Ethereum’s revenue has dropped sharply over the past several months as competition from Layer-2 (L2) scaling solutions has increased.

The March Dencun Upgrade was a crucial development for the Ethereum blockchain, particularly in reducing transaction fees. However, this upgrade came at a cost.

Ethereum Revenue Sinks Amid Layer-2 Boom

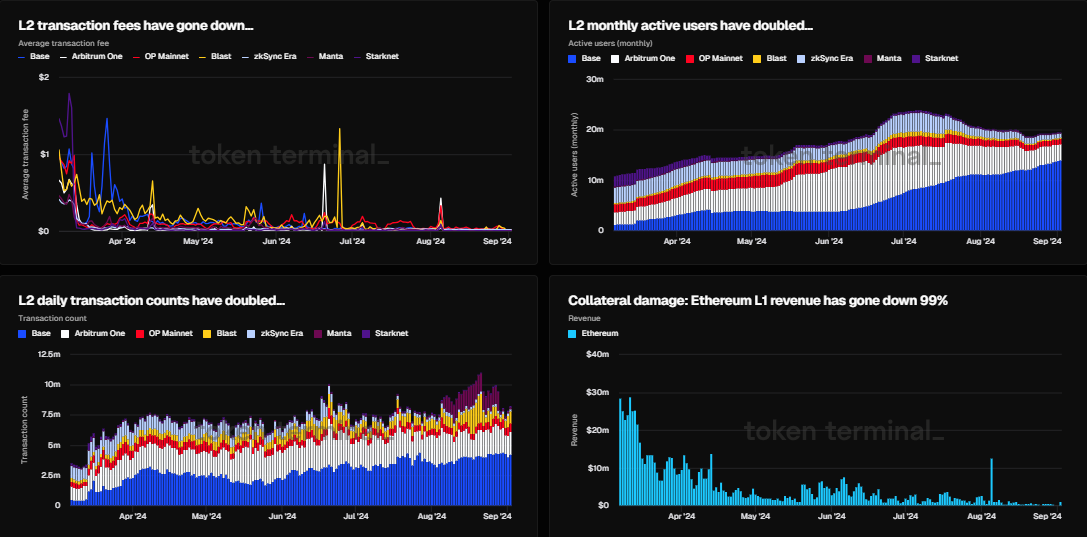

Ethereum’s revenue has plunged by 99% since the Dencun upgrade on March 13, as per Token Terminal data. The upgrade reduced transaction fees for Layer-2 (L2) solutions, doubling daily transaction counts and monthly active users.

Increased competition among over 70 active L2 solutions and 21 Layer-3 (L3) projects has further drawn users away from Ethereum’s mainnet, causing Ethereum’s network revenue to drop dramatically from $35.5 million on March 5 to $566,000 by late August.

Rob Viglione, CEO of Horizen Labs, believes Ethereum is transitioning from a primary transaction platform to a crucial settlement and security layer for Layer 2 networks. While this shift may cause short-term disruptions, it could ultimately fortify Ethereum’s role.

“We may see market consolidation among L2s, with a few dominant players emerging. Some might explore alternative data availability solutions, potentially challenging Ethereum’s position. Although, it’s likely that L2s with strong, unique use-cases will still be in demand for years to come. Ethereum’s revenue model is set to shift from individual transaction fees to generating revenue as the settlement layer for L2 networks. This transition positions Ethereum as critical infrastructure for a diverse blockchain ecosystem,” Viglione told BeInCrypto.

Read more: What Is the Ethereum Cancun-Deneb (Dencun) Upgrade?

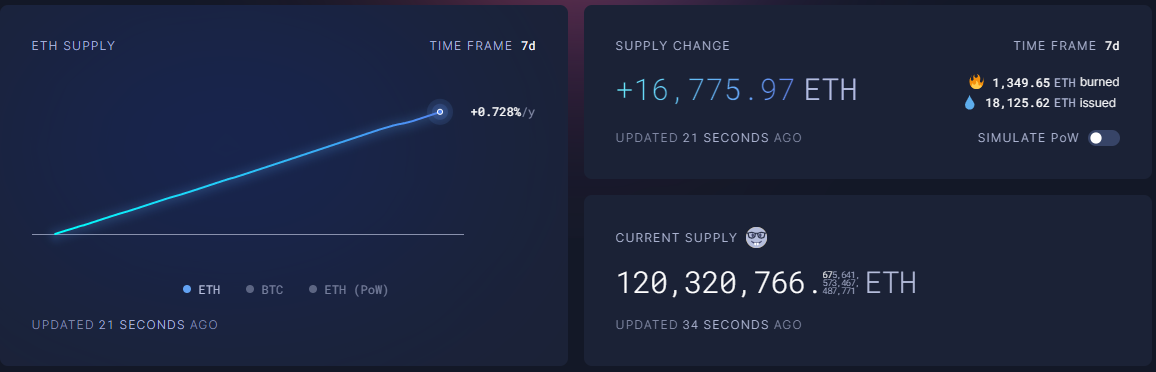

The Dencun Upgrade on Ethereum successfully reduced transaction costs but has had unintended consequences for token holders. Lower fees have limited demand for ETH, which would typically be used to settle network transactions.

This reduced demand has increased ETH’s supply, undermining the deflationary effects originally intended by Ethereum’s EIP-1559. As a result, Ethereum has returned to being an inflationary currency, regularly issuing more tokens than it burns. According to ultrasound.money data, more than 16,775 ETH tokens have been added to Ethereum’s overall supply since mid-April.

“We conclude that, at the current rate of network activity, Ethereum will not be deflationary again. The narrative of ‘ultrasound’ money has probably died or would need much higher network activity to come back to life,” CryptoQuant analysts said in a recent report.

Read more: A Deeper Look into the Ethereum Network

Despite reduced fees and concerns over Ethereum’s fading deflationary potential, some speculate that both Layer 1 and Layer 2 networks are on the brink of financial collapse, with investors potentially losing up to 80% of their value. However, Ethereum co-founder Vitalik Buterin disagrees, asserting that the network has grown stronger, even amidst these challenges.

The post Ethereum Revenue Plummets 99% after Dencun Upgrade appeared first on BeInCrypto.