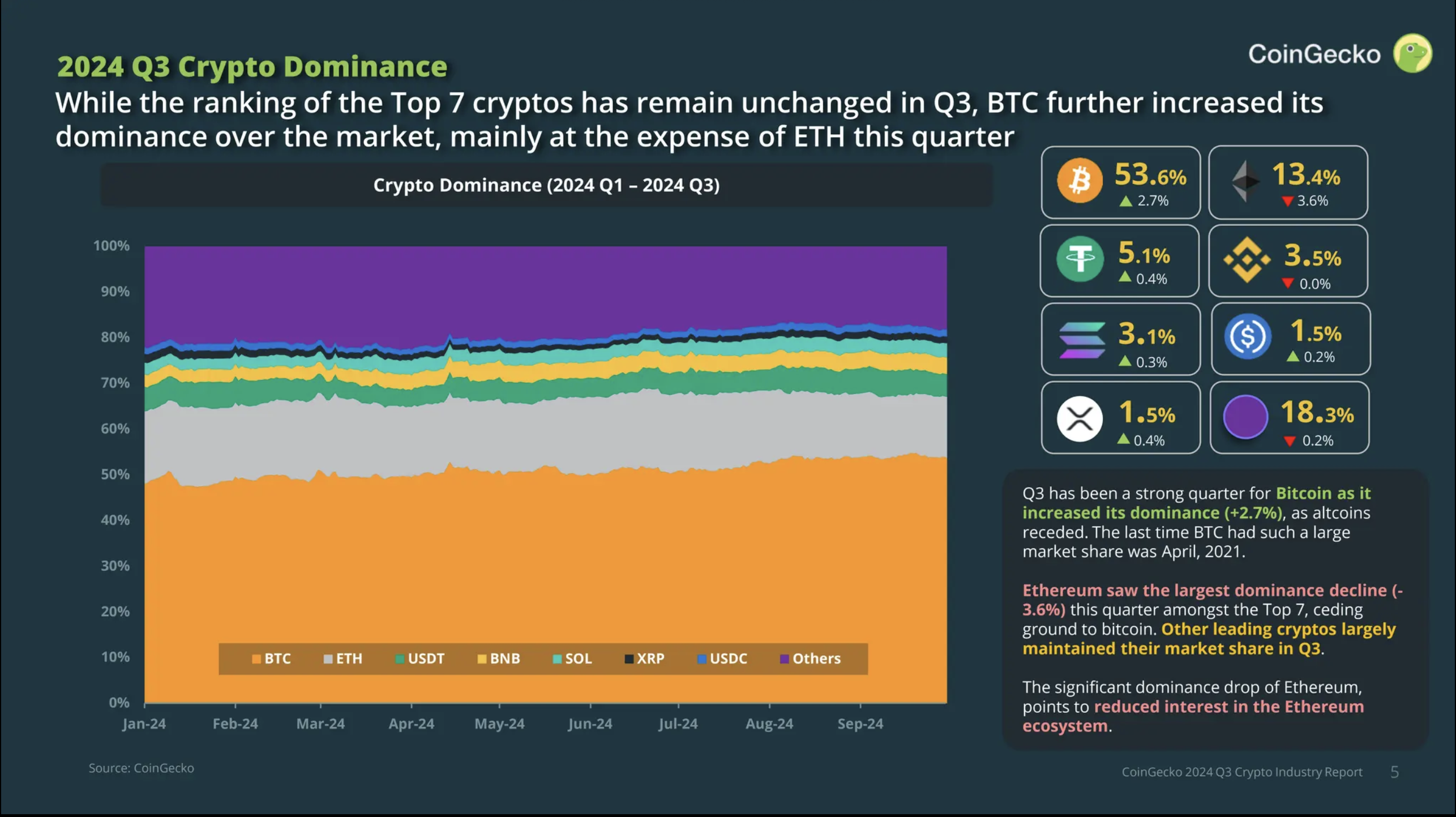

CoinGecko Q3 Crypto Industry Report determined that the whole market has shrunk by 1.0%. Bitcoin enjoys a 3-year high for market domination, and Ethereum is slipping in several metrics.

Several minor concerns need addressing, but the quarter as a whole has been positive for crypto.

Bitcoin in World Markets

CoinGecko report described several interesting market trends. At first glance, Bitcoin is performing quite well, with a share of the total crypto market over 53%. Moreover, as of writing, Bitcoin dominance stands over 58%.

This would mark Bitcoin’s highest dominance relative to other crypto assets since its bull run in April 2021.

Read More: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, CoinGecko raised several points that seem less bullish. The total market cap for all crypto assets declined slightly in this period, and even Bitcoin underperformed traditional assets like gold and several treasury bonds. British, Japanese, and US treasury bonds all overpowered Bitcoin after early August.

World government policies, especially those of these countries, had a marked influence this quarter. US rate cuts were a particular boon to Bitcoin, as were possible tax cuts in Japan.

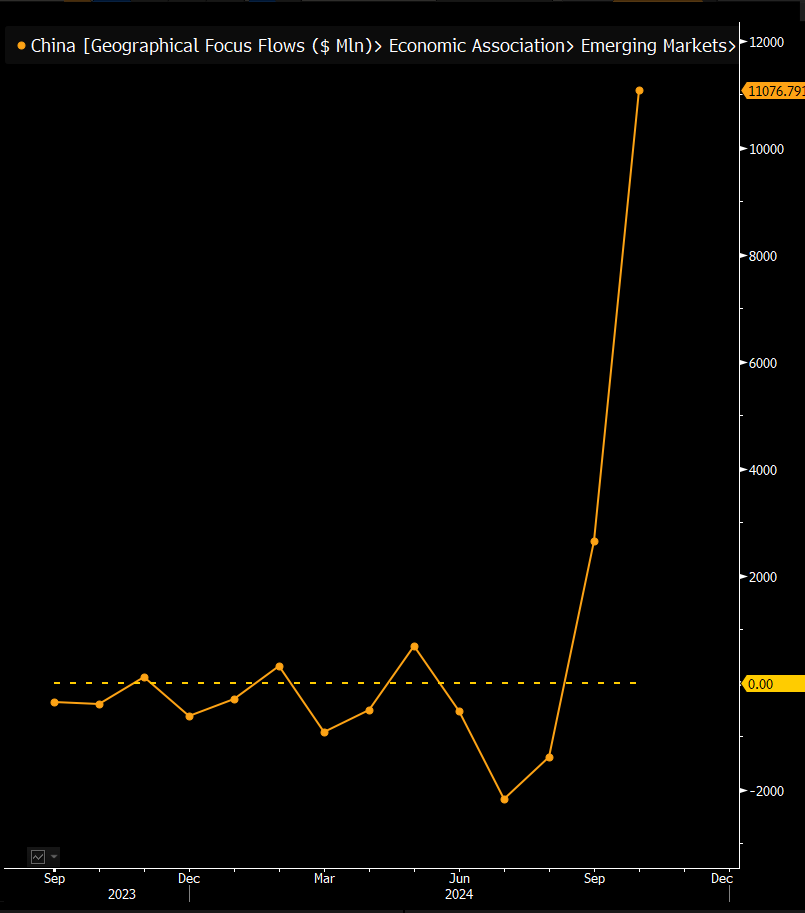

Stimulus announcements in China also helped buoy the entire crypto market. CoinGecko did not assess Chinese treasury bonds, but analyst Eric Balchunas noted high ETF performance:

“YEAR OF THE BULL: China ETFs’ October inflow total is now up to $11 billion. What a chart. $90 billion of asset purchases by the government will do that…” said Balchunas in a Monday post.

In short, Bitcoin is taking an outsized advantage over the crypto market, but this isn’t a triumph. The bigger market is floundering, and world economic policies brought this decentralized currency its biggest win.

“Although the price of Bitcoin remained flat in Q3, US Spot Bitcoin ETFs experienced larger net inflows…in Q3 compared to Q2. The resurgence of inflows boosted AUM by 13.2%,” the report claimed.

Ethereum Overshadowed?

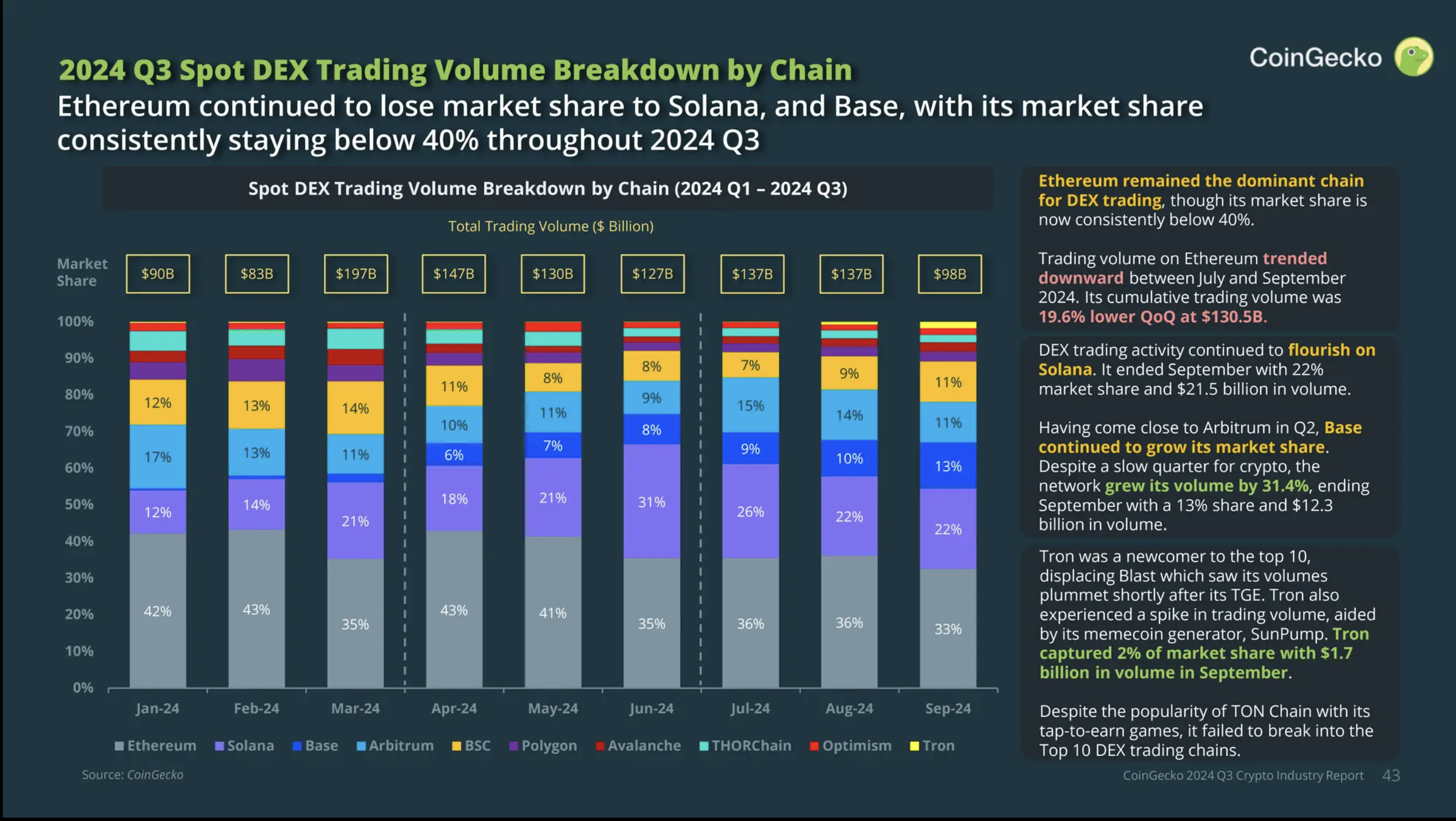

Ethereum (ETH) lost some of its market share to Bitcoin, but that’s not the only development CoinGecko focused on. Ethereum’s Layer-2 (L2) transactions rose 17.2% this quarter, but nearly half came from Base. This Ethereum L2 has been a breakout success recently, and it was responsible for 42% of ETH L2 transactions.

Read More: How to Create a Token on Base Blockchain: No Code Guide

Base has been steadily eating away at Ethereum’s hold over decentralized exchange (DEX) trading, growing while ETH shrinks. Solana has also taken bites out of ETH’s share, as CoinGecko previously noted this chain’s technical advantages.

“In 2024 Q3, Ethereum was the dominant chain for DEX trading, though its market share is now consistently below 40%. DEX trading activity continued to flourish on Solana, buoyed by the multitude of meme coins. Meanwhile, Base continued to grow its market share in Q3, despite being a slow quarter for the crypto market,” CoinGecko claimed.

Finally, neither Bitcoin nor Ethereum can claim a wholly successful quarter. The crypto market only shrank slightly in Q3 2024, but it’s still a concerning sign. Bitcoin’s successes and failures seem tied to a broad range of other factors, and Ethereum faces real competition.

The post Crypto Trends: Bitcoin’s Rise, Ethereum’s Challenge, and Global Market Influences appeared first on BeInCrypto.