- Ethereum showed a bearish market structure and could be headed for $2.5k.

- The OBV slipped below a key level as selling pressure increased.

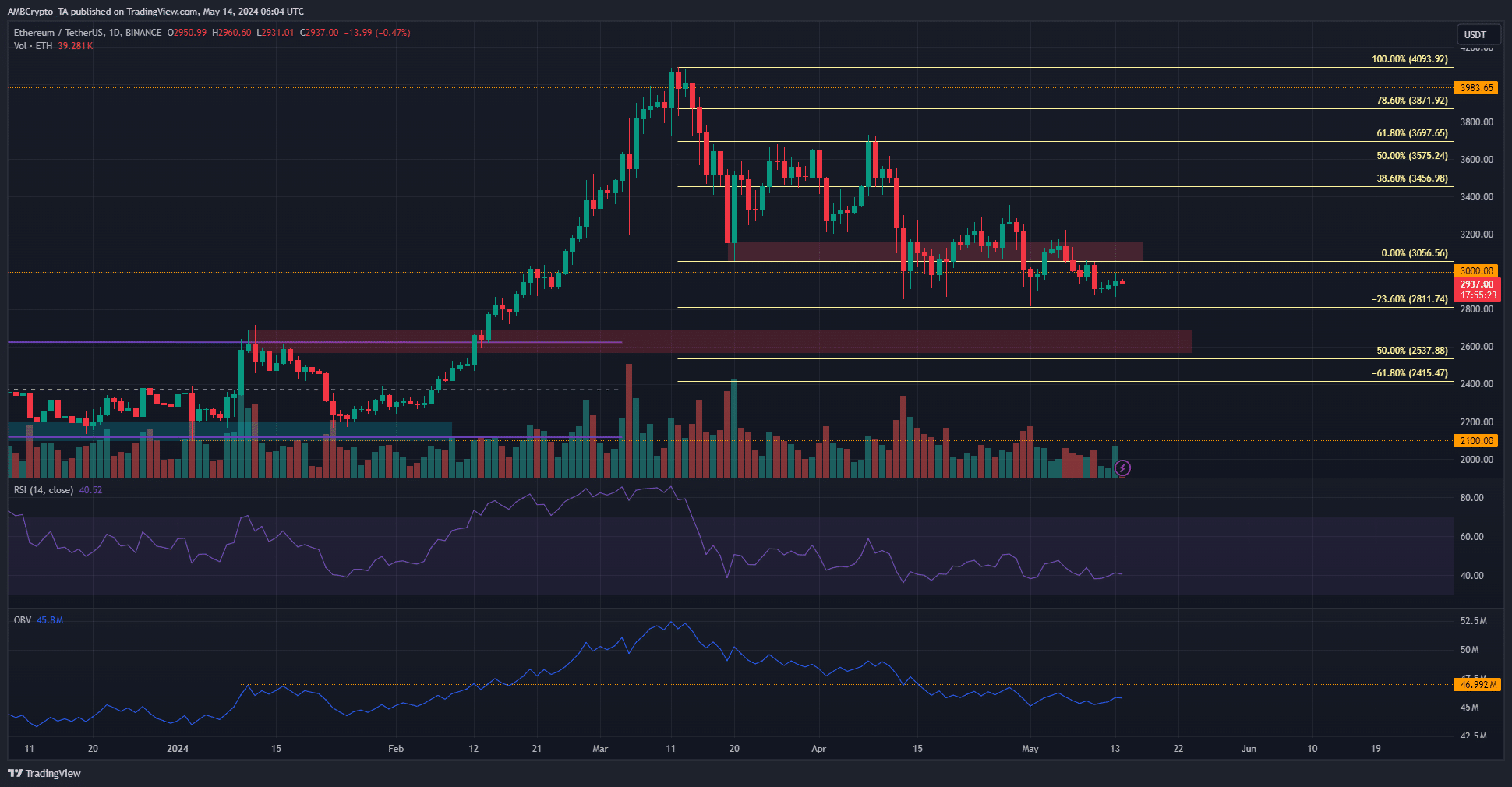

Ethereum [ETH] was in a bearish trend on the daily timeframe after dropping below the $3k mark six weeks ago.

Reports that the spot Ethereum exchange-traded funds (ETFs) applications in the U.S. were likely to face rejection would reinforce the bearish sentiment in the market.

Analysts projected far lower prices for Ethereum in the coming months in the event of a rejection. This lined up with the technical analysis, but it was unclear just how long the downtrend would persist.

The bearish market structure continued to hold sway

Source: ETH/USDT on TradingView

A set of Fibonacci retracement levels were plotted based on ETH’s drop from $4093 to $3056.

While this move did not shift the higher timeframe market structure bearishly, in mid-April, ETH fell below the $3k mark.

This swung the structure bearishly, and the OBV also fell below a significant level. At press time, the $3k resistance zone appeared strong, and the momentum was in bearish favor with an RSI reading of 40.5.

The Ethereum price prediction shows that a drop below $2.8k is likely, given the Fibonacci extension levels.

The 50% and 61.8% extension levels might be tested, but it is unclear if Ethereum would have a V-reversal or would consolidate at those levels.

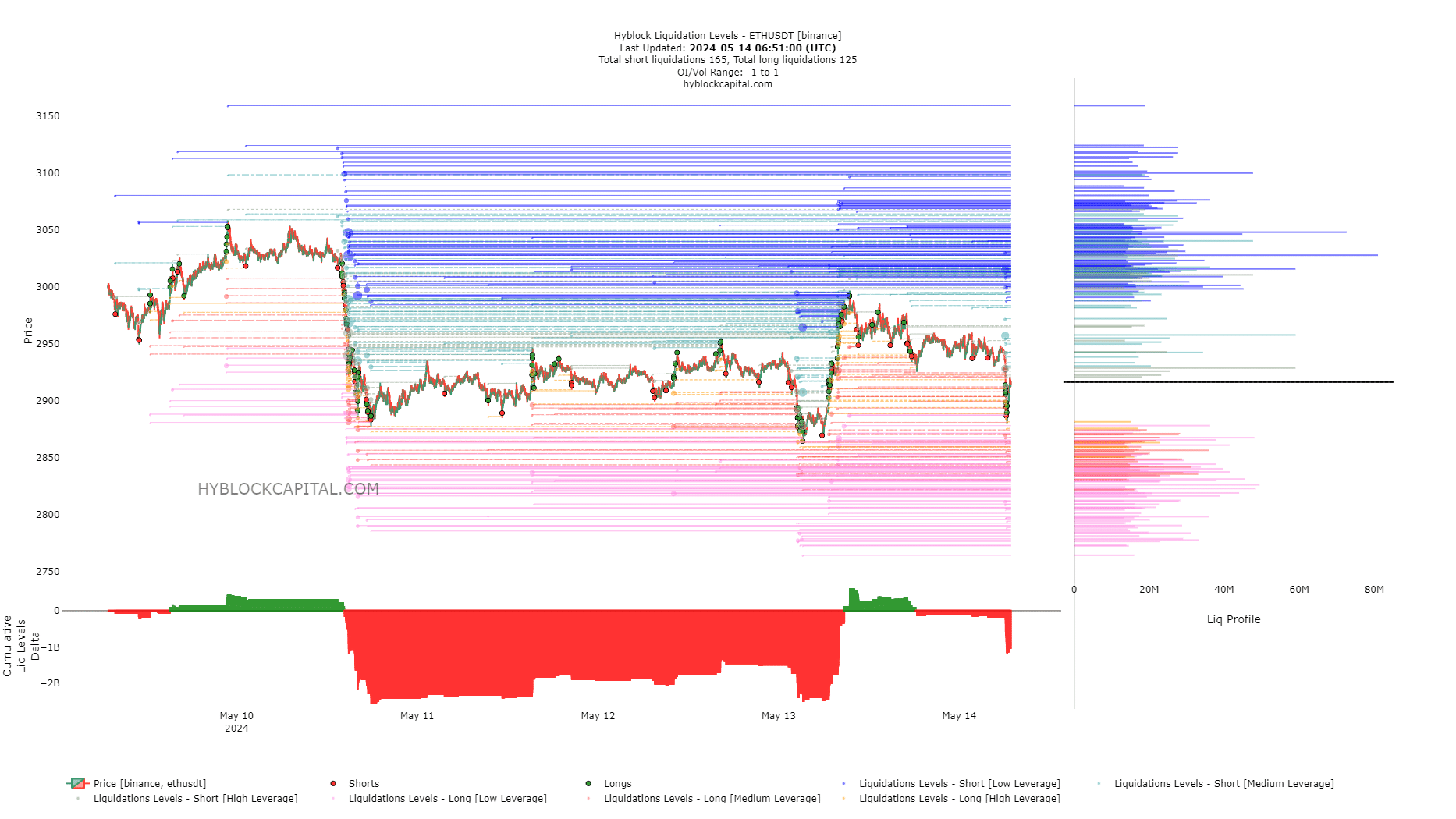

The liquidity chart showed the short-term bounce was over

Source: Hyblock

Just over 24 hours before the time of writing, the cumulative liq levels were deeply negative. This indicated that the short liquidations outnumbered the longs.

Read Ethereum’s [ETH] Price Prediction 2024-25

A few hours later, the price bounced from $2870 to $2990 to take out the late short sellers.

At press time, the cumulative liq levels were negative but less extreme. Hence, there is space for the prices to go further south. The $2840 region is a short-term Ethereum price prediction target.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.