The preliminary approval from the US Securities and Exchange Commission (SEC) for several spot Ethereum exchange-traded funds (ETFs) has sparked renewed enthusiasm in the crypto market.

This development has led to significant gains for Ethereum (ETH) and several altcoins within its ecosystem, such as PEPE and Ethereum Name Service (ENS), over the past 24 hours. This signals strong investor confidence and optimism about the future of Ethereum-based assets.

DeFi Ecosystem Benefits from Ethereum’s Market Momentum

Ethereum’s price surged to $3,910, inching closer to the critical $4,000 mark. This represents a 3.5% increase in the last 24 hours. Crypto analyst Gert van Lagen sees a bullish outlook for Ethereum’s long-term price trajectory.

“ETH [1-week chart] showing strong hidden bullish divergence too! While the price makes higher highs, the momentum indicator (RSI) makes lower lows,” Van Lagen explained.

Analysts at crypto trading firm QCP Capital also shared their perspective on Ethereum’s recent surge. They said that ETH has strong support at $3,000. The analysts attributed potential institutional interest once the spot Ethereum ETF debuts as one reason.

“While we are structurally positive ETH, we don’t see a major breakout until we have more clarity on the S-1 approvals and get some inflow data, which should only be a matter of time,” they explained.

It is important to note that issuers must obtain approval for both 19-4b and S-1 forms to officially launch ETFs in the market. The recent SEC approval was only for the 19-4b forms. Analysts predict that the S-1 approval might come somewhere in June.

Additionally, altcoins in the Ethereum network have shown impressive growth, with PEPE rising by 13.5% and ENS increasing by 9.4%. They are now trading at $0.00001679 and $26.05, respectively.

Ethereum’s decentralized finance (DeFi) ecosystem has also experienced a surge. DefiLlama data shows that the total value locked (TVL) in Ethereum’s DeFi is $66.61 billion as of May 27, marking its highest TVL since mid-May 2022.

Read more: Which Are the Best Altcoins To Invest in May 2024?

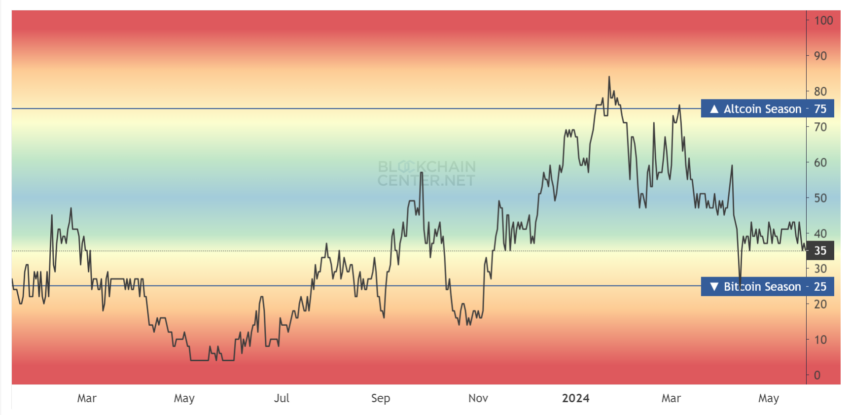

Despite the renewed interest, the market has not yet entered an altcoin season (altseason). According to the Altcoin Season Index, only 35% of the top 50 altcoins have outperformed Bitcoin in the last 90 days. To enter the altseason, the market needs 75% of altcoins to outperform Bitcoin.

Read more: What Is Altcoin Season? A Comprehensive Guide

In addition to the optimism from the ETF approval, Ethereum developers have announced the upcoming “Pectra” upgrade for Q1 2025. This update will introduce the Ethereum Virtual Machine (EVM) Object Format (EOF), which includes about 11 Ethereum Improvement Proposals (EIPs). EOF aims to improve the EVM code with an opt-in container system, marking a significant advancement in Ethereum’s development.

The post Optimism Post-ETF Approval Continues: Ethereum Soars to $3,900, Altcoins Rally appeared first on BeInCrypto.