In the last 24 hours, Ethereum (ETH) has seen a significant influx of nearly $57 million, predominantly driven by crypto whales despite a prevailing bearish sentiment in the broader market.

This development comes as Ethereum’s price struggles to maintain upward momentum.

Examining Ethereum Whales Activities

According to Spot On Chain, the buying spree involved multiple large transactions. These transactions highlight a possible strategic positioning or a response to the current market conditions.

The most notable among these is whale 0x3d4, which recently withdrew 8,877 ETH from Binance, valued at approximately $29 million, based on the price of $3,267 per ETH. This move marks the whale’s second substantial investment in Ethereum, having previously withdrawn 14,877 ETH from the same exchange.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

With Ethereum’s price now at an average of $2,863 per acquisition, the whale’s holdings are approximately $48.68 million. This suggests an unrealized gain of $6.02 million, or 14.1%.

Meanwhile, a new market player, whale 0x0d7, withdrew 1,800 ETH worth about $5.71 million from Binance. This marks the wallet’s first recorded transaction, signifying a potentially new significant player in the Ethereum market.

Another major transaction involved whale 0x435, which withdrew 7,128 ETH, translating to roughly $22.2 million. This withdrawal occurred when Ethereum was trading at $3,111.

Notably, this transaction pushed the whale back into a loss, as a subsequent 5.12% drop in Ethereum’s price over the next 12 hours exacerbated their financial position. This whale’s broader trading history shows a pattern of heavy accumulation and recent losses, with a net loss of $9.98 million, or -1.9%.

These transactions underscore a broader trend where major whale activities do not always correlate directly with profit outcomes. For instance, while whale 0x435 experiences losses, whale 0x3d4 sees gains. This situation illustrates the varied strategies and outcomes inherent in high-stake crypto investments.

Ethereum’s recent technical analysis adds another layer of intrigue. BeInCrypto’s analyst outlined that after touching the 0.382 Fibonacci support level at approximately $2,867, Ethereum exhibited resilience by bouncing back.

However, it faces significant hurdles, with the 50-day Exponential Moving Average (EMA) at around $3,277 and further resistance near the $3,320 and $3,650 Fibonacci levels.

A breakout above these could suggest a reversal of the current downward trend.

“Breaking out of the parallel descending channel would signal a bullish trend reversal for Ethereum. In such a scenario, Ethereum could potentially target or surpass its previous high of around $4,095,” BeInCrypto’s analyst wrote.

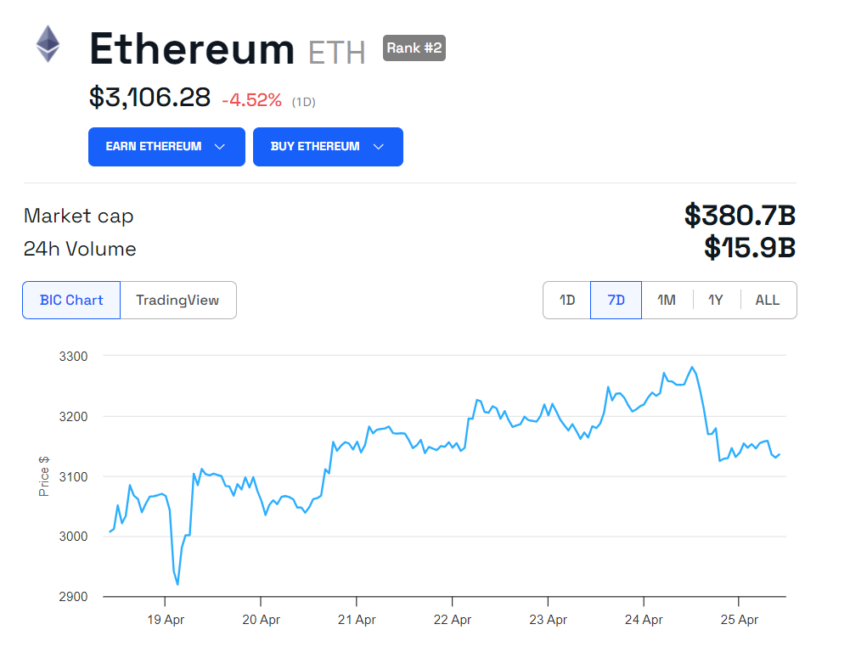

In contrast to these optimistic technical indicators, the market’s immediate response has been less favorable. Ethereum’s price recently fell to $3,106, marking a 4.52% decrease within the day.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

As these whale transactions unfold, their impact on Ethereum’s market dynamics will be closely monitored. Historically, significant whale activity, whether buying or selling, has served as a key indicator of potential market shifts, signaling incoming volatility or forecasting a possible stabilization.

The post Crypto Whales Have Bought Nearly $57 Million in Ethereum (ETH) Over the Past 24 Hours appeared first on BeInCrypto.