Vitalik Buterin, Ethereum’s co-founder, has unveiled plans to revamp how transaction fees are assessed. Termed multidimensional gas pricing, this initiative could revolutionize Ethereum’s transaction mechanisms.

The evolution of Ethereum’s pricing mechanism is crucial in staying competitive in the blockchain space. It needs to attract users and developers amid rising competition.

Vitalik Buterin Explains Why Ethereum Needs Multidimensional Gas Pricing

Historically, Ethereum uses gas to measure the computational effort required for transactions and block processing. This unit combined various computational efforts, such as calculations and storage operations, into a single metric. While this simplified transactions, it introduced significant inefficiencies by failing to distinguish between different types of resource demands.

Buterin criticized the traditional model for its oversimplification. He stated that it treated diverse resources as if they were interchangeable, which they are not in practice.

Read more: When Are Ethereum Gas Fees Lowest?

Consequently, the introduction of multidimensional gas with Ethereum Improvement Proposal (EIP) 4844 marks a significant evolution. This proposal aims to allocate blockchain resources more accurately and efficiently.

The recent Dencun upgrade exemplifies this approach by integrating “blobs” to reduce the cost of rollups—secondary layer solutions that enhance Ethereum’s scalability. Buterin noted, “rollups have become 100x cheaper, and transaction volume on rollups increased by more than 3x.”

Buterin’s proposal for multidimensional gas pricing aims to increase throughput and maintain network security. It also addresses economic aspects by optimizing transaction and operational costs.

However, there is a tradeoff with decreasing transaction fees. Following the Dencun upgrade, the median Ethereum transaction fee has seen a dramatic reduction, decreasing by over 90% across various Ethereum layer-2 networks.

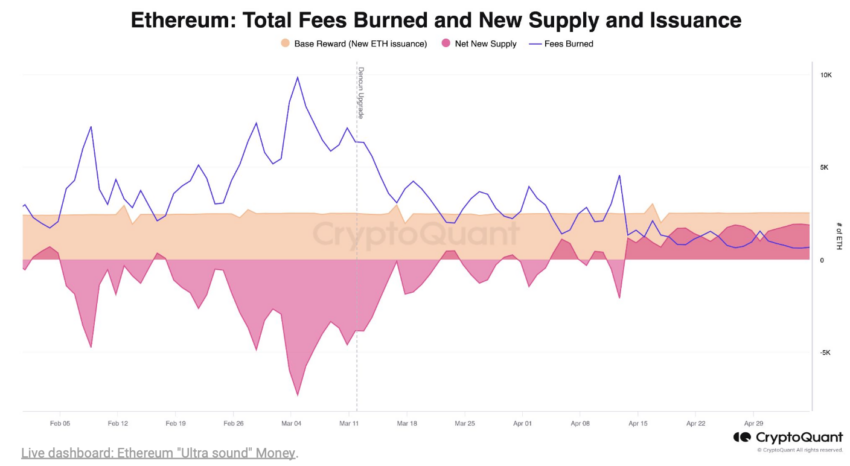

“The new supply of ETH is now growing at the fastest daily rate since the Merge as fees burned plummeted as a consequence of the Dencun upgrade,” CryptoQuant mentioned in a report shared with BeInCrypto.

This reduction in transaction fees has decreased the total fees burned despite high network activity. As a result, the burn rate of the circulating ETH supply has slowed, effectively shifting Ethereum from a deflationary to an inflationary currency.

Meanwhile, Ethereum faces a competitive threat from Solana, a blockchain network that processes transactions at lower costs. Dan Smith, a senior research analyst at Blockworks, suggests that Solana could overtake Ethereum in transaction fees as soon as this week.

His analysis is based on the total economic value, which includes transaction fees and the captured maximal extractable value (MEV) returned to validators.

Read more: What Is Maximal Extractable Value (MEV)?

However, Ethereum still leads in the transaction fees. According to DefiLlama, it generated over $2.34 million in transaction fees in the past 24 hours, compared to Solana’s $1.19 million.

The post Vitalik Buterin Discusses New Plan for Ethereum Transaction Fees appeared first on BeInCrypto.