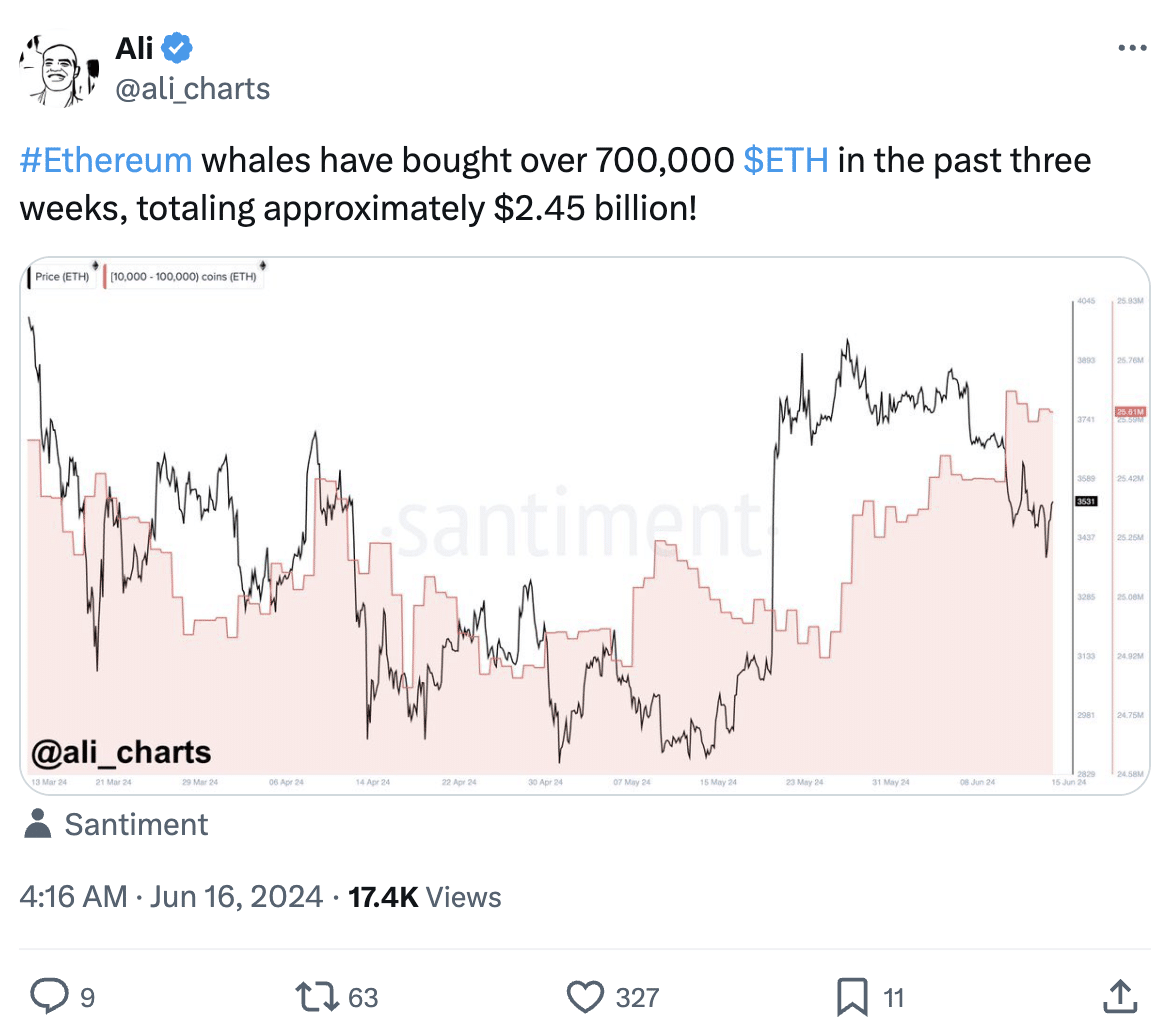

- Whale accumulation of ETH grew, according to recent data.

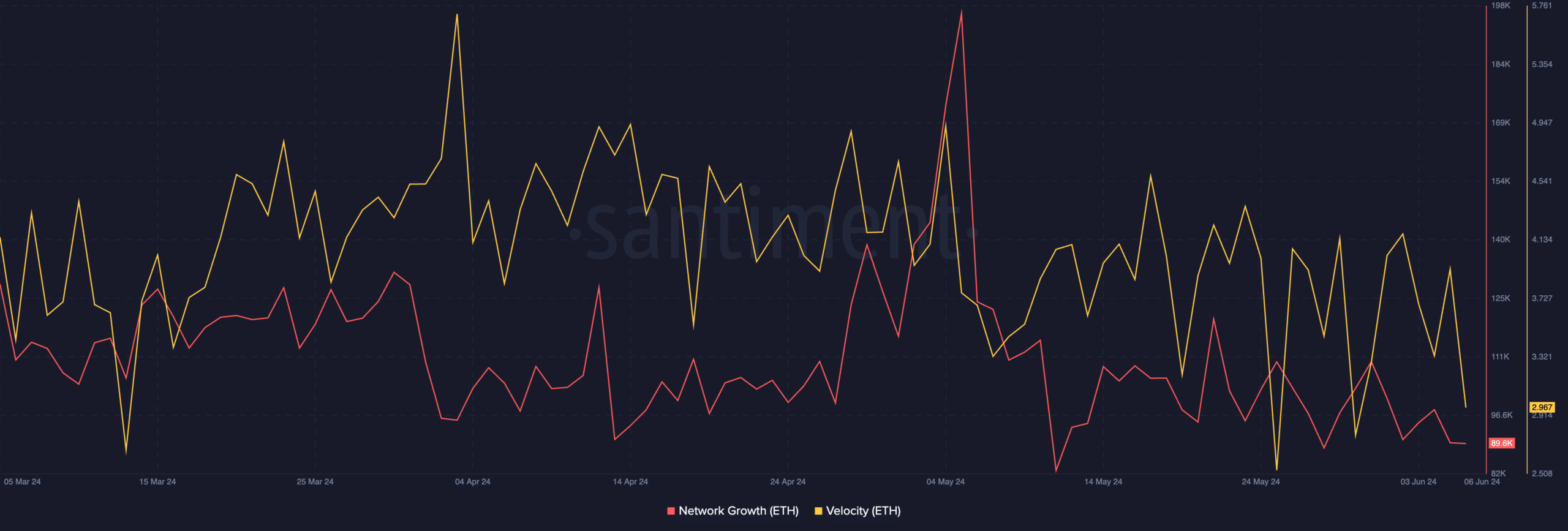

- Network growth and velocity of ETH fell materially.

Ethereum’s [ETH] recent dip in price did not reduce the optimism that traders and investors had in the slightest.

Ethereum whales start to buy

Recent data showed that Ethereum whales, or large-scale investors, have accumulated over 700,000 ETH in the past three weeks, representing a total of approximately $2.45 billion.

This significant buying spree suggested that these whales believe in the long-term potential of Ethereum and view the recent price dip as a buying opportunity.

Their actions could be a sign of confidence in Ethereum’s future, potentially keeping the cryptocurrency’s price stable.

At press time, ETH was trading at $3,569.40. After slightly going below the $3,400 levels, the price of ETH bounced back, presumably due to the eagerness of the whales that accumulated ETH.

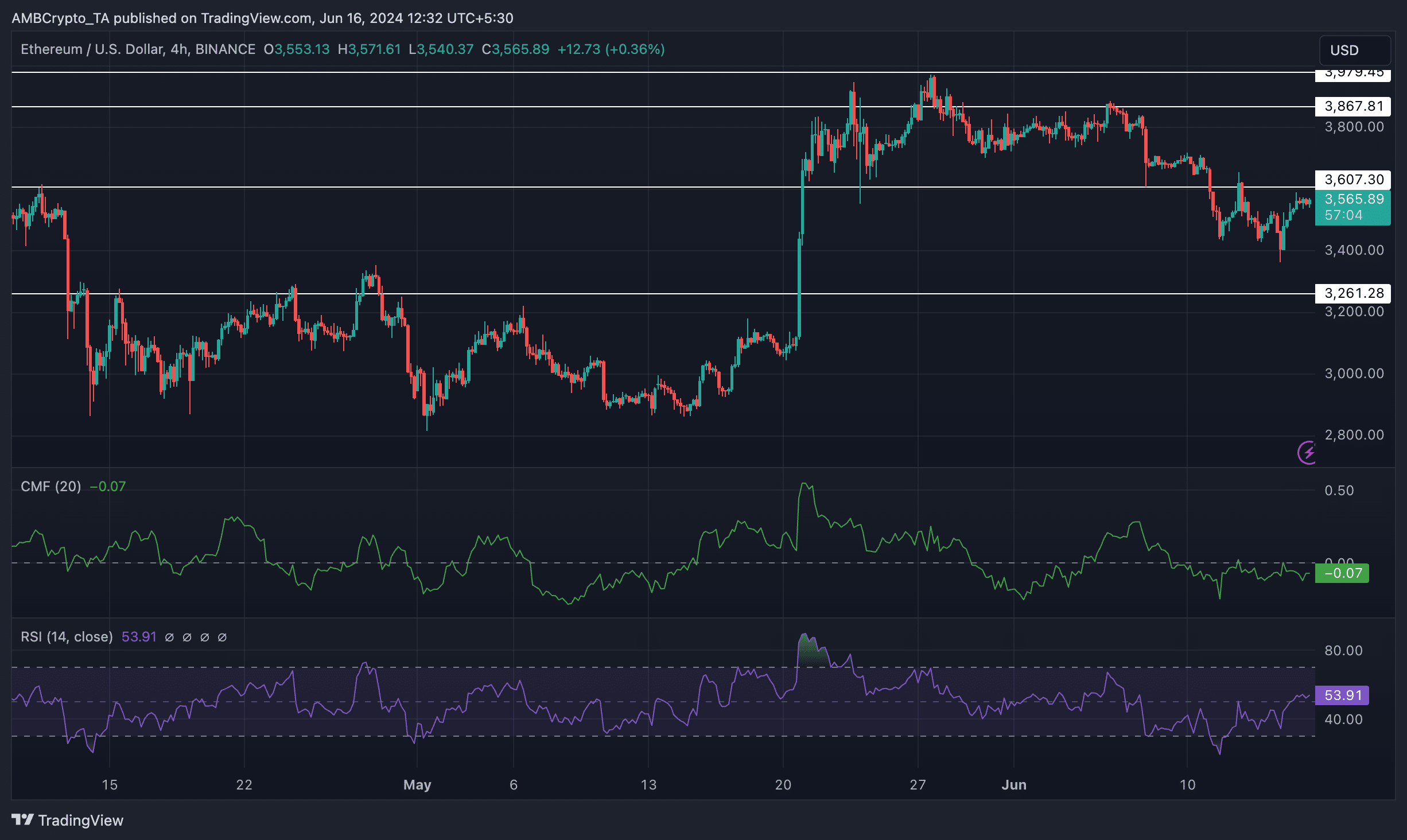

Even though this uptick was significant, it wasn’t profound enough to break the bearish trend that was established by the price after the 27th of May.

After the price exhibited the double top pattern during this period, the price of ETH witnessed multiple lower lows and lower highs.

The price of ETH would need significant bullish momentum for it to break out and reach new highs. Unfortunately for ETH, the CMF (Chaikin Money Flow) was observed to be declining.

This meant that the money flowing into ETH had decreased. A declining CMF paints a bearish picture for ETH’s future.

In contrast to the CMF, the RSI (Relative Strength Index) for ETH had grown materially over the last few days, indicating that the bullish momentum around ETH was rising.

If this bullish momentum continues to grow, ETH may test the $3,607.30 level again and weaken that resistance. Moreover, the possibility of a reversal would also grow, if this ends up happening.

Looking at on-chain data

AMBCrypto’s analysis of Santiment’s data revealed that the Network Growth for ETH had declined.

Read Ethereum (ETH) Price Prediction 2024-25

This meant that the number of new addresses showing interest in ETH had significantly fallen over the last few days. This indicated that new addresses weren’t willing to buy ETH even at the current discounted prices.

Moreover, the velocity of ETH also fell, implying a decline in ETH trades, which is also not a positive sign.