Significant movement has occurred in the crypto market since the US Securities and Exchange Commission’s (SEC) preliminary approval for spot Ethereum exchange-traded funds (ETFs).

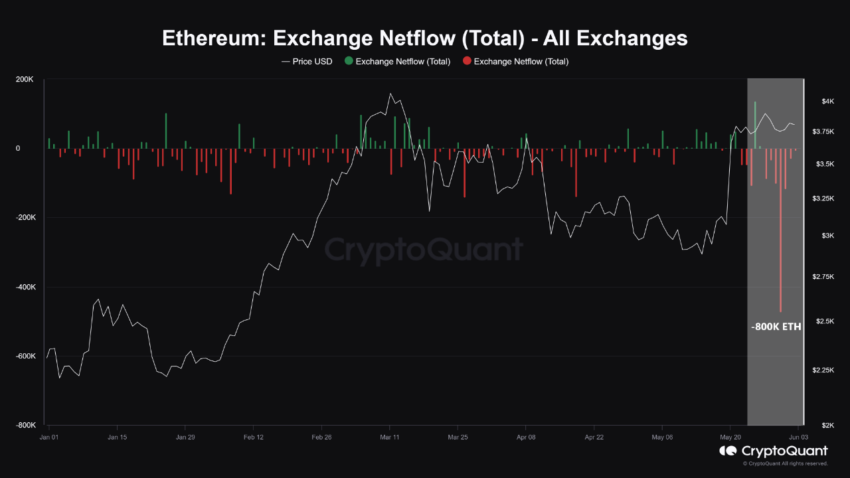

A recent analysis by CryptoQuant highlights that unidentified entities have withdrawn over 800,000 Ethereum (ETH) from crypto exchanges, valued at approximately $3 billion.

Surge in Ethereum Withdrawals Signals Investor Optimism

Burak Kesmeci, an analyst at CryptoQuant, assumes that these transactions originated from either individual crypto whales or institutional investors. He speculated that the individual whales anticipate an increase in the ETH price following the approval of a spot ETF. Meanwhile, institutional investors are likely getting ready for the launch of these ETFs.

“These institutions may want to meet the demand of their investors with the launch of the spot Ethereum ETF,” Kesmeci wrote.

Read more: Ethereum ETF Explained: What It Is and How It Works

Despite the anonymity surrounding these transactions, both are drawn to the market behavior observed after the approval of spot Bitcoin ETFs.

The migration of such a large volume of ETH from exchanges typically indicates a preference for holding assets in self-custodial platforms. This situation leads to tighter supply conditions on crypto exchanges.

Therefore, Kesmeci projected that the current withdrawals would positively influence Ethereum’s price in the medium term. The reduction in exchange-held ETH often hints at a future supply squeeze, potentially driving prices higher as availability diminishes.

Indeed, the preliminary approval for spot Ethereum ETFs has infused renewed optimism in the market and broader crypto industry. BeInCrypto previously reported that some protocols in the Ethereum ecosystem, like Aave and Uniswap, experienced a total value locked increase (TVL) during the period.

Bloomberg ETF analysts James Seyffart and Eric Balchunas have weighed in. They predict that the Ethereum ETFs could capture 10% to 20% of the flow seen by their Bitcoin counterparts. According to SoSo Value data, spot Bitcoin ETFs have garnered a total net inflow of $13.6 billion since their inception.

Read more: How to Invest in Ethereum ETFs?

Seyffart and Balchunas expect final approval for the Ethereum ETFs by July, suggesting that the market could see even more significant movements in the coming months.

The post Crypto Whales Withdraw $3 Billion in ETH from Exchanges After Spot Ethereum ETF Approval appeared first on BeInCrypto.