- EigenLayer finally rolls out its EIGEN crypto with an impressive FDV and major listings.

- A recap of the EigenLayer’s TVL and other performance metrics.

Ethereum based restaking protocol EigenLayer kicked off October with the unlocking and listing of its EIGEN crypto. According to the Eigen Foundation’s official X handle, the unlock means the token is now available for trading and staking.

The EIGEN token unlock is expected to put EigenLayer on the fast lane for more economic expansion and engagement. It is also expected to boost governance and support the project’s place in the decentralized landscape.

Multiple top exchanges have already listed the EIGEN token including Binance.

EIGEN had a $4.05 opening price and a fully diluted valuation of $6.8 billion. It tanked slightly to its $3.85 press time price, with a $727.14 billion market cap. The token has a 1.68 billion max supply but its initial circulating supply was 186.58 million coins.

EIGEN hit a high of $4.45 and a low of $3.52 on its first day of listing. Although the token unlock event happened in the last 24 hours, the EigenLayer network has been quite active so far in 2024. Its total value locked had a parabolic expansion in the first half of the year.

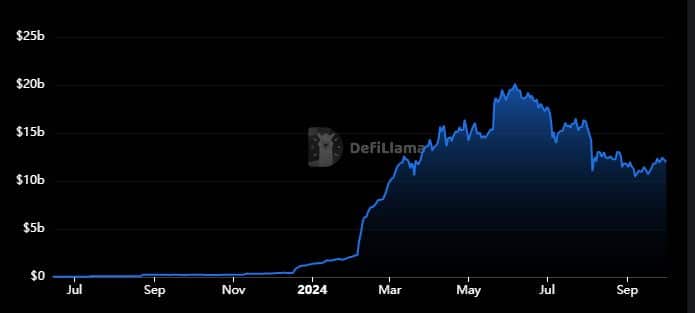

The EigenLayer TVL crossed the $1 billion mark in December 2023 and peaked at just over $20 billion in June. The staking protocol experienced significant outflows since then but it still has a decent TVL at $12 billion.

Will the EIGEN launch support more TVL growth?

EIGEN’s launch may provide enough social exposure to encourage more TVL growth. Some holders may be encouraged to stake their tokens for rewards, hence the possibility of an uptick.

On top of that the market has been exhibiting recovery from the bearish period between June and August. This recovery, combined with bullish expectations may favor EIGEN staking.

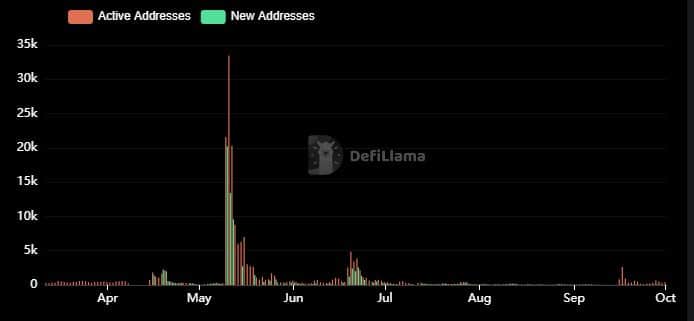

The EIGEN unlocking may also support more address activity. The latter has been relatively subdued over the last few months. The highest number of active addresses recorded in a single day so far this year was in May.

Active addresses peaked slightly above 33,000 addresses and new addresses were recorded at just over 13,000.

EigenLayer active addresses have since experienced a massive decline. The number of daily active addresses and new addresses dropped below 100 in August and September. Address activity saw a bit of resurgence in the second half of September.

Now that EIGEN has been unlocked, we are curious to see how the development will impact its price action moving forward.