, deciding which AVSs to back introduces another degree of complexity for those engaging in restaking. This decision-making process creates a murky environment where accurately assessing risks becomes challenging.

Providers of LRT may be tempted to chase the highest possible yields, potentially exposing their users to higher levels of risk without a comprehensive understanding of the implications.

Read more: Ethereum Restaking: What Is It And How Does It Work?

Despite these concerns, restaking is paving the way for innovative DeFi protocols and may significantly influence Ethereum’s economic model. With the DeFi sector’s TVL in LRTs nearing $8.5 billion and platforms like CoinGecko categorizing restaking tokens as a significant growth area, the trajectory of restaking in Ethereum’s ecosystem is set for substantial evolution.

The post Coinbase: Restaking Can Be a Game-Changer in Validator Incentives, But at What Cost? appeared first on BeInCrypto.