- Novice crypto traders are overwhelmed by fear, but seasoned market analysts advise otherwise.

- A combination of different ETH metrics indicate strong bullish sentiment due to increased wallet activities.

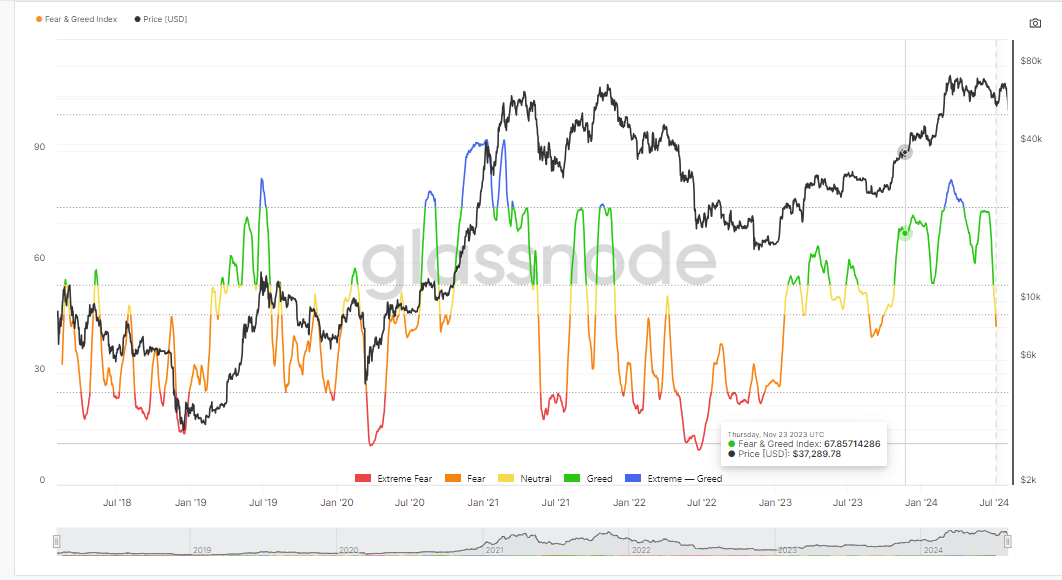

Fear is dominating the crypto markets right now, and seasoned analysts often advise to “be greedy when others are fearful.”

This strategy has proven effective over time, as it taps into emotional intelligence to navigate market cycles.

Market analyst Quinten cited on X (formerly Twitter) that the current fear in the market is a signal to buy more crypto.

Historical patterns show that such fear often precedes major price rallies, as seen when most cryptos previously surged to new ATHs, according to Glassnode data.

What is Ethereum up to?

Despite concerns about a global recession and potential world conflicts, Ethereum [ETH] showed promising signs of growth, as wallet activity on the Ethereum blockchain has surged recently.

Combined key metrics including active wallet addresses in the last 30 days, circulation, network growth, and transaction volume, are all on the rise as the graph from Santiment indicates.

This upward trend suggests that now is not the time to panic, but rather an opportunity to invest in ETH assets.

ETH: Covid crash vs. now

During the Covid-19 crash, Ethereum hit a low that scared many new investors, causing them to sell during the market’s drop.

However, shortly after, Ethereum’s price surged as the market recovered. The recent crash in the past 24 hours resembles the Covid-19 downturn, suggesting that we might see a similar rally soon.

The current market fear could signal an upcoming upward trend for Ethereum, mirroring the recovery pattern seen previously.

Ascending triangle retested

The recent market sell-off is viewed as a significant test of Ethereum’s previous price patterns.

Is your portfolio green? Check out the ETH Profit Calculator

Technically, Ethereum’s price action is revisiting the old breakout level and could potentially rise to a new all-time high by the third quarter of 2024.

The strategy is to buy Ethereum aggressively whenever the price falls below $2300 and hold, anticipating future gains as the market recovers.