- Ethereum’s Open Interest has decreased, potentially easing market tensions.

- The asset’s price shows signs of recovery, with a current rise to $3,585.

In recent developments within the cryptocurrency markets, Ethereum [ETH] has shown signs of a modest recovery after a turbulent period.

Over the last 24 hours, ETH has seen a rise of 1.5%, marking a potential turnaround from its week-long downtrend which has now culminated in a 2.5% drop.

This resurgence has allowed Ethereum to cross the significant price threshold of $3,500, trading around $3,585 at press time.

This improvement in price accompanies a notable decrease in market pressure, as evidenced by changes in Ethereum’s Open Interest (OI).

Open Interest, which aggregates the total of all open positions in the market, whether long or short, serves as a barometer for market activity and sentiment.

Market eases as Ethereum’s OI dips

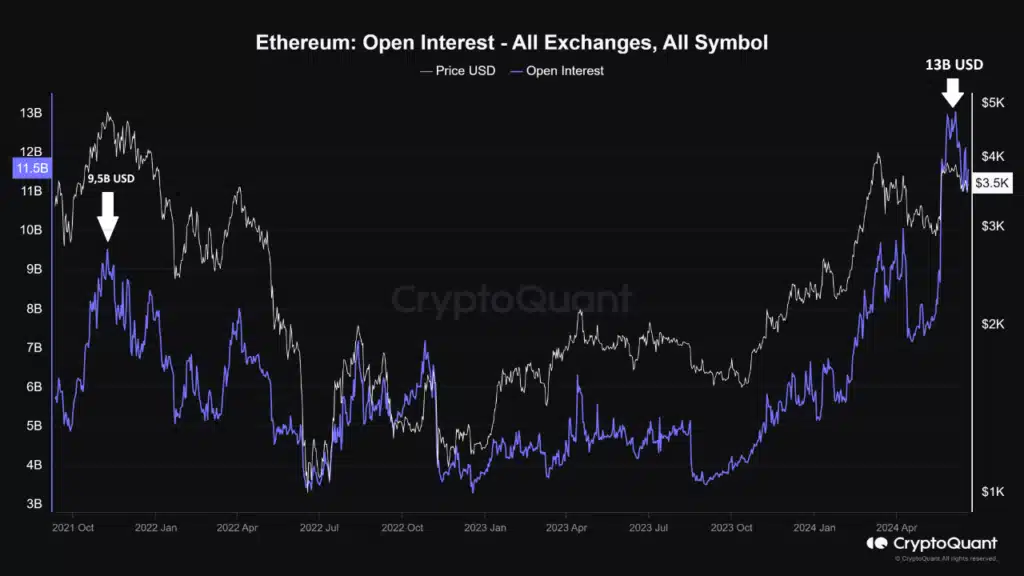

Recently, data from CryptoQuant has highlighted a significant reduction in Ethereum’s Open Interest, which dropped from a high of $13 billion to $11.5 billion.

This reduction grants the market much-needed breathing space, potentially alleviating some of the speculative pressures that have overheated the market in recent times.

The CryptoQuant analyst particularly noted,

“Whether this pullback in OI data is sufficient will be determined by market makers, but we can say that the boiling water has cooled down a bit.”

Meanwhile, the peak in Ethereum’s Open Interest previously coincided with its all-time high price of $4,891 in 2021, reaching up to $9.5 billion during that bull run.

In contrast, the current cycle saw the OI escalate to a record $13 billion without renewing the all-time high, indicating a heightened level of market leverage and speculative interest.

This extreme level of Open Interest led to significant market corrections, with about $400 million in Ethereum positions liquidated since early June.

$285 million of these were long positions, and $113 million were shorts, the analyst revealed.

Investors trudge on

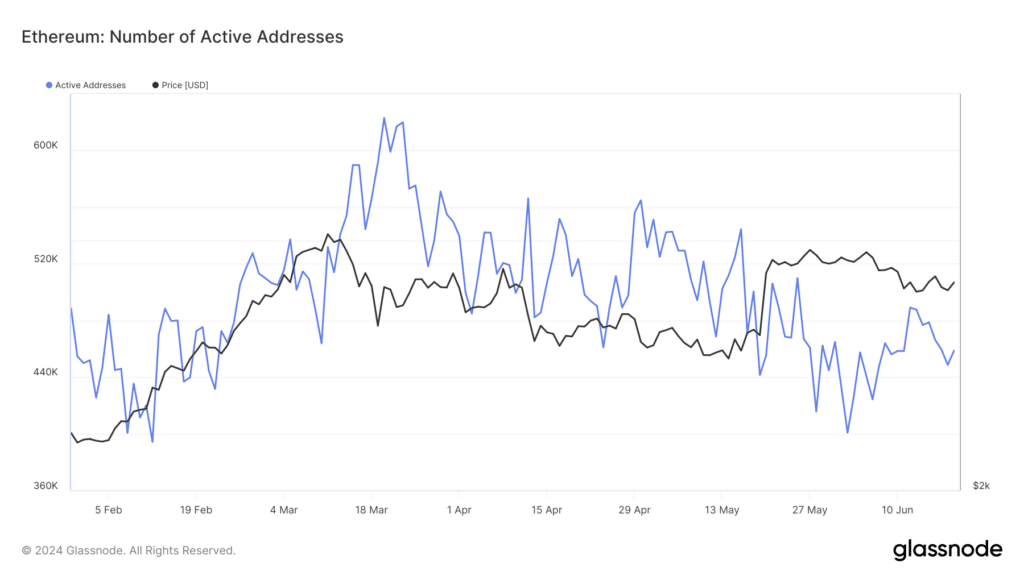

Adding complexity to the market’s behavior, Ethereum’s active addresses have shown a decline, suggesting a decrease in user engagement or network activity.

This, per Glassnode, recently dipped from a high of 489,000 active addresses, reflecting potential shifts in investor behavior and market participation.

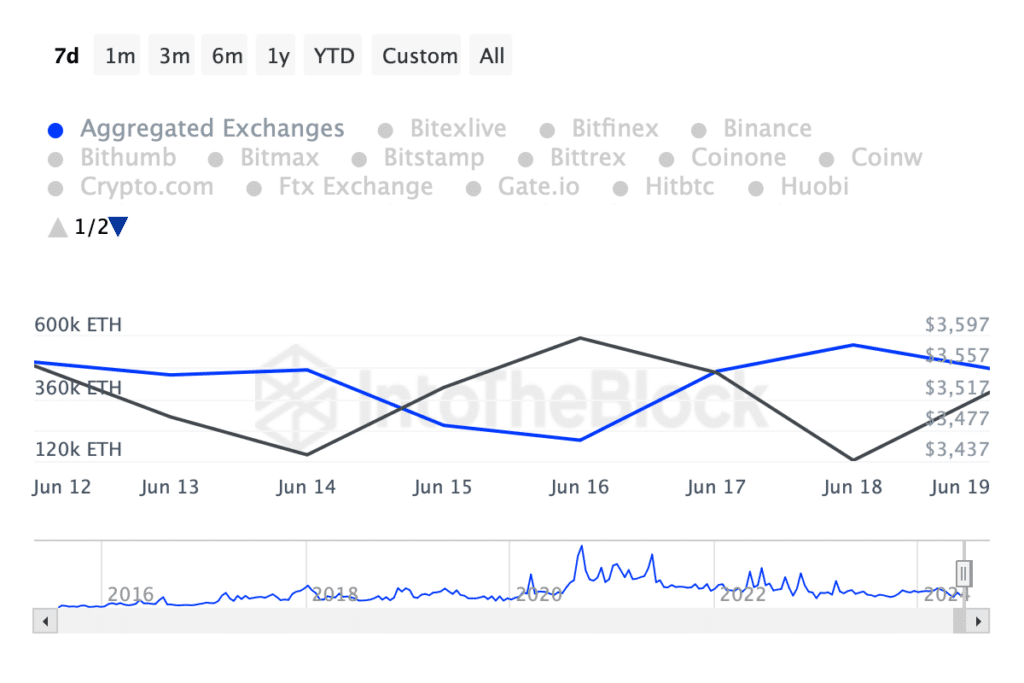

Concurrently, IntoTheBlock’s data indicated ongoing accumulation activities among Ethereum investors, despite the market’s challenges.

Over the past week, Ethereum saw a net outflow from exchanges exceeding 400,000 ETH, signaling strong investor confidence and potential anticipation of price appreciation.

Read Ethereum’s [ETH] Price Prediction 2024-2025

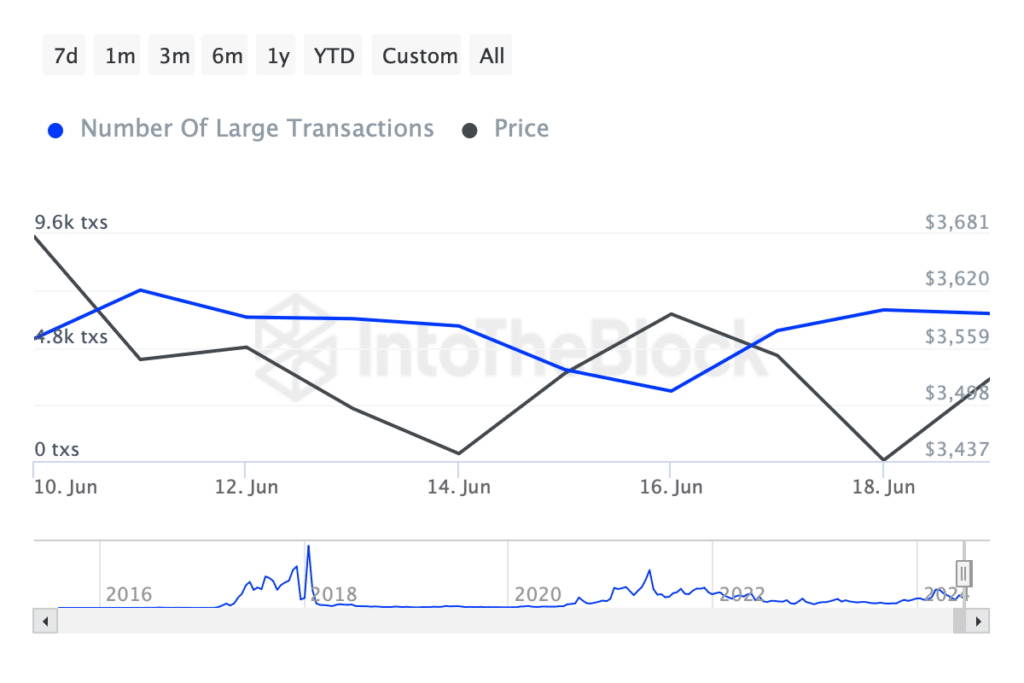

The trend is supported by a report from AMBCrypto, which noted that Ethereum’s exchange supply has hit an eight-year low.

This coincided with a surge in large transactions (over $100k), which have increased significantly in just the past week.